Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Chase Ultimate Rewards Transfer Partners and How To Use Them [2024]

Jarrod West

Senior Content Contributor

452 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Jessica Merritt

Editor & Content Contributor

104 Published Articles 543 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3360 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![chase rewards travel partners Chase Ultimate Rewards Transfer Partners and How To Use Them [2024]](https://upgradedpoints.com/wp-content/uploads/2018/09/Emirates-First-A380-3.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Chase airline transfer partners, chase hotel transfer partners, earning ultimate rewards, how to transfer ultimate rewards, booking travel with the chase travel portal, other ways to use your points, combining ultimate rewards from different accounts, redeeming ultimate rewards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- Chase Ultimate Rewards points transfer to 11 airline and 3 hotel partners, offering a 1:1 transfer ratio for maximum value.

- Popular airline partners include United MileagePlus, Southwest Rapid Rewards, and British Airways Executive Club, each offering unique redemption opportunities.

- Transferring points to partners is generally quick, with most partners processing transfers instantly or within a day or 2.

Chase Ultimate Rewards points are perhaps the most valuable points out there. Thanks to their flexibility and transfer options, we regularly give Chase Ultimate Rewards one of the best valuations in our monthly valuations . There are plenty of great ways to earn Ultimate Rewards points and even more fun ways to redeem them for award flights and hotel stays.

In this post, we’ll show you all of Chase’s transfer partners, how to transfer Ultimate Rewards to these partners, and much more. After reading our guide, you’ll be ready to book an amazing getaway!

The Chase Ultimate Rewards program currently has 11 airline transfer partners — the latest program, Air Canada Aeroplan, was added in August 2021.

Points transfer to all these airlines at a 1:1 ratio, which is one of the reasons Ultimate Rewards points are so valuable.

Aer Lingus AerClub

Major Hub: Dublin (DUB)

Airline Alliance: None, but has airline partners

Aer Lingus is a part of the International Airlines Group (IAG), which also includes British Airways, Iberia, and Qatar Airlines, so you’ve got some flexibility when it comes to how you redeem your Aer Lingus AerClub Avios . That said, its award chart isn’t quite as valuable as many of the other Chase Ultimate Rewards transfer partners.

However, it does offer a couple of solid sweet spots for those looking to travel to The Emerald Isle. On off-peak dates, you can book a one-way ticket from the U.S. East Coast to Dublin for 13,000 Avios in economy or 50,000 Avios in business class.

Air Canada Aeroplan

Major Hubs: Calgary (YYC), Montréal (YUL), Toronto (YYZ), and Vancouver (YVR)

Airline Alliance: Star Alliance

Air Canada Aeroplan is easily one of the best Chase transfer partners for premium cabin award tickets thanks to its lucrative partner award chart .

For instance, you could fly one-way in business class to South America or most European destinations for 60,000 points. If you prefer to fly to Asia in business class, that would be 85,000 points so long as the distance covered is less than 11,000 miles.

Further, Aeroplan can be exceptional for award bookings because of its low taxes and fees on many partner tickets, and you can add a stopover on any itinerary for just 5,000 more points.

Air France-KLM Flying Blue

Major Hubs: Paris (CDG), Amsterdam (AMS)

Airline Alliance: SkyTeam

Another excellent option for economy and business class tickets between the U.S. and Europe is the Flying Blue program . Redemption rates are already quite reasonable, with solid award availability as well. You can often find one-way economy tickets to Europe for as low as 22,500 miles and one-way business class tickets for 56,500 miles.

While those rates are decent on their own, the Flying Blue program offers Promo Rewards each month that can drop the award ticket price for select routes by 25% to 50%, allowing you to get stellar value out of Flying Blue miles.

British Airways Executive Club

Major Hubs: London Heathrow (LHR), London Gatwick (LGW)

Airline Alliance: Oneworld

British Airways Executive Club gets a lot of flack in the points in miles community due to the large fuel surcharges for both economy and business class tickets between the U.S. and Europe. However, British Airways Avios can be incredibly useful for short-haul tickets that can often be relatively expensive.

For instance, U.S. domestic nonstop flights under 1,150 miles on American Airlines and Alaska Airlines cost just 9,000 Avios in each direction, along with low taxes of just $5.60. This can take you between destinations like New York and Miami, Chicago and Houston, or Seattle and Los Angeles.

Emirates Skywards

Major Hub: Dubai (DXB)

While Emirates Skywards offers some of the most sought-after award redemptions for business and first class on its signature A380, and more recently its game-changer first class on the 777 , the airline has also gone through a recent string of devaluations that have made this award more expensive through higher fuel surcharges .

Fortunately, one great sweet spot remains that allows you to fly Emirates’ fifth freedom routes between the U.S. and Athens or Milan, for 85,000 miles in first class one-way, or an incredible 90,000 miles round-trip in business class, with significantly lower taxes and fees.

Iberia Plus

Major Hub: Madrid (MAD)

Another entry into the Avios family is Iberia Plus . Unsurprisingly, its award program has a decent amount of overlap with the others, but its award pricing between the U.S. and Spain presents an incredibly sweet spot for award travelers.

It’s common to see many U.S. carriers charge 30,000 points to fly between the U.S. and Europe in economy class, but Iberia charges just 34,000 Avios to fly between the U.S. and Madrid in business class on off-peak dates — one of the cheapest ways to get across the pond in business class.

JetBlue TrueBlue

Major Hubs: New York (JFK), Boston (BOS)

JetBlue is a low-cost U.S. carrier that is known for its great inflight product both in economy and its Mint business class seats.

However, since its TrueBlue loyalty program ties award redemptions to the cash cost of the ticket, you’ll usually receive just 1.1 cents per point towards Mint redemptions , and 1.3 to 1.4 cents per point on economy tickets.

This can be a better deal than booking through the Chase Travel portal for Chase Sapphire Preferred cardholders with a 1.25 cent per point redemption rate, but a poor choice for Chase Sapphire Reserve cardholders with a 1.5 cent per point redemption rate. That said, you can often get much more value out of your Chase Ultimate Rewards points using other transfer partners.

Singapore Airlines KrisFlyer

Major Hub: Singapore (SIN)

While you might overlook Singapore Airlines KrisFlyer as an option for domestic travel, as a Star Alliance partner it offers great award pricing on domestic United flights, including 17,500 miles for flights between the U.S. mainland and Hawaii, and 27,500 miles for flights between the U.S. and Europe.

Singapore miles are also your only option if you want to book a highly sought-after ticket in Singapore Suites class between the U.S. and Singapore or its fifth freedom route between the U.S. and Frankfurt.

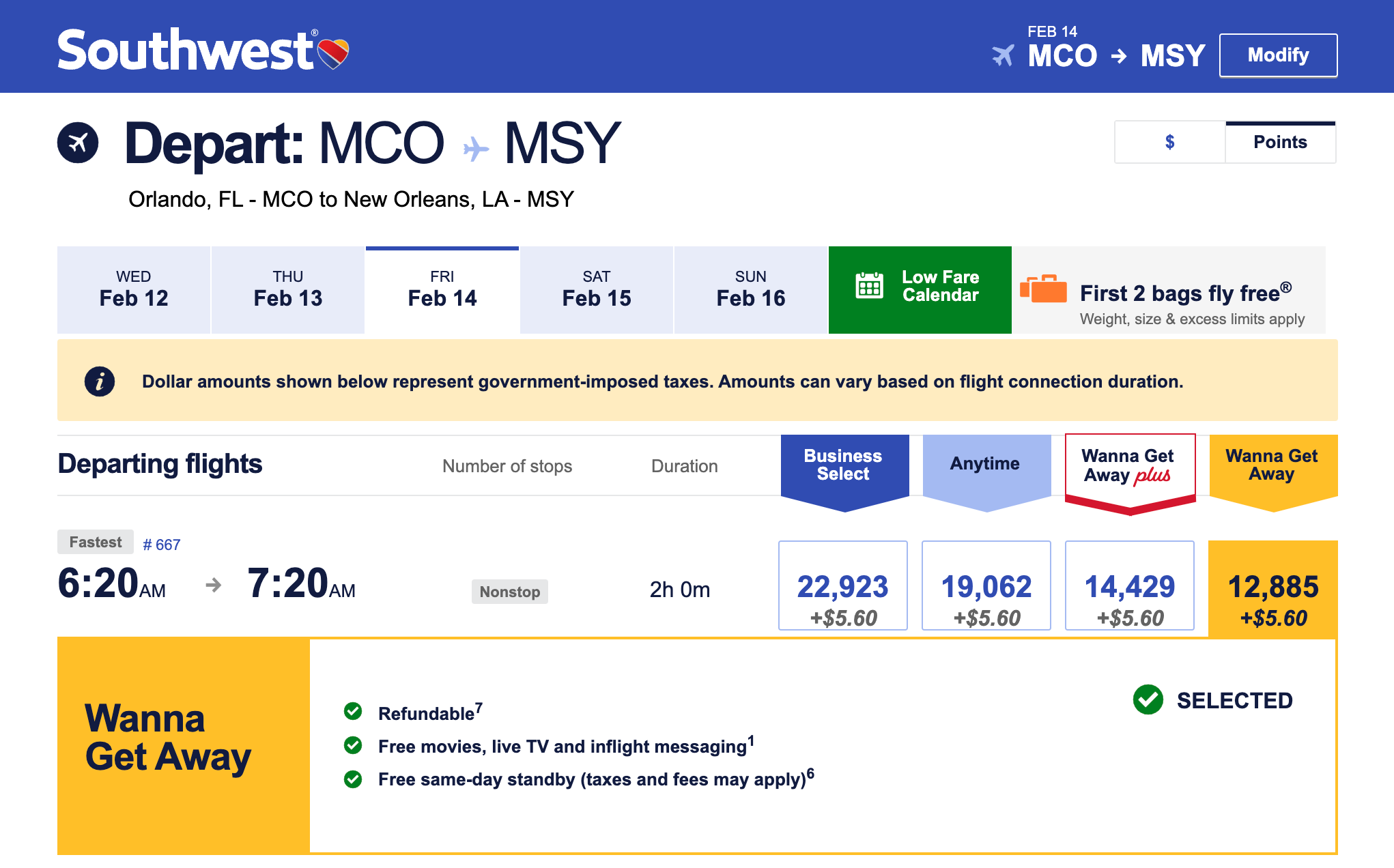

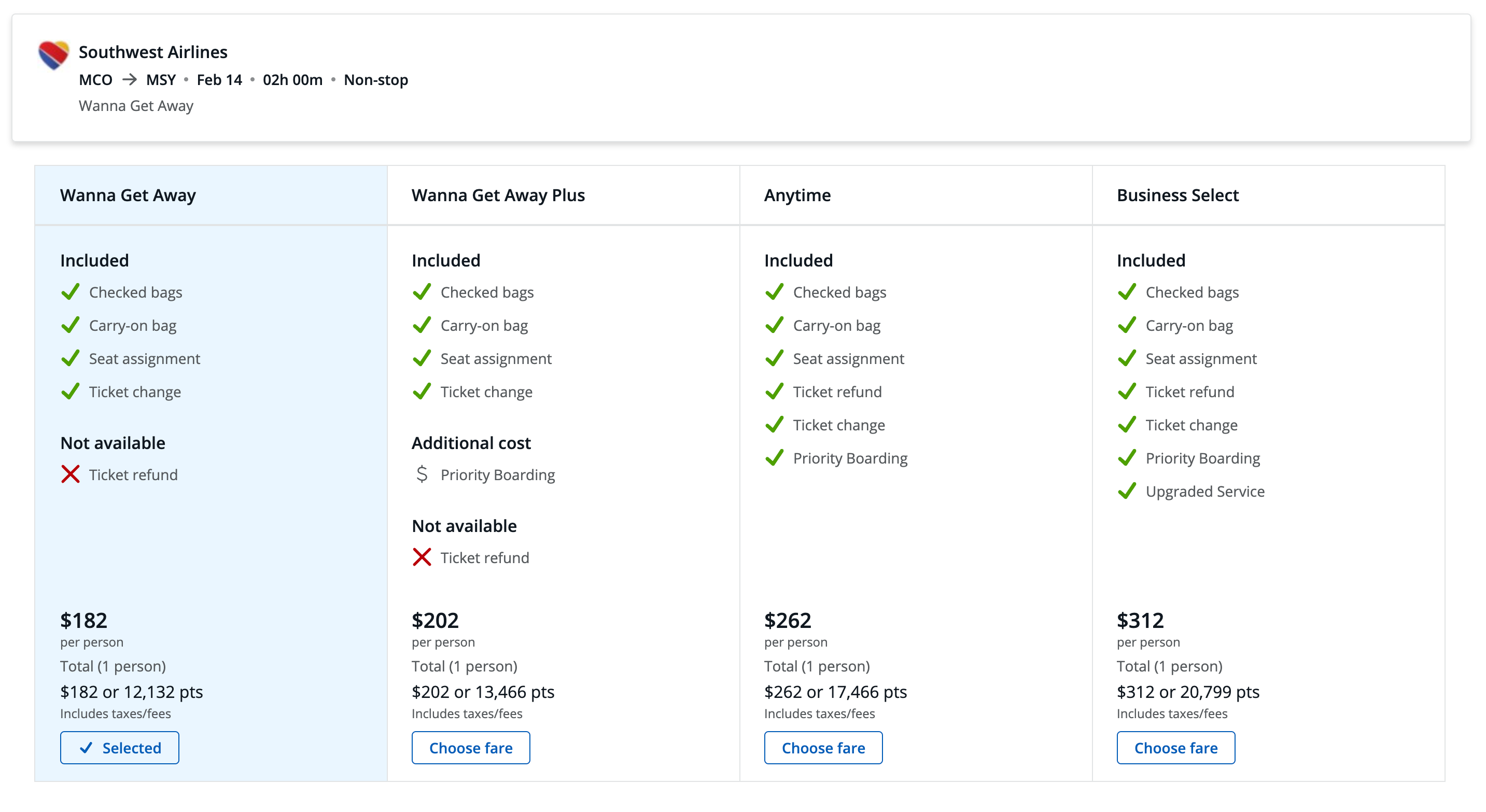

Southwest Rapid Rewards

Major Hubs: Atlanta (ATL), Baltimore (BWI), Chicago (MDW), Dallas (DAL), Denver (DEN), Houston (HOU), Las Vegas (LAS), Los Angeles (LAX), Oakland (OAK), Orlando (MCO), Phoenix (PHX)

Airline Alliance: None

Southwest is the world’s largest low-cost carrier with an award program in Rapid Rewards that’s similar to JetBlue in that it operates on fixed value redemptions, allowing you to usually get between 1.3 to 1.4 cents per point on your redemption that is tied to the cash cost of the ticket.

Since you can often get much more value out of your Chase Ultimate Rewards points than this, we generally advise against transferring to Southwest. However, one sweet spot is for those who have the Southwest Companion Pass , as your redemption value doubles on tickets where your companion flies with you for free.

United MileagePlus

Major Hubs: Chicago (ORD), Denver (DEN), Houston (IAH), Los Angeles (LAX), Newark (EWR), San Francisco (SFO), Washington DC (IAD)

In addition to being one of the most well-known Chase transfer partners for U.S. flyers, United MileagePlus also benefits from being able to book award travel on fellow Star Alliance airlines with low taxes and fees. In terms of booking tickets on its own metal, now that United has moved to dynamic pricing, getting outsized value using its currency isn’t quite as easy as it once was.

However, it does offer the incredibly valuable United Excursionist Perk , which allows you to tack on a free one-way flight on round-trip bookings for no added miles, so long as the flight is within the same region. For example, you could fly from the U.S. to Istanbul, Istanbul to London, and London back to the U.S., and your Istanbul to London leg (a 4-hour flight covering 1,500 miles) costs no added miles.

Virgin Atlantic Flying Club

Major Hub: London Heathrow (LHR), Manchester (MAN)

The second largest carrier based out of the U.K., Virgin Atlantic doesn’t participate in an airline alliance but offers several great partnerships that award travelers can take advantage of.

One of which is booking Delta One business class awards between the U.S. and Europe for just 50,000 miles one-way, which is far less than what Delta would charge using its own miles to book these awards. You can also book ANA first class awards between the U.S. and Japan for as low as 55,000 miles one-way.

Ultimate Rewards can also be transferred to 3 hotel rewards programs. Like Chase’s airline partners, all transfers to hotel partners occur at a 1:1 ratio.

IHG One Rewards

Headquarters: Denham, England

Number of Properties: ~6,000

The IHG One Rewards program recently went through a revamp, but as a dynamically-priced program, it seldom makes sense to transfer your Chase Ultimate Rewards points.

For instance, we value IHG One Rewards points at 0.5 cents per point, so any redemptions above that level are generally considered to be a good value. Given that, it wouldn’t make sense to transfer Chase Ultimate Rewards points, which are worth a minimum of 1.25 cents per point through the Chase Travel portal, to a program where getting half of that value would be considered a good deal.

Marriott Bonvoy

Headquarters: Bethesda, Maryland

Number of Properties: ~8,500

As with IHG, we seldom advise against transferring your hard-earned Chase Ultimate Rewards points to Marriott Bonvoy where nights at top-tier hotels can cost upwards of 85,000 to 100,000 points per night. Not only is it fairly easy to get more value out of other Chase partners, but you’ll also find that you’d likely be better off booking a Marriott hotel through the Chase Travel portal than transferring to Marriott directly.

World of Hyatt

Headquarters: Chicago, Illinois

Number of Properties: ~1,200

If you thought Hyatt would be similar to the other 2 hotel programs, think again. The World of Hyatt program is one of the best Chase Ultimate Rewards transfer partners and a darling in the points of miles community thanks to the value its award chart offers.

While the program recently went through a devaluation with the addition of peak pricing, even the most expensive award nights in the portfolio don’t exceed 45,000 points per night. This means you can book free nights at top-tier Hyatt hotels for roughly half of what programs like Marriott and Hilton often charge for similar hotels.

Hot Tip: Use our transfer partner tool to see how many points you’ll get when you transfer your Chase Ultimate Rewards to partner airlines and hotels!

With several Chase card options available, there are ample opportunities to earn Ultimate Rewards points that can help you book your next trip.

Recommended Chase Cards (Personal)

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases through March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

The Chase Freedom Unlimited ® is easily one of the best cash-back credit cards on the market. There aren’t many no-annual-fee credit cards that offer multiple great bonus categories like 5% back on travel purchased through Chase, 3% back on dining and drugstore purchases, and 1.5% back on all other purchases.

When paired with other Chase cards in the Ultimate Rewards family, you can transfer that cash back into points if you wish – making it one of the most lucrative cards in your wallet.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- 5% back on travel purchased through Chase Travel℠

- 3% back on dining and drugstore purchases

- 3% foreign transaction fee

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited ® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- APR: 0% Intro APR for 15 months on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

The Freedom Flex card is an excellent no-annual-fee card that still earns big with 5% cash-back on travel and other bonus categories.

The Chase Freedom Flex℠ sure does pack quite a punch — especially for a no-annual-fee card.

The Freedom Flex card is an incredible option for those looking for a well-rounded cash-back card, or a powerful point-earner when paired with a premium card in the Ultimate Rewards family.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Powerful cash-back earner: 5% back on quarterly categories and travel purchases through Chase Ultimate Rewards, 3% back on dining and drugstore purchases, and 1% back on all other purchases

- No annual fee

- 3% foreign transaction fees in U.S. dollars

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Flex ® card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- APR: 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

Business owner? See our list of the best Chase business credit cards .

Chase Shopping Portal

You can also shop through the Shop through Chase portal to earn extra Ultimate Rewards points when making purchases online. This is an easy way to boost your earnings on purchases you would make anyway.

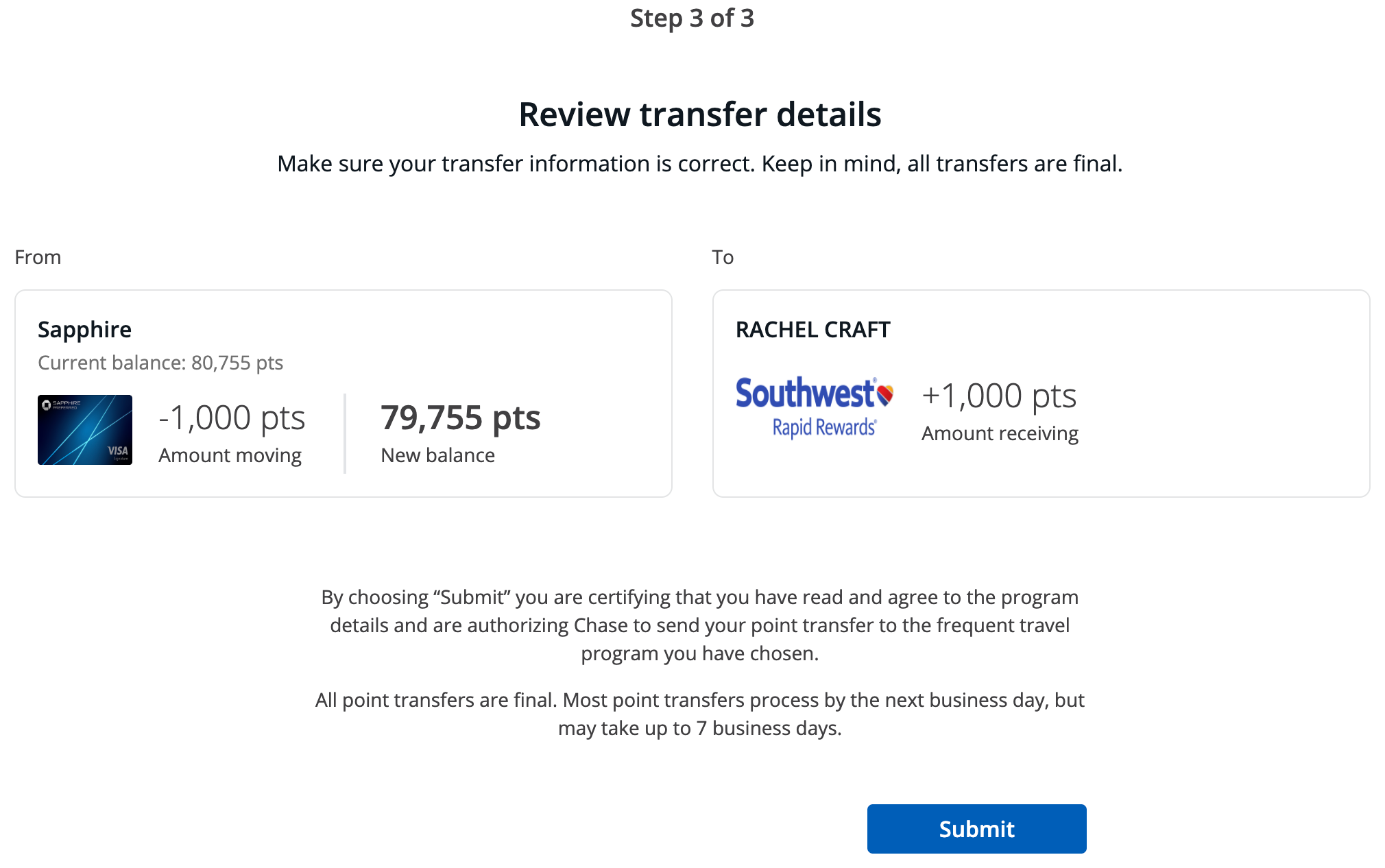

Once you have some Ultimate Rewards points and are ready to transfer them to a partner to book your next big vacation, here are the simple steps to make the transfer process easy.

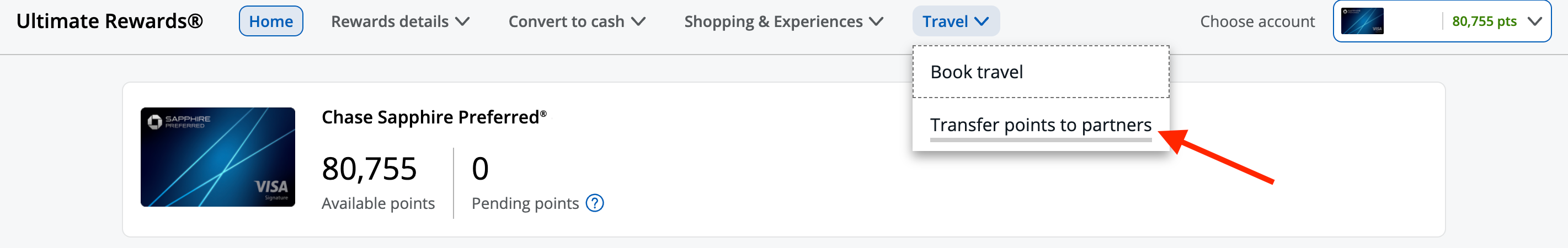

Step 1: After logging into the Ultimate Rewards site , select the appropriate card. If you want to transfer points, you will need to select a premium Ultimate Rewards card with an annual fee — these include the Chase Sapphire Reserve card , Chase Sapphire Preferred card , and the Ink Business Preferred ® Credit Card . You can combine Ultimate Rewards points under your chosen card from others that don’t have annual fees.

Step 2: Select Transfer to Travel Partners under the Earn / Use drop-down menu.

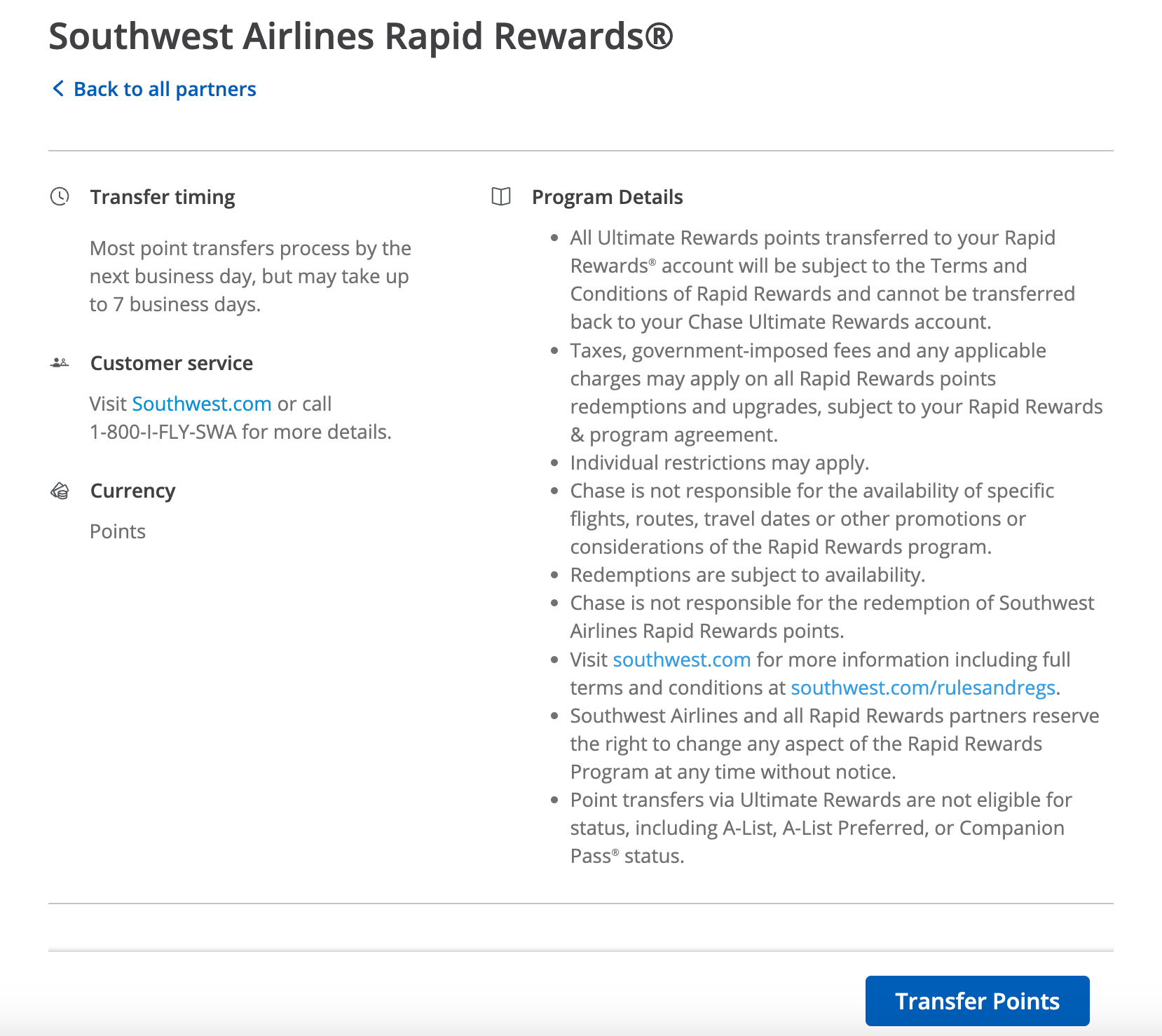

Step 3: Choose your desired airline and select Transfer Points .

You can also select from Chase’s hotel partners using the same steps.

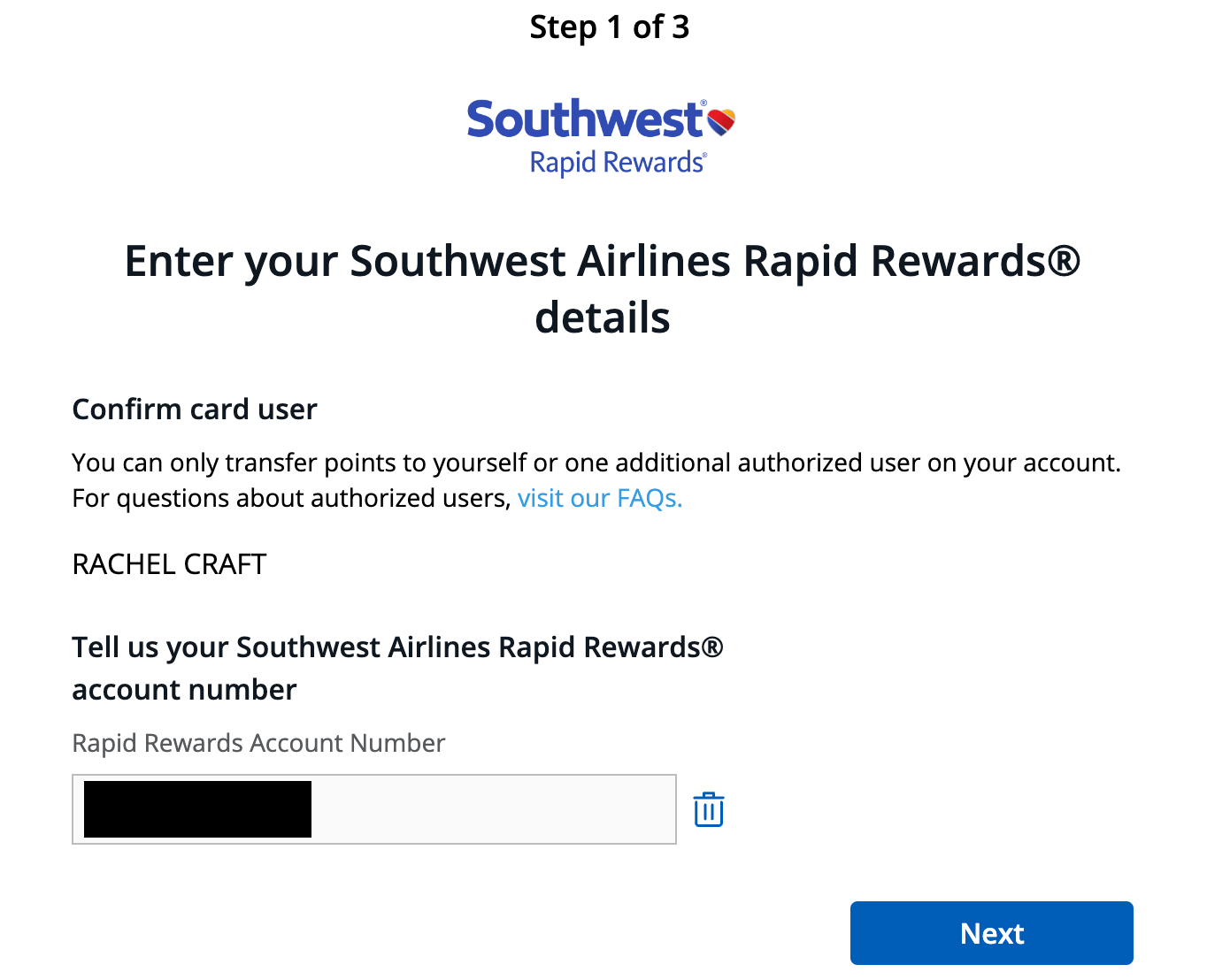

Step 4: If you haven’t already added your frequent flyer number or hotel rewards number, you will be prompted to do so.

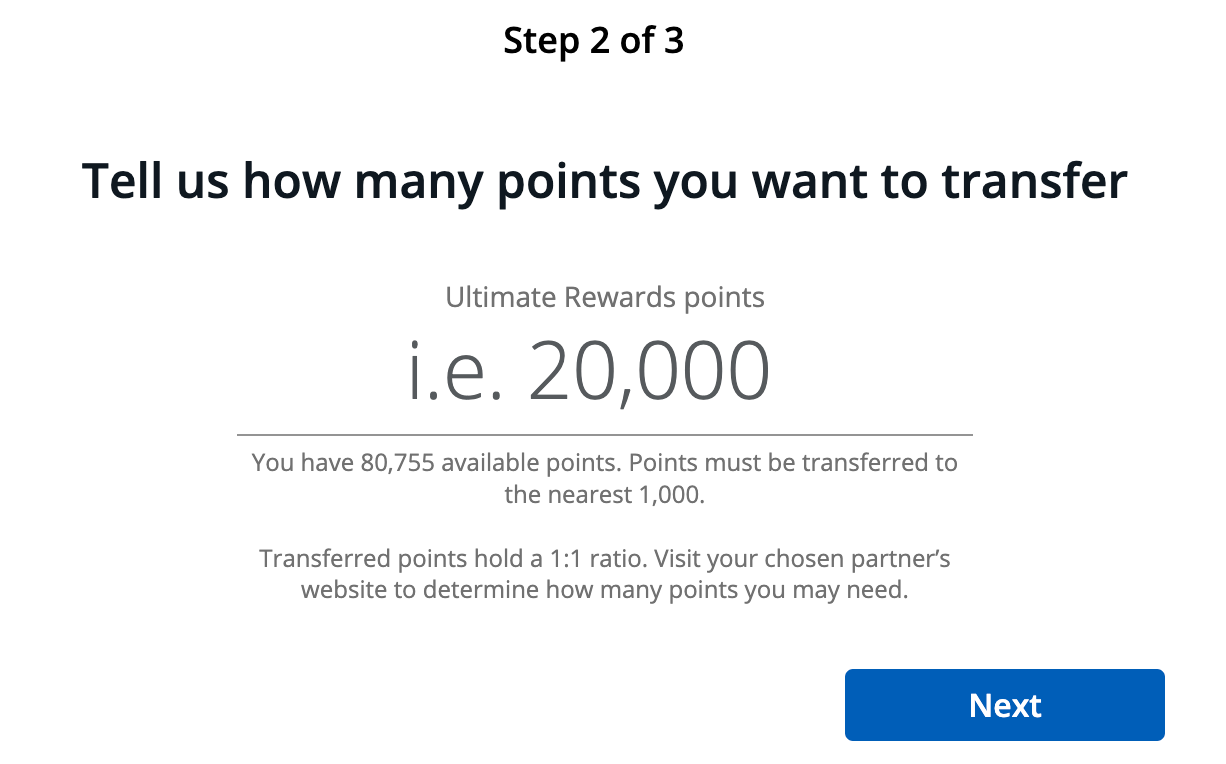

Step 5: Once you have linked your airline or hotel account to your Ultimate Rewards account, choose how many points you would like to transfer. Transfers must be done in increments of 1,000.

Step 6: Confirm the number of points you’re transferring and complete to transfer.

Step 7: Head over to the appropriate airline or hotel program’s website to book your award flight or award stay.

Sometimes, making your flight or hotel booking through the Chase travel portal can make a lot of sense. With the Chase travel portal, the points needed for specific redemption are tied to the cash cost. So, if a flight or hotel stay is relatively inexpensive, to the point where the point cost ends up being less than going through a transfer partner, then the Chase travel portal is a perfect option.

If you have the Chase Sapphire Reserve card, each Ultimate Rewards point is worth 1.5 cents when booking through the portal. If you have a Chase Sapphire Preferred card or Ink Business Preferred card, each point is worth 1.25 cents when booking with the Chase travel portal.

Similar to the transfer process, you simply select Travel under the Earn / Use Points drop-down menu.

Check out an example of a travel portal booking below:

This round-trip economy class booking with Star Alliance airline United from San Francisco (SFO) to Honolulu (HNL) costs as few as 7,900 Ultimate Rewards points.

Should You Transfer to a Partner or Book Through Chase?

Let’s think about the booking discussed above. If you were to book this same itinerary by transferring the points to Chase partner United Airlines, it would cost 12,500 miles. In this case, booking through the portal would be a much better deal.

Bottom Line: To ensure you get the most out of your points, it’s important to check both the portal and transfer options when searching for flights.

The Chase travel portal allows you to book hotels at the same 1.5 cents per point for cardholders of the Chase Sapphire Reserve card or 1.25 cents per point with the Chase Sapphire Preferred card or Ink Business Preferred card.

You can also redeem your points for gift cards to merchants including Airbnb , Lowe’s, Home Depot , and Amazon . Additionally, you can redeem your points for statement credits. Unfortunately, these options are a very poor use of points in terms of value, and we do not recommend them!

Combining Ultimate Rewards from your different Chase accounts is a simple process. In the menu bar, you will see the points you have earned on your selected card. If you hover over the points available, you will see a drop-down menu of your cards and the available points from each.

Select Combine Points to consolidate your points under a single card. If you have the Chase Sapphire Reserve card, keep your Ultimate Rewards points there since they’ll be worth a minimum of 1.5 cents each.

Hot Tip: You can also combine points with 1 other household member . This is a great way to pool points with your significant other for a great redemption.

Using your Ultimate Rewards points for travel is the best way to get the most value out of them. With multiple transfer partners and countless ways to redeem points for travel, it can be overwhelming!

We’ve compiled multiple lists of the best ways to use your Chase Ultimate Rewards for some incredible travel experiences. See below:

- The Best Ways To Use Ultimate Rewards Points

- The Best Ways To Use 10,000 (Or Fewer) Chase Ultimate Rewards Points

- The Best Ways To Use 100,000 Ultimate Rewards Points

The Chase Ultimate Rewards program should be a staple in your points-earning strategy. If you are just starting your miles and points journey, we recommend earning Ultimate Rewards initially. Check out our Beginner’s Guide to get started on the right track.

Chase Ultimate Rewards points are easy to earn, easy to redeem, and can get you excellent value when you use them properly. Before you know it, you’ll be taking a trip of a lifetime … and then doing it again!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

![chase rewards travel partners How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Chase Transfer Partners

- How to Earn Ultimate Rewards

- Airline Transfer Partners

- Hotel Transfer Partners

- How to Transfer Ultimate Rewards

Chase Ultimate Rewards Transfer Partners 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex®. The details for these products have not been reviewed or provided by the issuer.

- Chase Ultimate Rewards® partners with 11 airlines and 3 hotel loyalty programs.

- Transferring points to travel partners is the best way to maximize the value of your Chase rewards.

- Several Chase credit cards earn Chase Ultimate Rewards, including the popular Chase Sapphire Preferred® Card.

When you use a Chase credit card , you're paying for purchases in dollars, but all your spending helps you rack up another kind of currency: Chase Ultimate Rewards® points.

Chase Ultimate Rewards points are some of the most valuable credit card rewards you can earn. Chase Ultimate Rewards are transferable points , which means you can move them over to various airline and hotel partner programs to book travel, in addition to the option of booking through Chase Travel℠ or using points toward eligible everyday purchases through Pay Yourself Back .

Maximizing Chase points requires knowing when and with whom you should redeem them. While you can use Chase Ultimate Rewards points to make purchases and pay for travel directly through Chase Travel℠, it's possible to significantly increase their value by transferring them to one of Chase's travel partners.

Chase Transfer Partners: The Basics

Chase has 14 travel transfer partners: 11 airline frequent flyer programs and three hotel programs.

Chase lets you transfer points at a 1:1 ratio in 1,000-point increments, and those transfers typically happen instantly (that's important for making sure you can grab an award flight or an award stay before it's gone). There are a few exceptions, though, and we've noted those in our breakdown of each partner below.

The value of those points can vary widely depending on where you want to go in the world and when you plan to travel. So, the best approach with Chase Ultimate Rewards is to be meticulous. Comparing all your options on departure/arrival dates and resort locations can help you figure out how to harness the most power from each of your points.

Also, be sure to keep a close eye on your email for alerts from Chase or these travel companies about exclusive offers, such as transfer bonuses, that can get you cheaper redemptions on flights and hotel stays.

How to Earn Chase Ultimate Rewards Points

You'll need to earn Chase Ultimate Rewards points before you can enjoy transferring them for award travel. Doing that requires having one or more of the best Chase credit cards in your wallet:

Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1x point per $1 spent on all other purchases.

22.49% - 29.49% Variable

Earn 60,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel credit can effectively shave $300 off the annual fee if you use it

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong bonus rewards on travel and dining

- con icon Two crossed lines that form an 'X'. Very high annual fee

If you're new to rewards credit cards you may want to start elsewhere, but if you know you want to earn Chase points and you spend a lot on travel and dining, the Sapphire Reserve is one of the most rewarding options.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases.

21.24% - 26.24% Variable

Earn 120,000 bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High sign-up bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3x bonus points on several spending categories, including travel and advertising purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes comprehensive travel coverage

- con icon Two crossed lines that form an 'X'. Welcome bonus has a very high minimum spending requirement

The Ink Business Preferred® Credit Card offers a huge welcome bonus and solid earning and benefits for a moderate annual fee. If your small-business expenses line up with the card's bonus categories and you like redeeming Chase Ultimate Rewards® points for travel, this is one of the best small-business credit cards to consider.

- Earn 120k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,200 cash back or $1,500 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase TravelSM

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% cash back on travel purchased through Chase Travel℠. Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery services. Earn unlimited 1% cash back on all other purchases.

0% intro APR on purchases and balance transfers for the first 15 months

20.49% - 29.24% Variable

Earn $200 cash bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous bonus cash-back categories

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great welcome bonus

- con icon Two crossed lines that form an 'X'. Booking through Chase Travel℠ can restrict outside earning potential

- con icon Two crossed lines that form an 'X'. Varying percentages and rotating calendar categories require extra attention

- con icon Two crossed lines that form an 'X'. 3% foreign transaction fees

The Chase Chase Freedom Flex® is a great pick if you want one of the best no-annual-fee cards with big earning potential and impressive benefits. It's an even better choice if you already collect Ultimate Rewards points with other Chase cards, because you can combine your points and potentially get even more value.

Earn 5% cash back on travel purchased through Chase Travel℠; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases

Earn an additional 1.5% cash back on everything you buy

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Solid flat cash-back rate

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can combine cash-back rewards with Ultimate Rewards points if you have an eligible card

- con icon Two crossed lines that form an 'X'. Some other cards offer a higher rate of cash back on certain types of purchases

The Chase Freedom Unlimited® is a great choice for credit card beginners and experts alike. With no annual fee and a high earnings rate, it's worth considering as an everyday card — and it's even better when you pair it with an annual-fee Chase card like the Chase Sapphire Reserve®.

- Intro Offer: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

Once you start using any of these Chase cards, be sure to browse bonus offers via online shopping portals to maximize your rewards . There are many ways to rack up even more reward points with hundreds of online retailers, and it's a simple way to make every purchase more rewarding.

Also note that you can use Chase's no-annual-fee cards, including the Chase Freedom Unlimited® and the Chase Freedom Flex® , to turbo-charge your stash of Chase Ultimate Rewards. That's because as long as you have a "premium" Chase card — like the Chase Sapphire Reserve® or Ink Business Preferred® Credit Card — you can move over the rewards you earn from a cash-back Freedom or Ink card to redeem them with transfer partners or simply get more value toward Pay Yourself Back and Chase Ultimate Rewards Travel redemptions.

Chase Ultimate Rewards Airline Transfer Partners

Aer lingus aerclub.

If you're looking to travel to Ireland, Aer Lingus is one of the most convenient places to start your search, and as a Chase transfer partner, it can also be a very valuable way to fly.

The airline's award chart divides travel by zone and peak/off-peak redemptions. Even the most expensive zone (Zone 6, which includes travel between Dublin and Los Angeles, Miami, Orlando, San Francisco, and Seattle) includes one-way tickets for as low as 16,250 Avios.

You can also use Avios to upgrade to business class. The upgrade fee varies between peak and off-peak travel. The good news: Two-thirds of the year is considered off-peak, according to AerClub's 2024 calendar .

Air Canada Aeroplan

Air Canada's Aeroplan loyalty program is Chase's newest airline transfer partner, and it's a great option even if you don't fly Air Canada. Because the airline is part of the Star Alliance, you can redeem Aeroplan points for flights on over 45 alliance and non-alliance partners, including United, Lufthansa, and Etihad.

Award flights in North America start at just 6,000 points, and there are numerous sweet spots for international partner flights as well. You can check Air Canada's Points Predictor Tool for an estimate of how much specific awards cost.

Air France-KLM Flying Blue

Flying from Los Angeles to Paris takes nearly 11 hours, so a Chase Ultimate Rewards transfer can be especially appealing here. A seat in business class for that journey starts at 67,500 miles. The only thing better than drinking champagne in France is drinking champagne on the way to France in the front of the bus.

And while France may be in the name, there are plenty of other redemption options available via Flying Blue, thanks to partnerships with KLM, Aircalin, GOL, Japan Airlines, Kenya Airways, and SkyTeam.

British Airways Executive Club

Sticking with Avios points, let's look at an example of reward travel with British Airways Executive Club . BA is part of the Oneworld alliance, and that alliance — which includes 14 airlines that serve more than 170 countries and territories — can be key to making the most of transferring your points.

If you redeem Avios for British Airways flights, it's hard to get outsized value, due to BA's insanely high fuel surcharges and fees that are tacked on to the points cost. However, there are some sweet spots if you redeem for partner award flights — including flights from the US East Coast to Ireland and the Caribbean, or the US West Coast to Hawaii.

Iberia Plus

Not one, not two, but three different programs allow you to turn your Chase Ultimate Rewards points into Avios points.

Unfortunately, Iberia's award chart is dominated by "peak" times on the calendar (forget finding a good deal from June through mid-September), but if you're up for a trip in February, March, October, or November, you may be able to find a good way to redeem those points.

Emirates Skywards

Emirates award flights come in three varieties: Saver, Flex, and Flex Plus. The Saver option is, naturally, the lowest cost in terms of points and the best way to maximize the value of your Chase Ultimate Rewards points.

Emirates may be best known for flying to the United Arab Emirates, but transferring your Chase points to miles will let you explore reward options with 15 of its airline partners. For example, you can use 70,000 miles for a round-trip economy ticket between South Korea and the US on Korean Air or 120,000 miles for a one-way ticket in business class on Qantas from Sydney, Australia to Los Angeles.

JetBlue TrueBlue

Even if you only have a few TrueBlue points, you could be able to put them good to use. For example, you can score a one-way ticket from Boston to Fort Lauderdale for just 3,800 points. The ticket is $61, so you're getting 1.6 cents per point.

JetBlue also has a partnership with Hawaiian Airlines, but you'll need to call 800-538-2583 to inquire about availability (which is limited). If you're looking for an island vacation, though, it could be worth picking up the phone. One-way economy seats from the West Coast are just 22,000 points.

Singapore Airlines KrisFlyer

The Singapore Airlines KrisFlyer award chart is fairly straightforward and breaks down travel to/from destinations in 13 zones.

On top of those divisions, there are two types of KrisFlyer award tickets: Advantage and Saver. The only "advantage" to Advantage tickets is that you'll find them more frequently. They cost more. You're better off trying to find a Saver option, which starts at 7,500 miles. And if you can somehow stumble into a first-class seat from the East Coast to Singapore for 132,000 miles, do it. That is the definition of high-flying luxury.

Timing alert: It's important to note that transfers for KrisFlyer take longer to process, typically two business days. So you'll need to plan further in advance if this is a transfer that fits your travel needs.

Southwest Airlines Rapid Rewards

Southwest's reward redemption valuations don't take nearly as much research as other airlines. Instead of thinking about peak and off-peak travel dates and zones, you'll simply look at how much the fare costs in dollars and you'll have a good idea of a comparable cost in Southwest points .

The values are linked. For example, a flight from Chicago to Los Angeles that costs $112 requires 7,566 points, and that same flight one week later runs $313 or 23,556 points. The lower cost has a slightly higher value of 1.4 cents per point. Nothing amazing, but also nothing too complicated.

United MileagePlus

To get a sense of some of the cheap miles redemptions you can score on United , the airline regularly spotlights award flight deals on its website. For example, 5,000 miles for a ticket from Newark to Orlando, and 22,500 miles for a ticket from Chicago to Honolulu are both enticing offers right now (these change periodically).

You can dig deeper than those highlighted deals (after all, they're spotlighting them because they want to fill the seats) to find more competitive offers, too. Think outside the US borders — United is part of the Star Alliance, which includes 26 airlines that fly all over the world.

Virgin Atlantic Flying Club

You can find some incredible deals with Virgin Atlantic Flying Club points. Even though Virgin Atlantic isn't part of an airline alliance right now, it partners with a number of airlines including Delta, ANA, and Hawaiian Airlines.

Award flights on Virgin Atlantic to the UK and beyond can be a good deal, but keep in mind Virgin Atlantic adds high taxes and fees to its own flights.

Chase Ultimate Rewards Hotel Transfer Partners

Ihg one rewards.

From a Holiday Inn Express to a boutique experience at Kimpton Hotel, IHG has loads of properties where you can enjoy an evening without paying any actual cash. However, IHG's points redemption values here aren't anything to write home about.

Sure, it would be great to spend a night at the InterContinental Bangkok or InterContinental Bali, but my searches reveal that redemption rates at IHG properties rarely exceed the 1-cent mark. In that case, you're better off booking a room directly through the Chase Travel℠ .

Marriott Bonvoy

No matter where you go, you'll probably find a Marriott property. With 30 brands that range from the high-end world of Ritz-Carlton and St. Regis to limited-service, budget-friendly options like Fairfield Inn and TownePlace Suites, Marriott Bonvoy points can book you a room in a wide range of accommodations.

The catch: It's hard to find a redemption that increases the value of your Chase Ultimate Rewards points. Marriott Bonvoy's award pricing is now dynamic, and I rarely find options that increase the value of Marriott points. There are exceptions, though, proving that you should always do your research.

Timing alert: Bonvoy transfers typically process by the next business day, not immediately.

World of Hyatt

If you're looking to make the most of your Chase Ultimate Rewards points for a hotel stay, I recommend starting with the World of Hyatt program . In addition to affordable, 5,000-point redemption rates at limited-service properties like Hyatt Place and Hyatt House, this loyalty program has loads of luxurious properties where you can cash in your points for a more meaningful redemption.

Consider some of these examples for a getaway: a queen room at the Andaz San Diego (15,000 points per night versus $313 per night), a villa at the Park Hyatt Maldives Hadahaa (30,000 points per night versus $1,045 per night), and a standard king the Park Hyatt Beaver Creek, Colorado (30,000 points per night versus $1,900 per night).

How to Transfer Chase Ultimate Rewards Points

Once you've found a great redemption through a Chase Ultimate Rewards airline or hotel partner, your next step is to transfer your points from Chase to the loyalty program where you want to make a booking.

To get started, log into your Chase account and navigate to the Chase Ultimate Rewards page. Click "Earn/Use," and you'll see various options, including "Transfer to Travel Partners." Click this, then you'll be presented with a list of Chase's 14 transfer partners.

Click "Transfer Points" next to the transfer partner you're eyeing, and you'll be prompted to enter your airline or hotel loyalty program info. If you don't have an account yet, don't worry — it's free to sign up, so you'll just have to do that before initiating the transfer.

Once you have your Chase account and your frequent-flyer or hotel loyalty program account connected, you can initiate the transfer, and in most cases, the transaction will go through immediately.

Chase Ultimate Rewards Transfer Partner Frequently Asked Questions

Chase has a diverse range of transfer partners in its Chase Ultimate Rewards program. These partners include leading airlines and hotel loyalty programs such as United Airlines, Southwest Airlines, British Airways, Hyatt, Marriott, and more. By transferring your Chase Ultimate Rewards points to these partners, you can access a variety of travel options, from flights to hotel stays, unlocking greater value and flexibility in your rewards.

Chase Ultimate Rewards points can be transferred to several airline partners, and among them is United Airlines, a member of the Star Alliance network. By transferring your Chase Ultimate Rewards points to United Airlines MileagePlus, you can access the extensive Star Alliance network and redeem your points for flights with various member airlines, expanding your travel options and benefits.

Chase Ultimate Rewards points can be transferred to several hotel loyalty programs, including popular options like Hyatt, Marriott Bonvoy, and IHG Rewards Club. This allows you to use your points for hotel stays at a wide range of properties within these programs, offering flexibility and value when planning your accommodations during your travels.

To transfer Chase Ultimate Rewards points to partner loyalty programs, log in to your Chase account, select 'Transfer to Travel Partners,' choose the partner program, enter your account details, and confirm the transfer. Be aware of transfer times and ratios for each partner. Your points will then be available for redemption within the selected loyalty program.

- Main content

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

A Guide To Getting The Most Out Of Chase Ultimate Rewards With Travel Partners

Knowing how to take advantage of Chase airline and hotel partners can help you stretch your Ultimate Rewards further.

/images/2019/05/09/chase-ultimate-rewards-with-travel-partners.jpg)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Chase Ultimate Rewards is one of the most popular credit card rewards programs — and for good reason.

The program offers several redemption options, and with some credit cards , you can squeeze more value out of your points when you redeem them for travel or transfer them to Chase airline partners or hotel partners.

Transferring your points to travel partners gives cardholders the most potential value, but maximizing rewards value this way isn’t always straightforward. Here are some of the best travel credit cards that earn Ultimate Rewards points and what you need to know about them.

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Ink Business Preferred

Chase airline partners

Chase hotel partners, how to transfer chase ultimate rewards to an airline or hotel partner, are there transfer “rules” i should know, faqs about chase transfer partners, what’s the benefit of using transfer partners over earning points and miles directly.

There are 11 Chase airline partners, each of which allows transfers at a 1:1 ratio in 1,000-point increments.

The value you gain from transferring points can vary based on where you move your points to and how you redeem them from there.

On average, most airlines offer a value of 1.2 to 1.5 cents per point. However, you can potentially get more value with the right booking strategy. For example, some travelers have reported getting business class tickets on Singapore Airlines for less than 100,000 points, a fare that might otherwise cost thousands of dollars.

It’s also important to consider other aspects, including award availability and blackout dates. Some airlines, for instance, limit how many award tickets they offer on a single flight. So if enough people have already booked a flight with points or miles, you’ll have to change up your itinerary. Others will have blackout dates on which there’s no availability for award tickets.

Southwest Airlines and JetBlue are two airlines that don’t have blackout dates at all. Searching for award availability, however, can be trickier. While some airlines allow you to search through your frequent flyer account with them, others may require you to check through a travel partner or alliance site to get the best look.

How to know if you’re getting the best value

Ultimately, the best redemption is the one that works best for you. While booking a business class ticket may give you a better value than flying economy to New York City, it’s not helpful if you’re planning a trip to the Big Apple and don’t have a desire to visit Southeast Asia.

That said, if you can use more than one transfer partner to get where you want to go, take some time to research the various options. Head to each website and find out how many points or miles it’ll take to book a flight, then pick the option that will save you the most points.

This process can take time, but it can save you a lot over the long run. There are also free resources that can help you learn about maximizing your points, like our group, FBZ Elite Travel & Points .

Chase has three hotel transfer partners, all of which allow you to transfer points at a 1:1 ratio in 1,000-point increments.

As with the Chase airline partners, redemption value can vary based on when and how you book your hotel stay with these partners.

On average, though, World of Hyatt points are potentially worth double or even triple the value you can get with Marriott Bonvoy and IHG Rewards Club points. But accessibility is another challenge. Hyatt, for instance, has roughly 850 properties worldwide, while IHG and Marriott have approximately 5,600 and 7,000 properties, respectively.

All three hotel brands advertise no blackout dates, but the policies may not apply to certain properties or bookings.

Again, the most important thing is that you get a redemption that works for your travel plans. If your destination has all three hotel brands, you’ll get more average value by booking with Hyatt over the other two. However, if there are only IHG and Marriott hotels in and around the city, redemption value can depend.

As with airline redemptions, take some time to check out different redemption options. Run through some dummy bookings with hotels in the area to see which one you can get with the fewest number of points.

As you do, be aware of the location of the hotels you’re comparing. One hotel may be the cheapest, but it may be so far out of the city that you need to use a rental car or ridesharing service to get around. As such, it’s important to balance cost and convenience to get the right fit.

If you’re looking to maximize the value of your Chase Ultimate Rewards through a partner, the process is relatively simple. Start by logging into your Chase Ultimate Rewards account, then choose the card with the points you want to transfer. Alternatively, you can reach your rewards account through your online banking account.

Once you’re in the right rewards account, hover over “Use points” in the menu and click on “Transfer to Travel Partners.” This will open a new page listing all of the program’s transfer partners.

Click on the program you want to transfer to and, if you haven’t already, add your loyalty information. Then enter the number of points you want to transfer — in increments of 1,000 — and submit your request.

Chase Ultimate Rewards has a few terms and conditions to know about before you submit your transfer request.

First, you can only transfer points to a loyalty account owned by you or an authorized user who lives in your household. Also, some transfers may incur a fee, but Chase will notify you of the fee before you submit your request.

Finally, all point transfers are final. So once the rewards have been moved, Chase won’t process any cancellations or refunds.

What airlines do Chase points transfer to?

If you have an eligible card and you’re looking to transfer your Chase points at a 1:1 ratio, there are 10 participating airlines:

- Virgin Atlantic

Is Delta a Chase transfer partner? Do Chase points transfer to American Airlines?

Delta is not a Chase transfer partner. However, SkyTeam member Air France/KLM is a partner, so you can transfer your Chase points to the Flying Blue program and use them to book other SkyTeam Alliance flights .

Similarly, if you’re looking to transfer points to American Airlines, you need to do it through British Airways. You can transfer your Chase points to the Avios program, and then use them to book American Airlines flights.

Alternatively, it’s also possible to book your flights through the Chase Ultimate Rewards portal if you’d like to book directly with Delta or American, though this may offer a lower value for your points depending on your card and the flights you book.

Can I transfer Chase Ink points to Chase Sapphire?

Yes, you can. Log into your Ultimate Rewards account and select the correct accounts to transfer points between. Be sure your credit cards are all associated with the same account so you can transfer your rewards.

How do I use my Chase points for flights?

Either book through Chase Ultimate Rewards using your points, or transfer your points to your airline’s rewards program and then book your flights as normal through the airline’s site.

Can I transfer my Chase points to someone else?

Yes, Chase allows you to pool Ultimate Rewards points with one member of your household. So if you and your partner both have a card that uses the rewards program, you can transfer points back and forth to take advantage of your combined earning power.

You can also transfer points between your own Ultimate Rewards-earning cards. So if you have the Chase Freedom Unlimited and the Chase Sapphire Reserve , you can transfer points earned with the Chase Freedom Unlimited to the Chase Sapphire Reserve to gain access to better redemption options. Add the Chase Freedom Flex to this duo and you have the Chase trifecta , a smart strategy for maximizing your Chase earning and redemptions.

How many Chase points do you need for a flight?

The number of Chase points you need for a flight depends on the airline, the cabin you choose, and where you’re traveling. In general, you need anywhere between 5,000 and 260,000, based on whether you’re in economy or first class, flying domestically or internationally.

Transferring Chase Ultimate Rewards points isn’t the only way to rack up rewards with the program’s transfer partners. Marriott, JetBlue, United, and several other programs have co-branded credit cards, like the Chase United Explorer Card , that allow you to earn points and miles directly.

While those Chase credit cards often provide added features like elite hotel status, free anniversary nights, priority boarding, or free checked bags, putting all of your eggs in one basket rewards-wise can be challenging and come back to bite you.

Specifically, airlines and hotel chains sometimes make changes to their loyalty programs that devalue their rewards points or miles. If you have a card that earns rewards directly with a devalued program, the worth of your rewards balance instantly depreciates.

If, however, you have Ultimate Rewards points, you have the flexibility to transfer your points to another program that hasn’t been devalued recently, or you can use your points to book travel directly through Chase.

Great for Flexible Travel Rewards

Chase sapphire preferred ® card.

/images/2024/03/28/chase_sapphire_preferred_032824.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

Rewards Rate

5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases

- Generous welcome offer valued at $750 when redeemed via Chase Travel

- High rewards on dining and bookings via Chase Travel

- 25% more value when redeeming points for travel through Chase Travel

- Up to $50 in annual statement credits for hotel stays booked through Chase Travel

- Receive valuable travel protections like trip delay reimbursement and primary rental car insurance

- Has a $95 annual fee

- Doesn’t offer airport lounge access or premium travel perks like Global Entry or TSA PreCheck credit

- Doesn't offer bonus points on gas or in-person groceries purchases

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

/authors/ben-luthi_uVgqu3a.png)

Author Details

Credit Cards

Financial planning.

- Cheapest Car Insurance

- Cheapest Full Coverage Car Insurance

- Car Insurance Cost Calculator

- Best Car Insurance

- Compare Car Insurance Costs

- Average Cost of Car Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Best Life Insurance Companies

- Best Universal Life Insurance

- Best Life Insurance for Seniors

- Compare Quotes

- Best Auto and Home Insurance Bundle

- Homeowners Insurance

- Renters Insurance

- Health Insurance

- Pet Insurance

- Small Business Insurance

Insurance Guidance

- Conventional Mortgages

- Jumbo Loans

- Best HELOC Loans and Rates

- Get a HELOC With Bad Credit

- Pay Off Your Mortgage With a HELOC

- Pros and Cons of HELOCs

- The HELOC Approval Process

- Mortgage Payment Calculator

- Reverse Mortgage Calculator

- FHA vs. Conventional Loan Calculator

- Private Mortgage Insurance Calculator

- Debt-to-Income Ratio Calculator

Mortgage Guidance

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Travel Rewards Credit Cards

- Best Airline Credit Cards

- Best Credit Cards for Excellent Credit

Best Business Credit Cards

- Best American Express Cards

- Best Capital One Credit Cards

- Best Chase Credit Cards

- Best Citi Credit Cards

- Best Bank of America Credit Cards

- Cash Back Calculator

- Pros and Cons of Balance Transfers

- Practical Guide for Improving Credit Fast

- Average Credit Score by Age

- Credit Cards For Bad Debt

- Credit Card Glossary

Recent Credit Card Reviews & Comparisons

- Best Personal Loans of 2024

- Best Personal Loans for Excellent Credit

- Best Personal Loans for Good Credit

- Best Personal Loans for Bad Credit

- Best Same-Day Approval Loans

- Best Personal Loans for Debt Consolidation

- Best Private Student Loans

- Best Student Loans for Bad Credit

- Best Student Loans for International Students

- Best Low-Interest Student Loans

- Best Student Loans Without a Co-Signer

- Personal Loan Calculator

- Auto Loan Calculator

- Student Loan Calculator

- How to Calculate Loan Payments

- Can You Get a Personal Loan With Bad Credit?

Loans Guidance

- Compound Interest Calculator

- Cost of Living Calculator

- Financial Literacy Handbook

- Guide to Retirement Planning

- Ultimate Guide to Budgeting

- Understanding Types of Debt

- How to Pay Down Student Loan Debt

- How to Start Saving & Investing

- Should You Rent or Buy a House

- How to Pay for College

- Guide to Buying a Car

- Guide to Negotiating Salary

- Safest Cities in America

- Top Cities for Job Seekers

- Most & Least Tax-Friendly States

- Most Dangerous Days for DUIs

Chase Ultimate Rewards Points Transfer Partners

Chase Ultimate Rewards transfer partners offer a great way to maximize the value of your points from Chase.

Doug Milnes, CFA

Head of Credit Cards at MoneyGeek

Doug Milnes is a CFA charter holder with over 10 years of experience in corporate finance and the Head of Credit Cards at MoneyGeek. Formerly, he performed valuations for Duff and Phelps and financial planning and analysis for various companies. His analysis has been cited by U.S. News and World Report, The Hill, the Los Angeles Times, The New York Times and many other outlets. Milnes holds a master’s degree in data science from Northwestern University. He geeks out on helping people feel on top of their credit card use, from managing debt to optimizing rewards.

Lee Huffman

Credit Card and Personal Finance Expert

Lee Huffman is a credit card and personal finance expert at MoneyGeek. He has spent 18 years as a financial planner and corporate finance manager, with 12 years of experience writing about early retirement, credit cards, travel, insurance and other personal finance topics. His writings are published on The Points Guy, Investopedia and NerdWallet. Huffman earned his business management degree from Pepperdine University and his master's degree in eBusiness from the University of Phoenix. He enjoys showing people how to travel more, spend less and live better through the power of travel rewards.

Updated: August 20, 2024

Advertising & Editorial Disclosure

- Chase Cards With Transfer Partners

- Chase Travel Partners?

- Benefits of Using Transfer Partners

- How to Maximize Your Points

MoneyGeek partners with leading industry experts and advertisers to help you get to your financial happy place. Our content is accurate when posted but offers may change over time. We may receive compensation for partner advertisements, but our editorial team independently reviews and ranks products. Learn more about our editorial policies .

Chase's travel rewards program, known as Chase Ultimate Rewards, allows cardholders to accumulate points on their spending. A standout attribute of this initiative is the ability to leverage these points with Chase transfer partners, which include a range of airline and hotel loyalty programs. With Chase travel partners, points can be transferred at a 1:1 ratio, all without any transfer fees. This method frequently offers a greater return on value compared to directly redeeming them through the Chase travel portal.

A few of the 14 travel partners you may transfer your Ultimate Rewards points to include British Airways Executive Club, Emirates Skywards, Virgin Atlantic Flying Club and Marriott Bonvoy.

To take advantage of these transfer opportunities, you typically need to have one of Chase's premium Ultimate Rewards cards. Some no-annual-fee cards earn Ultimate Rewards points, but you can't directly transfer those points to partners unless you also have one of the premium cards. If you do have both, you can combine your points onto the premium card and then transfer to partners.

- Chase lets you transfer your points to 14 airline and hotel rewards programs.

- You can transfer your points to Chase’s travel partners at a 1:1 ratio.

- You can transfer your points using the Chase website or app.

Which Chase Cards Allow Transfer Partners?

Chase credit cards associated with the Ultimate Rewards program allow you to leverage Chase transfer partners by converting your points to the bank's travel partners. While these cards carry annual fees, they offer significant value, especially for frequent travelers.

To maximize your earning potential and if you're comfortable managing multiple cards, you may want to consider setting up a Chase trifecta . This strategy involves holding three Chase cards that offer higher reward rates based on different spending categories. Additionally, with the flexibility Chase provides, you can incorporate a cash back card into your portfolio. This is because Chase enables you to merge your cash back with points from other eligible Chase cards, further enhancing the benefits of having multiple travel partners.

While Chase markets some of its products as cash back cards, they're essentially part of the Ultimate Rewards program and earn reward points. Only, they offer fewer redemption options. You may move your reward points between different Chase cards you have for free. You may then transfer the points to any of the Ultimate Rewards transfer partners.

By transferring your points from one Chase card to another, you also have the ability to increase their value. For instance, while the value of one point you earn by using either of the Chase Freedom cards is 1 cent, transferring your points from these cards to the Sapphire Reserve card ups their value to around 1.5 cents per point when booking travel or using the Pay Yourself Back feature.

Who Are Chase’s Travel Partners?

While Chase allows you to make travel bookings through its Ultimate Rewards platform, you may get better value if you transfer them to a Chase Ultimate Rewards partner. Whether you transfer your points to an airline or a hotel partner, you get a 1:1 ratio. This means 1,000 Ultimate Reward points convert to 1,000 airline miles or hotel points.

Cardholders can choose from 11 airline frequent flyer programs and three hotel reward programs. Transferring is relatively easy through the Ultimate Rewards platform.

Chase Ultimate Rewards faces stiff competition from reward programs of other card issuers such as Capital One, Amex and Citi. But it manages to hold its own by ensuring its points are of good value and giving cardholders considerable freedom in how they use their points. Providing significant spend-based welcome bonuses through some of its cards also benefits them.

Chase’s Airline Partners

Chase’s airline partners include local as well as international airlines. Some of these are also part of popular airline alliances. That gives you the ability to use your points with even more airlines.

Other Airline Partners

- Aer Lingus AerClub. Transferring your points to AerClub might work well if you travel to Ireland. Its award chart categorizes travel based on peak or off-peak redemptions and zones.

- Air Canada Aeroplan . If your travels take you to Canada, Air Canada's Aeroplan might be the way to go. Even if Canada is not on your travel itinerary, you might benefit from it being a part of the Star Alliance.

- Emirates Skywards . Emirates is ideal if you wish to travel to the United Arab Emirates. In addition, while this program is not a part of any alliance, it is partnered with most airlines serving different countries.

- Air France-KLM Flying Blue. Flying Blue offers up to 50% off on reward tickets across specific routes. It is Chase's only airline partner from the SkyTeam alliance, which has 19 other member airlines.

- Iberia Plus. Spain-based Iberia consistently offers affordable economy fares for transatlantic flights. It is part of the Oneworld alliance.

- JetBlue TrueBlue . This low-cost American airline also has a presence in Latin America and the Caribbean. In addition, it partners with over nine other airlines.

- Singapore Airlines KrisFlyer . KrisFlyer award tickets come in the form of Advantage and Saver. While the former's cost more, they are easier to come across. Singapore Airlines is a member of the Star Alliance.

- Virgin Atlantic Flying Club . Virgin Atlantic's reward flights from the U.S. to Europe can turn out to be good deals, but you need to account for the high fees and taxes you might need to pay. It partners with over 20 other airlines.

Chase Hotel Partners

Transferring your Chase reward points to a hotel partner might work well for you if you prefer to use any of the brands over others.

Before transferring points to an airline or hotel partner, make sure that there is award space available. Once you transfer points to a partner, you cannot unwind the transfer. — Lee Huffman , credit card expert at BaldThoughts.com

What Is the Benefit of Transferring Points With Chase Travel Partners?

The value of your Ultimate Rewards points depends on the card you use and how you choose to redeem them. If you wish to get cash back, each point is valued at one cent. If you use your points to make travel bookings through the Ultimate Rewards platform, their worth typically varies from one cent to 1.5 cents per point. The benefit of transferring points to Chase travel partners is that you get even more value for your points. However, this is not necessarily always the case.

How to Use Chase Ultimate Rewards With Transfer Partners

Using your Chase Ultimate Rewards points with its transfer partners requires that you transfer them to the partner in question first. For example, if you wish to use your Ultimate Rewards points with the British Airways Executive Club, you'll need to get online and carry out a points transfer first.

Remember that your points' value doesn't always increase when you transfer them to a travel partner. Sometimes, you might get better value by using your points through the Ultimate Rewards platform instead of an airline or hotel rewards program. For example, if you have a Sapphire Reserve Card and wish to fly with JetBlue, you may get better value for your points through the Ultimate Rewards platform than through the JetBlue TrueBlue program.

It's also important to note that the value of your points may vary based on the routes, dates and class you wish to fly. Once you decide to transfer your Ultimate Reward points to a Chase travel partner, you need to follow a relatively straightforward process.

Log in to the Chase Ultimate Rewards platform.