- Trending Stocks

- Bajaj Housing INE377Y01014, BAJAJHFL, 544252

- Ola Electric INE0LXG01040, OLAELEC, 544225

- Suzlon Energy INE040H01021, SUZLON, 532667

- Tata Motors INE155A01022, TATAMOTORS, 500570

- BSE Limited INE118H01025, BSE, 0

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- Fixed Deposits

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Seasonality Analysis

- Stock Advisory by SEBI's RIA

- Auri ferous Aqua Farma , 519363

- Loans @ 12% Up to ₹ 15 Lakhs!

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Picks Personal Finance

- My Subscription My Offers

- Loans

- Home FII & DII Activity

- Earnings Technical Trends

- Webinar Bonds

- Web Stories

- Silver Rate

- Storyboard18

- Economic Indicators

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Share.Market Financial Freedom

- Research Picks Policybazaar

- MF Summit Startup Conclave

- Mutual Fund Summit IFBA Season 3

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Advanced Technical Charts

- International

- Go pro @₹99

- Assembly Elections

- Instant ₹15 Lakhs!

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Travel Services

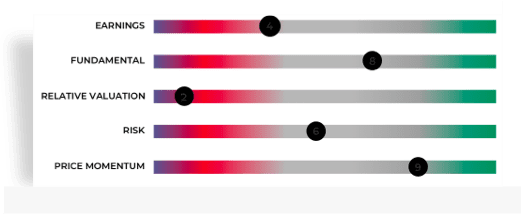

Samco Stock Rating

Easy Trip Planners Ltd.

As on 19 Sep, 2024 | 03:59

* BSE Market Depth (19 Sep 2024)

As on 19 Sep, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

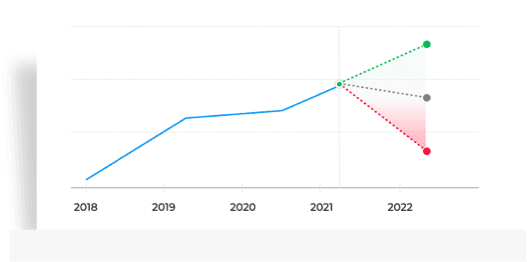

Forecast

Stock with good financial performance alongside good to expensive valuation

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 25.07% away from 52 week high

- Market Cap - Above industry Median

- Promoters holding remains unchanged at 64.30% in Jun 2024 qtr

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing Debt to Equity

Companies decreasing their debt to equity ratio, decreasing roe, companies that are decreasing efficiency in utilisation of shareholders funds, debt free companies.

- D/E< D/E 1 yr Back

- Market Capitalization >250

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- Debt =0 AND

- Market Capitalization >500

5X Premium to Book Value

Companies trading at more than 5 times their book values, debt free, pledge free, list of companies with zero debt and pledge, fii selling, companies in which fiis are reducing holding.

- Price to book value > 5 AND

- Book value >0 AND

- Market Capitalization >500 AND

- Pledged percentage<0.1 AND

- Debt<0.1

- FIIHolding<FIIHolding1QtrBack AND

- MarketCap>500

Rising Book Value

Book value of these companies rising over last 3 years, price to book value above industry, companies with price to book value above industry.

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

- Price to book value >Industry PBV AND

Premium to Peers

Companies trading at premium pe valuation as compared to their industry peers, fii selling, dii buying, list of companies in which fiis have reduced and diis increased holding qoq.

- Price to Earning >Industry PE AND

- DIIHolding>DIIHolding1QtrBack AND

- MarketCap>250

Double Trouble

Companies reporting falling profits and profit margins yoy.

- NetProfit<NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

Price and Volume

Seasonality analysis.

2 out of 4 years Easy Trip Planners has given positive returns in September .

Ease My Trip says work on electric bus prototype underway, aim to ply 2,000 EV buses in two years

EaseMyTrip shares zoom 14% as company ventures into electric bus manufacturing, announces new subsidiary Easy Green Mobility Sep 05 2024 04:44 PM

Easy Trip Consolidated June 2024 Net Sales at Rs 152.60 crore, up 23.01% Y-o-Y Aug 26 2024 12:22 PM

EaseMyTrip Q1 FY25 u2013 Defending profitability at the cost of market share Aug 16 2024 10:57 AM

Easy Trip Standalone June 2024 Net Sales at Rs 105.90 crore, up 3.48% Y-o-Y Aug 14 2024 12:01 PM

Community Sentiments

What's your call on Easy Trip today?

Read 9 investor views

Thank you for your vote

You are already voted!

best share to destroy your money View more

Posted by : SabAmeer

Repost this message

best share to destroy your money

suresh_visu1987

jackpot stock what a solid performance operator is clever he understood my strategy. View more

Posted by : suresh_visu1987

jackpot stock what a solid performance operator is clever he understood my strategy.

wese humbhi 43 kya 70 ko bhi tod shkte hain bas sath main nhi hain iss liye View more

Posted by : ygrs

wese humbhi 43 kya 70 ko bhi tod shkte hain bas sath main nhi hain iss liye

- Broker Research

WILSON HOLDINGS PRIVATE LIMITED

Nishant pitti.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

GRAVITON RESEARCH CAPITAL LLP

Hrti private limited, minerva ventures fund.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Rikant pittie, nishant pitti.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Rikant Pittie & PACs Disposal

Nishant pitti & pacs disposal, nishant pitti disposal, prashant pitti acquisition, prashant pitti & pacs acquisition.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Easy Trip Planners - Board Meeting Outcome for Proposed Investment In Rollins International And Pflege Home Healthcare

Easy trip planners - announcement under regulation 30 (lodr)-press release / media release.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds have increased holdings from 0.06% to 0.08% in Jun 2024 qtr.

- Number of MF schemes remains unchanged at 8 in Jun 2024 qtr

- FII/FPI have decreased holdings from 2.78% to 2.57% in Jun 2024 qtr

About the Company

Company overview, registered office.

223, FIE Patparganj Industrial Area, ,East Delhi,,

011-43131313

http://www.easemytrip.com

Selenium Tower B, Plot No. 31-32,,Gachibowli, Financial District, Nanakramguda,Seri

Hyderabad 500032

040-67161500, 67162222, 33211000

040-23420814, 23001153

http://www.kfintech.com

Designation

Chairman & CEO

Executive Director

Independent Director

Included In

INE07O001026

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

EASY TRIP PLANNERS LTD

Easemytrip chart , upcoming earnings, key stats , about easy trip planners ltd, financials .

See all ideas

Analyst rating

Frequently asked questions.

- Technical Signals

- Live Stream

- My Watchlist

- Stock Recos

- BigBull Portfolio

- Stock Reports Plus

- Market Mood

- Investment Ideas

- Sector: Services

- Industry: Online Service/Marke...

Easy Trip Planners Share Price

- 40.46 -0.54 ( -1.30 %)

- Volume: 1,04,08,560

- 40.45 -0.55 ( -1.34 %)

- Volume: 17,06,916

- Last Updated On: 19 Sep, 2024, 03:59 PM IST

- Last Updated On: 19 Sep, 2024, 03:57 PM IST

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Easy Trip Planners share price insights

Meeting Agenda: Others. Please add to watchlist to track closely.

Company has spent 1.01% of its operating revenues towards interest expenses and 13.91% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)

50 day moving crossover appeared today. Average price decline of -4.44% within 30 days of this signal in last 5 years.

Stock gave a 3 year return of -0.98% as compared to Nifty Midcap 100 which gave a return of 101.28%. (as of last trading session)

Easy Trip Planners Ltd. share price moved down by -1.30% from its previous close of Rs 40.99. Easy Trip Planners Ltd. stock last traded price is 40.46

Insights Easy Trip Planners

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 65.44

- EPS - TTM (₹) 0.62

- Dividend Yield (%) 0.00

- VWAP (₹) 40.40

- PB Ratio (x) 11.61

- MCap (₹ Cr.) 7,091.71

- Face Value (₹) 1.00

- BV/Share (₹) 3.53

- Sectoral MCap Rank 18

- 52W H/L (₹) 54.00 / 37.00

- MCap/Sales 12.87

- PE Ratio (x) 65.42

- VWAP (₹) 40.35

- 52W H/L (₹) 54.00 / 37.01

Easy Trip Planners Share Price Returns

Et stock screeners top score companies.

Check whether Easy Trip Planners belongs to analysts' top-rated companies list?

Easy Trip Planners News & Analysis

Board Meeting Outcome for Proposed Investment In Rollins International And Pflege Home Healthcare

Announcement under Regulation 30 (LODR)-Press Release / Media Release

Easy Trip Planners Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Easy Trip Planners Share Recommendations

Recent recos.

Mean Recos by 1 Analysts

- Target ₹68

- Organization Anand Rathi

- Target ₹505

- Organization ICICI Direct

Analyst Trends

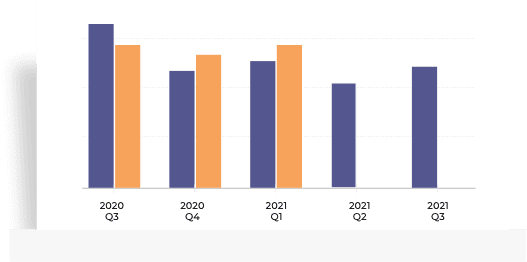

Easy trip planners financials.

- Income (P&L)

- Balance Sheet

Employee & Interest Expense

All figures in Rs Cr, unless mentioned otherwise

Financial Insights Easy Trip Planners

Easy trip planners share price forecast, get multiple analysts’ prediction on easy trip planners.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Easy Trip Planners Technicals

- Buy / Sell Signals

- Price Analysis

- Pivot Levels & ATR

Bullish / Bearish signals for Easy Trip Planners basis selected technical indicators and moving average crossovers.

20 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 19 Sep 2024

20D EMA: 40.91

Average price decline of -3.91% within 7 days of Bearish signal in last 5 years

50 Day EMA Crossover

50D EMA: 40.95

Average price decline of -4.44% within 30 days of Bearish signal in last 5 years

10 Day EMA Crossover

Appeared on: 18 Sep 2024

10D EMA: 41.33

Average price decline of -3.94% within 7 days of Bearish signal in last 5 years

14 Day EMA Crossover

14D EMA: 41.15

Average price decline of -3.84% within 7 days of Bearish signal in last 5 years

5 Day EMA Crossover

Appeared on: 17 Sep 2024

5D EMA: 41.72

Average price decline of -3.96% within 7 days of Bearish signal in last 5 years

MACD Crossover

Bullish signal on weekly chart

Appeared on: 13 Sep 2024

Region: Negative

Average price gain of 14.11% within 7 weeks of Bullish signal in last 10 years

200 Day EMA Crossover

Appeared on: 6 Sep 2024

200D EMA: 42.68

Average price decline of -5.35% within 30 days of Bearish signal in last 5 years

Bullish signal on daily chart

Appeared on: 5 Sep 2024

Average price gain of 5.28% within 10 days of Bullish signal in last 10 years

Stochastic Crossover

Appeared on: 30 Aug 2024

Region: Equlibrium

Average price gain of 10.65% within 7 weeks of Bullish signal in last 10 years

- Intraday 1 Week 38% Positive Movement since 1st Jan 2005 on basis 61% Negative Movement since 1st Jan 2005 on basis Exclude Global Meltdown - 1st Jan 2008 to 10th Nov 2008 Covid Crisis - 1st Feb 2020 to 31st Mar 2020

Pivot Levels

Average true range, easy trip planners peer comparison.

- Easy Trip Planners Stock Performance

Ratio Performance

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

- There’s no suggested peer for this stock.

Peers Insights Easy Trip Planners

Easy trip planners shareholding pattern.

- Total Shareholdings

Easy Trip Planners MF Ownership

MF Ownership details are not available.

Top Searches:

Easy trip planners corporate actions.

- Easy Trip Planners Board Meeting/AGM

- Easy Trip Planners Dividends

About Easy Trip Planners

Easy Trip Planners Ltd., incorporated in the year 2008, is a Small Cap company (having a market cap of Rs 7,169.68 Crore) operating in Services sector. Easy Trip Planners Ltd. key Products/Revenue Segments include Commission (Air Passage), Income From Advertisement, Other Services and Other Operating Revenue for the year ending 31-Mar-2023. For the quarter ended 30-06-2024, the company has reported a Consolidated Total Income of Rs 156.22 Crore, down 9.47 % from last quarter Total Income of Rs 172.56 Crore and up 23.35 % from last year same quarter Total Income of Rs 126.64 Crore. Company has reported net profit after tax of Rs 33.93 Crore in latest quarter. The company’s top management includes Mr.Nishant Pitti, Mr.Prashant Pitti, Mr.Rikant Pittie, Mr.Satya Prakash, Justice(Retd)Usha Mehra, Mr.Vinod Kumar Tripathi, Mr.Ashish Kumar Bansal, Ms.Nutan Gupta, Mr.Priyanka Tiwari. Company has S R Batliboi & Co. LLP as its auditors. As on 30-06-2024, the company has a total of 177.20 Crore shares outstanding. Show More

Nishant Pitti

Prashant Pitti

Rikant Pittie

Satya Prakash

Vinod Kumar Tripathi

Ashish Kumar Bansal

Nutan Gupta

Priyanka Tiwari

- S R Batliboi & Co. LLP S R Batliboi & Associates LLP

Online Service/Marketplace

Key Indices Listed on

Nifty 500, BSE 500, BSE 250 SmallCap Index, + 9 more

223, FIE Patparganj Industrial Area,East Delhi,Delhi, Delhi - 110092

http://www.easemytrip.com

More Details

- Easy Trip Planners Chairman's Speech

- Easy Trip Planners Company History

- Easy Trip Planners Directors Report

- Easy Trip Planners Background information

- Easy Trip Planners Company Management

- Easy Trip Planners Listing Information

- Easy Trip Planners Finished Products

FAQs about Easy Trip Planners share

- 1. What is Easy Trip Planners share price and what are the returns for Easy Trip Planners share? Easy Trip Planners share price was Rs 40.46 as on 19 Sep, 2024, 03:59 PM IST. Easy Trip Planners share price was down by 1.30% based on previous share price of Rs. 41.59.

- 2. Who is the CEO of Easy Trip Planners? Nishant Pitti is the Chairman & CEO of Easy Trip Planners

- 3. What is Easy Trip Planners's 52 week high / low? 52 Week high of Easy Trip Planners share is Rs 54.00 while 52 week low is Rs 37.00

- 4. What is the PE & PB ratio of Easy Trip Planners? The PE ratio of Easy Trip Planners stands at 66.29, while the PB ratio is 11.63.

- 5. Who are peers to compare Easy Trip Planners share price? Within Services sector Easy Trip Planners, Nazara Technologies Ltd., Infibeam Avenues Ltd., LE Travenues Technology Ltd., CarTrade Tech Ltd., Just Dial Ltd., Yatra Online Ltd., Matrimony.com Ltd., IndiaMART InterMESH Ltd., One97 Communications Ltd. and FSN E-Commerce Ventures Ltd. are usually compared together by investors for analysis.

- 6. What is the market cap of Easy Trip Planners? Market Capitalization of Easy Trip Planners stock is Rs 7,091.71 Cr.

- 1 analyst is recommending Strong Sell

- 8. What are the Easy Trip Planners quarterly results? Total Revenue and Earning for Easy Trip Planners for the year ending 2024-03-31 was Rs 609.08 Cr and Rs 103.11 Cr on Consolidated basis. Last Quarter 2024-06-30, Easy Trip Planners reported an income of Rs 156.22 Cr and profit of Rs 32.48 Cr.

- 9. Who's the chairman of Easy Trip Planners? Nishant Pitti is the Chairman & CEO of Easy Trip Planners

- 10. What is the CAGR of Easy Trip Planners? The CAGR of Easy Trip Planners is 53.38.

- Promoter holding have gone down from 65.54 (30 Sep 2023) to 64.3 (30 Jun 2024)

- Domestic Institutional Investors holding has gone up from 2.42 (30 Sep 2023) to 2.6 (30 Jun 2024)

- Foreign Institutional Investors holding has gone up from 2.3 (30 Sep 2023) to 2.57 (30 Jun 2024)

- Other investor holding has gone up from 29.73 (30 Sep 2023) to 30.53 (30 Jun 2024)

- 1 Week: Easy Trip Planners share price moved down by 1.53%

- 3 Month: Easy Trip Planners share price moved down by 5.67%

- 6 Month: Easy Trip Planners share price moved down by 6.67%

- PE Ratio of Easy Trip Planners is 65.44

- Price/Sales ratio of Easy Trip Planners is 12.87

- Price to Book ratio of Easy Trip Planners is 11.61

- 14. What dividend is Easy Trip Planners giving? An equity Interim dividend of Rs 0.1 per share was declared by Easy Trip Planners Ltd. on 11 Dec 2023. So, company has declared a dividend of 10% on face value of Rs 1 per share. The ex dividend date was 19 Dec 2023.

Trending in Markets

- Sensex Today

- Idea Share Price

- Indus Towers Share Price

- Excellent Wires and Packaging Share Price

- FirstCry Share Price

- NTPC Share Price

- Paytm Share Price

- Bajaj HFL Share Price

- US Fed Meeting Time

- US Fed Rate Cut

Top Gainers As on 03:59 PM | 19 Sep 2024

Top losers as on 03:00 pm | 19 sep 2024, easy trip planners quick links, equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Money Glow Up

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Easy trip planners limited (easemytrip.ns).

- Previous Close 40.99

- Day's Range 39.82 - 41.25

- 52 Week Range 37.00 - 54.00

- Volume 10,400,806

- Avg. Volume 15,736,678

- Market Cap (intraday) 71.714B

- Beta (5Y Monthly) 0.21

- PE Ratio (TTM) 65.26

- EPS (TTM) 0.62

- Earnings Date Nov 8, 2024 - Nov 12, 2024

- Forward Dividend & Yield 0.10 (0.24%)

- Ex-Dividend Date Dec 19, 2023

- 1y Target Est --

Easy Trip Planners Limited Overview Travel Services / Consumer Cyclical

Easy Trip Planners Limited, together with its subsidiaries, operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States. The company provides reservation and booking services related to travel and tourism through ease-my-trip portal and app or in-house call centre, which includes a range of travel-related products and services, such as airline tickets, hotels, and holiday and travel packages; and train tickets, bus tickets, air charter services, and cab bookings. It also offers travel guides and updates, and other reservation activities. The company was incorporated in 2008 and is based in New Delhi, India.

Full Time Employees

Fiscal year ends.

Travel Services

Related News

The New Magnificent Seven? These Stocks Not Named Nvidia Clear Buy Points

Meta Platforms Stock Headed for Record Close

These Stocks Are Moving the Most Today: Nvidia, AMD, Mobileye, First Solar, Tesla, Progyny, Darden, FedEx, and More

Stock market is ‘in a transition phase’ after rate cut: Citi

Nvidia and Taiwan Semi Stocks Rise. Why Fed’s Jumbo Rate Cut Is Boosting Shares.

Tesla Robotaxi Wide-Scale Deployment Unlikely Within 'Coming Years,' UBS Says

Dow Jones Near Record High After Fed Pivot, Jobs Surprise; Nvidia Clears Trendline Entry As Taiwan Semi Breaks Out (Live Coverage)

Now's the time to revisit portfolio goals as Fed cuts rates

Us equity indexes advance as fed's big rate cut boosts magnificient-7 trade.

The Fed just convinced markets it's not behind the curve

VW ‘considers cutting 30,000 jobs’

Why Edgewise Therapeutics Stock Is Up 50% on Thursday

Performance overview: easemytrip.ns.

Trailing total returns as of 9/19/2024, which may include dividends or other distributions. Benchmark is S&P BSE SENSEX .

1-Year Return

3-year return, 5-year return, compare to: easemytrip.ns.

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Statistics: EASEMYTRIP.NS

Valuation measures.

Enterprise Value

Trailing P/E

Forward P/E

PEG Ratio (5yr expected)

Price/Sales (ttm)

Price/Book (mrq)

Enterprise Value/Revenue

Enterprise Value/EBITDA

Financial Highlights

Profitability and income statement.

Profit Margin

Return on Assets (ttm)

Return on Equity (ttm)

Revenue (ttm)

Net Income Avi to Common (ttm)

Diluted EPS (ttm)

Balance Sheet and Cash Flow

Total Cash (mrq)

Total Debt/Equity (mrq)

Levered Free Cash Flow (ttm)

People Also Watch

Easy Trip Planners Limited

NSEI:EASEMYTRIP Stock Report

Market Cap: ₹71.7b

Easy Trip Planners Future Growth

Future criteria checks 5/6.

Easy Trip Planners is forecast to grow earnings and revenue by 29.5% and 13% per annum respectively. EPS is expected to grow by 31% per annum. Return on equity is forecast to be 27.7% in 3 years.

Key information

Earnings growth rate

EPS growth rate

Recent future growth updates

Price target decreased by 7.9% to ₹41.00, consensus eps estimates fall by 18%, price target decreased by 14% to ₹47.00, consensus revenue estimates fall by 12%, earnings miss: easy trip planners limited missed eps by 6.1% and analysts are revising their forecasts.

Consensus EPS estimates fall by 11%, revenue upgraded

Recent updates, easemytrip launches marketplace, scanmytrip.com, integrated on ondc network, easy trip planners limited, annual general meeting, sep 28, 2024, first quarter 2025 earnings released: eps: ₹0.19 (vs ₹0.15 in 1q 2024), the trend of high returns at easy trip planners (nse:easemytrip) has us very interested.

Investors Can Find Comfort In Easy Trip Planners' (NSE:EASEMYTRIP) Earnings Quality

Here's Why Easy Trip Planners (NSE:EASEMYTRIP) Can Manage Its Debt Responsibly

Full year 2024 earnings released: EPS: ₹0.58 (vs ₹0.77 in FY 2023)

Easy trip planners limited to report q4, 2024 results on may 24, 2024, there's reason for concern over easy trip planners limited's (nse:easemytrip) price.

Third quarter 2024 earnings released: EPS: ₹0.26 (vs ₹0.24 in 3Q 2023)

Easy trip planners limited declares interim dividend, easemytrip launches holiday packages and direct buses to ayodhya, investor sentiment improves as stock rises 27%, easy trip planners limited announced that it expects to receive inr 10 billion in funding, easy trip planners limited approves interim dividend for the financial year 2023-2024, payable on or before 10 january 2024, easy trip planners limited unveils explore bharat - discover the soul of india travel program, why the 32% return on capital at easy trip planners (nse:easemytrip) should have your attention.

Second quarter 2024 earnings released: EPS: ₹0.27 (vs ₹0.16 in 2Q 2023)

Easemytrip.com launches its latest offering, easydarshan, easemytrip launches smart voice recognition technology that redefines customers travel booking experience, easy trip planners limited, annual general meeting, sep 29, 2023, first quarter 2024 earnings released: eps: ₹0.15 (vs ₹0.19 in 1q 2023), easy trip planners limited to report q1, 2024 results on aug 14, 2023, easy trip planners limited announced that it expects to receive inr 846.797864 million in funding from capri global holdings private limited, easy trip planners limited agreed to acquire 51% stake in guideline travels holidays india private limited, dook travels private limited and tripshope travel technologies private limited., co-founder recently sold ₹2.7b worth of stock, easy trip planners limited (nse:easemytrip) analysts just trimmed their revenue forecasts by 12%.

Full year 2023 earnings: EPS and revenues miss analyst expectations

Easy trip planners limited to report q4, 2023 results on may 26, 2023, investor sentiment improves as stock rises 16%, is there now an opportunity in easy trip planners limited (nse:easemytrip).

Insufficient new directors

Third quarter 2023 earnings released: eps: ₹0.59 (vs ₹0.23 in 3q 2022), easy trip planners limited to report q3, 2023 results on feb 06, 2023, easy trip planners limited (nsei:easemytrip) entered into an agreement to acquire 55% stake in glegoo innovations private limited inr 30 million., easy trip planners limited (nsei:easemytrip) entered into an agreement to acquire 55% stake in glegoo innovations private limited., if eps growth is important to you, easy trip planners (nse:easemytrip) presents an opportunity.

Investor sentiment deteriorated over the past week

Easy trip planners limited (bse:543272) entered into a definitive agreement to acquire 75% stake in nutana aviation capital ifsc private limited., easy trip planners limited announces introduction of emtpro - an invite only, special programme for its elite customers, second quarter 2023 earnings: revenues exceed analysts expectations while eps lags behind, easy trip planners limited launches 2.0 self-booking tool for corporates, easy trip planners limited to report q2, 2023 results on nov 11, 2022, easemytrip.com to launch its new product line called save now buy later, easy trip planners limited, annual general meeting, aug 30, 2022, these analysts think easy trip planners limited's (nse:easemytrip) sales are under threat.

First quarter 2023 earnings released: EPS: ₹1.52 (vs ₹0.71 in 1Q 2022)

Easy trip planners limited to report q1, 2023 results on jul 29, 2022, here's why we think easy trip planners (nse:easemytrip) might deserve your attention today.

Full year 2022 earnings released: EPS: ₹4.87 (vs ₹2.81 in FY 2021)

Easy trip planners limited to report q4, 2022 results on may 25, 2022, investor sentiment improved over the past week, is now the time to put easy trip planners (nse:easemytrip) on your watchlist.

Easy Trip Planners Limited Approves the Appointment of Nutan Gupta for the Position of Chief Executive Officer

Third quarter 2022 earnings: revenues and eps in line with analyst expectations, easy trip planners limited (bse:543272) entered into a definitive agreement to acquire yolobus., easy trip planners' (nse:easemytrip) earnings are of questionable quality.

Second quarter 2022 earnings released: EPS ₹2.50 (vs ₹0.57 in 2Q 2021)

Company secretary & compliance officer preeti sharma has left the company, market participants recognise easy trip planners limited's (nse:easemytrip) earnings pushing shares 59% higher.

Full year 2021 earnings released: EPS ₹5.62 (vs ₹3.04 in FY 2020)

Earnings and revenue growth forecasts, analyst future growth forecasts.

Earnings vs Savings Rate : EASEMYTRIP's forecast earnings growth (29.5% per year) is above the savings rate (6.7%).

Earnings vs Market : EASEMYTRIP's earnings (29.5% per year) are forecast to grow faster than the Indian market (17.2% per year).

High Growth Earnings : EASEMYTRIP's earnings are expected to grow significantly over the next 3 years.

Revenue vs Market : EASEMYTRIP's revenue (13% per year) is forecast to grow faster than the Indian market (10.2% per year).

High Growth Revenue : EASEMYTRIP's revenue (13% per year) is forecast to grow slower than 20% per year.

Earnings per Share Growth Forecasts

Future return on equity.

Future ROE : EASEMYTRIP's Return on Equity is forecast to be high in 3 years time (27.7%)

Discover growth companies

High growth companies in the Consumer-services industry.

- Markets Data

- Equities Screener

- Sectors & Industries

- Company Announcements

- Director Dealings

- World Markets

Easy Trip Planners Ltd

Select symbol.

- EASEMYTRIP:NSI National Stock Exchange of India

- Add to watchlist

- Add to portfolio

- Add an alert

- Price (INR) 40.46

- Today's Change -0.52 / -1.27%

- Shares traded 10.41m

- 1 Year change -9.28%

- Beta 1.4529

Apply Cancel Actions

Your alerts done, apply cancel comparisons, suggested comparisons.

- Thomas Cook (India) Ltd

- PVR INOX Ltd

- Wonderla Holidays Ltd

- Imagicaaworld Entertainment Ltd

- Yatra Online Ltd

- Tbo Tek Ltd

- Le Travenues Technology Ltd

Key statistics

Events & activity.

- EASEMYTRIP:NSI price moved over +1.41% to 42.57 Sep 16 2024

- EASEMYTRIP:NSI price falls below 50-day moving average to 40.00 at 03:04 BST Sep 19 2024

- EASEMYTRIP:NSI price falls below 15-day moving average to 40.00 at 03:04 BST Sep 19 2024

EASY TRIP PLANNERS LTD

Easemytrip chart , upcoming earnings, key stats , about easy trip planners ltd, financials .

See all ideas

Analyst rating

Frequently asked questions.

Easy Trip Planners Ltd

The company offers a comprehensive range of travel - related products and services under the flagship brand ''Ease My Trip''.

It also provides end- to -end travel solutions, including airline tickets, hotels and holiday packages,rail tickets, bus tickets and taxis as well as ancillary value- added services such as travel insurance, visa processing and tickets for activities and attraction.

Leading OTA firm Easy Trip Planners(EMT) is the fastest growing, 2nd largest, and only profitable company in the online travel portal in India. The company offers a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotel and holiday packages, rail tickets, and bus tickets. [1]

- Market Cap ₹ 7,170 Cr.

- Current Price ₹ 40.5

- High / Low ₹ 54.0 / 37.0

- Stock P/E 35.9

- Book Value ₹ 3.60

- Dividend Yield 0.25 %

- ROCE 43.4 %

- Face Value ₹ 1.00

- Sales & Margin

- EV / EBITDA

- Price to Book

- Market Cap / Sales

- Company has reduced debt.

- Company is almost debt free.

- Company has delivered good profit growth of 49.0% CAGR over last 5 years

- Company has a good return on equity (ROE) track record: 3 Years ROE 40.6%

- Stock is trading at 11.2 times its book value

- Company has high debtors of 180 days.

- Promoter holding has decreased over last 3 years: -10.6%

* The pros and cons are machine generated. Pros / cons are based on a checklist to highlight important points. Please exercise caution and do your own analysis.

Peer comparison

Sector: E-Commerce/App based Aggregator Industry: Travel Agencies

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

Profit & Loss

Balance sheet, shareholding pattern.

Numbers in percentages

* The classifications might have changed from Sep'2022 onwards. The new XBRL format added more details from Sep'22 onwards. Classifications such as banks and foreign portfolio investors were not available earlier. The sudden changes in FII or DII can be because of these changes. Click on the line-items to see the names of individual entities.

Announcements

- Board Meeting Outcome for Proposed Investment In Rollins International And Pflege Home Healthcare 2d - EaseMyTrip acquires stakes in Rollins and Pflege.

- Announcement under Regulation 30 (LODR)-Press Release / Media Release 13 Sep - EaseMyTrip partners with IIFA for exclusive holiday packages.

- Announcement under Regulation 30 (LODR)-Press Release / Media Release 12 Sep - EaseMyTrip launches ScanMyTrip.com on ONDC Network.

- Update on board meeting 10 Sep - Board meeting rescheduled to discuss multiple acquisitions.

- Board Meeting Intimation for Considering The Proposal Of Multiple Acquisitions 9 Sep - Board meeting to discuss multiple acquisitions.

Annual reports

- Financial Year 2024 from bse

- Financial Year 2023 from bse

- Financial Year 2022 from bse

- Financial Year 2021 from bse

- Aug 2024 Transcript Notes PPT

- May 2024 Transcript Notes PPT

- Feb 2024 Transcript Notes PPT REC

- Nov 2023 Transcript Notes PPT REC

- Aug 2023 Transcript Notes PPT REC

- May 2023 Transcript Notes PPT

- Apr 2023 Transcript Notes PPT

- Feb 2023 Transcript Notes PPT

- Nov 2022 Transcript Notes PPT

- Sep 2022 Transcript Notes PPT

- Aug 2022 Transcript Notes PPT

- May 2022 Transcript Notes PPT

- Feb 2022 Transcript Notes PPT

- Nov 2021 Transcript Notes PPT

- Aug 2021 Transcript Notes PPT

- Jul 2021 Transcript Notes PPT

- Jun 2021 Transcript Notes PPT

- Apr 2021 Transcript Notes PPT

- Privacy Policy

- Historical Data

- Targets Short Term (Tomorrow, Weekly)

- Targets Long Term (Yearly)

Stocks To Watch Today - 1 May 2024: Piccadily Soars to All-Time High, Axis Bank Creates New 52-Week Peak & More

Stock To Watch Today - 30 Apr 2024: Piccadily Agro, Gallantt Metal, Mahindra & More!

Stocks To Watch Today (23 Apr 2024): Gallantt Metal Hits New All-Time High, TECHNOE Brews 52-Week High & More

Five Stocks to Watch Today (22 Apr 2024): TRIL, Gallantt, Berger, Winsome, and Bharat Road Witness Milestones

Hot Stocks To Watch Today (19 Apr 2024): TRIL, Gallantt, Berger Paints Hit Milestones Yesterday, Setting Stage for Market Surprises!

29 Aug 2024: Nifty 50 Closes at ₹25,156.75 (+0.41%), Bajaj Auto & Gujarat State Petronet Shine, Adani Enterprises & Adani Energy Struggle

27 Aug 2024: Nifty 50 Closes at ₹24,996.05 (-0.06%), Bajaj Finserv & Samvardhana Motherson Shine, While Adani Enterprises Shows Bearish Signals

23 Aug 2024: Nifty 50 Closes at ₹24,811.5 (+0.16%), Bajaj Finserv & Bajaj Auto Shine with New All-Time Highs!

22 Aug 2024: Nifty 50 Closed at ₹24,811.5 (+0.16%), TITAN & Berger Paints enjoying 7-day winning streak.

21 Aug 2024: Nifty Closes at ₹24,672.84 (+0.4%), TCS closing higher for the past 6 days & HAVELLS since past 8-days

Select Page

Home / Short Term Target / Easemytrip

Easy Trip Share Price Target - Tomorrow, Next Week & Next Month

Updated: Mar 16, 2024 02:42:42 PM IST | Posted by Nippun | Predictions

- 1: Easy Trip Recent Performance

- 2: Chart: Easy Trip Share Price Target - Tomorrow

- 3: Table: Easy Trip Share Price Target - Tomorrow

- 4: Summary: Easy Trip Share Price Prediction For Tomorrow

- 5: Chart: Easy Trip Share Price Target - Next Week

- 6: Table: Easy Trip Share Price Target - Next Week

- 7: Summary: Easy Trip Share Price Prediction For Next Week

- 8: Chart: Easy Trip Share Price Target - Next Month

- 9: Table: Easy Trip Share Price Target - Next Month

- 10: Summary: Easy Trip Share Price Prediction For Next Month

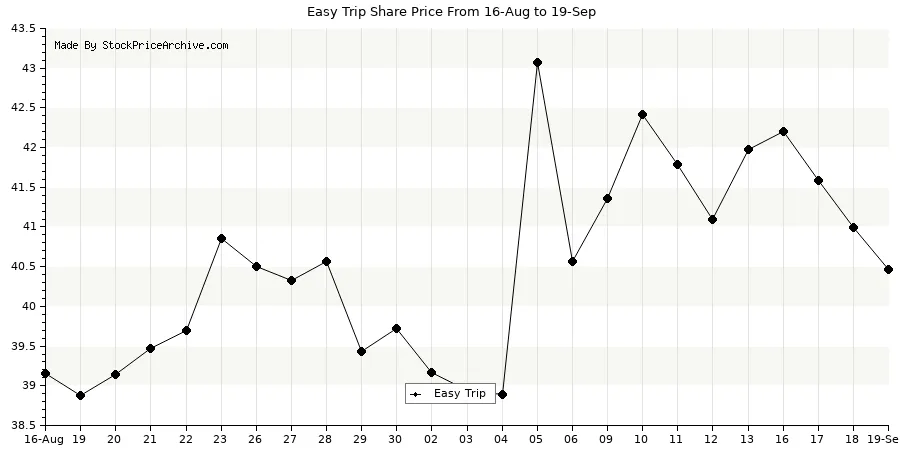

Easy Trip Recent Performance

Over the past 26 trading days, the value of Easy Trip's stock has increased by ₹1.39 (+3.56%) . On 14 Aug 2024, one share was worth ₹39.07 and by 19 Sep 2024, the value jumped to ₹40.46 . During this period it created a highest high of ₹44.38 and lowest low of ₹38.70 .

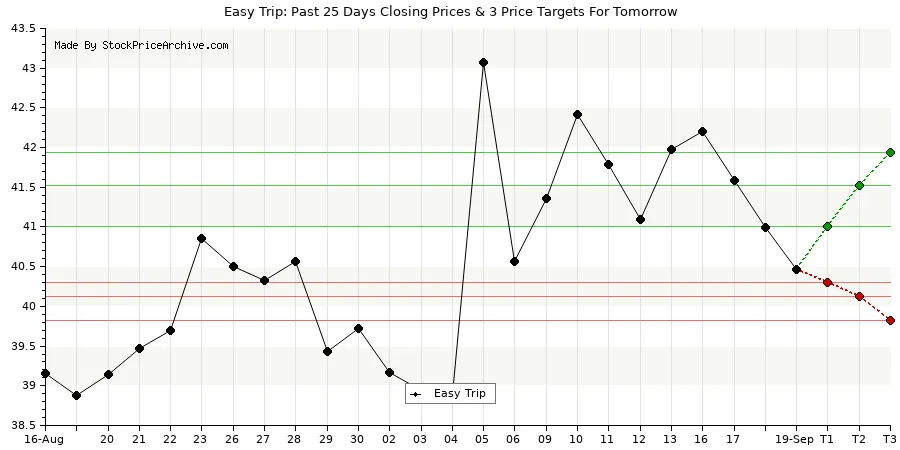

Below Image represents line chart of daily close price of Easy Trip, helping you visualize how the price has changed day by day.

Chart: Easy Trip Share Price Target - Tomorrow

The line chart displays the Easy Trip daily closing prices for the past 26 trading days using a black line. The green line indicates the potential targets, while the red line shows the potential Stop-Loss (SL) levels.

For detailed target and stop loss values for Easy Trip shares for Thu 19 Sep 2024, see the table below.

Table: Easy Trip Share Price Target - Tomorrow

By analyzing Easy Trip stock with today and past crucial price points and technical indicators we derived following targets for Tomorrow: Fri, 20 Sep, 2024!

Summary: Easy Trip Share Price Prediction For Tomorrow

Thu 19 Sep 2024: Easy Trip finished the day at ₹40.46, losing ₹-0.53 (-1.29%) in 1 day.

In summary, our analysis of Easy Trip for tomorrow predicts a rise of 1.33% to 3.65% with three potential targets T1: ₹41.00, T2: ₹41.52, T3: ₹41.94 and Stop-Loss (SL) at SL1: ₹40.30, SL2: ₹40.12, SL3: ₹39.82 .

Additionally, we've identified a support level at ₹39.82 — think of this as a safety net where the price might stop falling and there's also a resistance level at ₹41.25 , which is like a ceiling at which the price might have a hard time breaking through. These targets are based on our study of past trends and technical analysis using various indicators.

After looking at tomorrow's share price prediction, let's now check what next week might hold for Easy Trip.

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Join our WhatsApp group

Join our Telegram group

Your phone number will be HIDDEN to other users.

Chart: Easy Trip Share Price Target - Next Week

The chart displays the Easy Trip weekly closing prices for the past 25 trading weeks using a black line. It also shows three targets using a green line, while the red line shows the potential Stop-Loss (SL) levels for next week.

For detailed target and stop loss values for Easy Trip shares for next week, see the table below.

Table: Easy Trip Share Price Target - Next Week

By analyzing Easy Trip stock with today and past crucial price points and technical indicators we derived following targets for the next week!

Summary: Easy Trip Share Price Prediction For Next Week

As of Thu 19 Sep 2024, Easy Trip share price stands at ₹40.46, losing ₹-1.52 (-3.62%) in this week.

In summary, our analysis of Easy Trip for next week predicts a rise of 1.82% to 4.02% with three potential targets T1: ₹41.20, T2: ₹41.62, T3: ₹42.09 and Stop-Loss (SL) at SL1: ₹40.11, SL2: ₹39.70, SL3: ₹39.19 .

After looking at tomorrow's and next week's share price prediction, let's now check what next month might hold for Easy Trip.

Chart: Easy Trip Share Price Target - Next Month

The chart displays the Easy Trip monthly closing prices for the past 25 months using a black line. It also shows three targets using green line, while the red line shows the potential Stop-Loss (SL) levels.

For detailed target and stop loss values for Easy Trip shares for next month, see the table below.

Table: Easy Trip Share Price Target - Next Month

By analyzing Easy Trip stock with today and past crucial price points and technical indicators we derived following targets for Next Month!

Summary: Easy Trip Share Price Prediction For Next Month

As of Thu 19 Sep 2024, Easy Trip share price stands at ₹40.46, gaining ₹0.74 (+1.86%) in this month.

In summary, our analysis of Easy Trip for next month predicts a rise of 2.79% to 5.16% with three potential targets T1: ₹41.59, T2: ₹42.09, T3: ₹42.55 and Stop-Loss (SL) at SL1: ₹40.11, SL2: ₹39.70, SL3: ₹39.19 .

After looking at tomorrow's, next week's and next month's share price prediction, you might wonder what this year or next year might hold for Easy Trip, we created a specific page for that check here: Easy Trip Share Price target for 2024 and 2025

As we wrap up, we hope you like our study on Easy Trip short term share price predictions, please kindly note that these forecasts are based on technical analysis, past trends, and machine learning models. They are for educational purposes only, not investment advice.

Methodology Behind the Prediction

The share price predictions present on our site are derived from a robust model that incorporates multiple economic indicators, technical indicators, company performance metrics, and industry-specific factors.

We have historical share price data of all stocks for which we present targets, so we analyze historical trends from those past data and overlay them with projected market conditions to estimate future share prices of a stock.

- Easy Trip Share Price History

- Easy Trip Price Long Term Target

- Easy Trip Dividend History

- Easy Trip Bonus History

- Easy Trip Split History

Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own research before making any investment.

About The Author

Hi, I’m Nippun, a tech enthusiast from Haryana, India. I have been coding since 2010 and using my coding skills in the share market since 2020. I have been coding scripts in Pinescript that work on Tradingview app/web. I love learning about new technology and applying it to solve real-world problems. Coding and share-market are my passions, and I enjoy finding and fixing bugs in code. I aim to share my skill set and experience that can positively impact society. Feel free to connect with me, and let’s learn from each other. My Twitter

Related Posts

Long-term share price prediction using technical analysis & machine learning.

March 9, 2024

Recent Posts

Easy Trip Planners Ltd

Price Chart

Go Pro! to unlock score, rank

and other metrics

How to use scorecard? Learn more

Key Metrics

Forecast & ratings.

from 1 analyst

Price Upside

Earnings growth, rev. growth, company profile.

Easy Trip Planners is an India-based online travel agency offering comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotels and holiday packages.

Tbo Tek Ltd

Thomas cook (india) ltd, india tourism development corp ltd, ecos (india) mobility & hospitality ltd, wise travel india ltd, get more out of tickertape, go pro.

Customise key metrics, see detailed forecasts, download stock data and more

Already a Pro member? Login

Price Forecast

All values in ₹

Revenue Forecast

All values in ₹ cr.

Earnings Per Share Forecast

Balance Sheet

Income Statement

EPS and DPS in ₹. Other numbers except Payout Ratio in ₹ cr

Company Updates

Annual report

Investor Presentation

Peers & Comparison

Price comparison, shareholdings, promoter holdings trend, total promoter holding.

In last 6 months, promoter holding in the company has almost stayed constant

Low Pledged Promoter Holding

Pledged promoter holdings is insignificant

Institutional Holdings Trend

Total retail holding.

In last 3 months, retail holding in the company has almost stayed constant

Foreign Institutional Holding

In last 3 months, foreign institutional holding of the company has almost stayed constant

Shareholding Pattern

Shareholding history, mutual funds holding trend, mutual fund holding.

In last 3 months, mutual fund holding of the company has almost stayed constant

Top 5 Mutual Funds holding Easy Trip Planners Ltd

Compare 3-month MF holding change on Screener

Insider Trades & Bulk Deals

Looks like this stock is not in any smallcase yet.

Dividend Trend

No dividend trend available

Corp. Actions

Announcements

Legal Orders

Upcoming Dividends

No upcoming dividends are available

Past Dividends

Cash dividend.

Ex Date Ex Date Dec 19, 2023

Dividend/Share

Ex Date Ex Date

Dec 19, 2023

Ex Date Ex Date Nov 18, 2021

Nov 18, 2021

Ex Date Ex Date Apr 27, 2021

Apr 27, 2021

Easy Trip Planners announced that the Annual General Meeting (AGM) of the company will be held on 28 September 2024.Powered by Capital Market - Live

EaseMyTrip.com has announced the acquisition of a 49% equity stake in Pflege Home Healthcare and 30% in Rollins International, marking its strategic expansion into the rapidly growing medical tourism sector. These acquisitions align with EaseMyTrip's mission to offer holistic travel solutions by integrating wellness and healthcare services into its service portfolio as medical tourism. EaseMyTrip has acquired Pflege Home Healthcare, a renowned home healthcare provider headquartered in Dubai. Pflege offers comprehensive care services across a wide range of segments, from doctor visits, Registered Nursing care at Home and physiotherapy to home-based medical equipment like ventilators and oxygen. Their patient-centric approach ensures high-quality, compassionate care in the comfort of their clients' homes. The acquisition of Pflege empowers EaseMyTrip to offer reliable healthcare services, expanding its offerings in the medical tourism domain to cater to travellers seeking medical treatments or wellness solutions abroad. Alongside Pflege Home Healthcare, Rollins International has a strong presence in India with its focus on gluten-free, lactose-free, and allergen-free food products, highly effective health supplements, and cutting-edge wellness therapies. Rollins also operates a range of brands offering state-of-the-art wellness devices, nutritional guidance, and recreational spaces. Rollins's flagship wellness centres are now present in New Delhi, Gurugram, Mumbai, Hyderabad, and Bengaluru and coming soon to even more localities, cities, and countries. This acquisition allows EaseMyTrip to enter the healthcare market with a robust portfolio designed to meet the unique needs of customers dealing with food allergies, distinct wellness requirements, and lifestyle challenges.Powered by Capital Market - Live

The board of Easy Trip Planners at its meeting held on 17 September 2024 has approved execution of definitive agreement(s) in connection with the proposed investment of 30% in the aggregate post money paid-up equity share capital of Rollins International (Rollins) for a value of Rs 60 crore by subscribing to the new equity shares of Rollins for which the subscription amount will be paid by the Company to Rollins by way of equity share swap, i.e., issuance of its own fully paid-up equity shares on preferential basis. The board has also approved execution of definitive agreement(s) in connection with the proposed investment of 49% in the aggregate post money paid-up share capital of Pflege Home Healthcare (Pflege) for an aggregate value of Rs 30 crore partly: a) by purchasing certain shares from the selling shareholder(s) of Pflege for an aggregate purchase consideration of Rs 20 crore, and b) by subscribing to the new shares of Pflege for an aggregate subscription amount of Rs 10 crore, for which the purchase consideration will be paid by the Company to the selling shareholder(s) and subscription amount will be paid by the Company to Pflege, both by way of equity share swap, i.e., issuance of its own fully paid-up equity shares on preferential basis. Powered by Capital Market - Live

EaseMyTrip.com is the 'Official Travel Partner' for the prestigious IIFA Festival 2024. Through this association, EaseMyTrip extends an opportunity to its customers to attend the much-anticipated star-studded event in the Indian entertainment industry. As part of this association, EaseMyTrip is offering specially curated holiday packages at special prices. These packages provide not only the perfect getaway but also a chance to be part of the star-studded IIFA festivities. A few lucky customers will get a golden opportunity to attend the event with a IIFA pass, adding an extra dash of excitement to their journeyPowered by Capital Market - Live

EaseMyTrip.com has unveiled India's first marketplace ScanMyTrip.com. It also becomes the first OTA to sell travel services on ONDC Network and buys from it. The new product, ScanMyTrip.com is a marketplace designed to enable OTAs, MSMEs, Travel agents and homestays to list their offering -Flights, Hotels and Homestay on ONDC Network, providing them access to a broader digital marketplace. EaseMyTrip's integration with ONDC Network will allow businesses in the travel and tourism sector to leverage the digital infrastructure that ONDC provides, empowering even the smallest of service providers to tap into a wide customer base. ScanMyTrip.com simplifies the onboarding process, making it easier for businesses to connect with travellers and compete in the online marketplace.Powered by Capital Market - Live

Easy Trip Planners has revised the meeting of the Board of Directors which was scheduled to be held on 13 September 2024. The meeting will now be held on 17 September 2024.Powered by Capital Market - Live

Easy Trip Planners will hold a meeting of the Board of Directors of the Company on 13 September 2024.Powered by Capital Market - Live

The Board of Easy Trip Planners at its meeting held on 05 September 2024 has approved the incorporation of a wholly owned subsidiary of the Company for the purpose of Electric Bus Manufacturing subject to necessary approval from the Ministry of Corporate Affairs. Powered by Capital Market - Live

EaseMyTrip.com has roped in popular Bollywood actress Jacqueline Fernandez as its brand ambassador. This strategic partnership is part of a long-term strategy to boost EaseMyTrip's brand presence and attract new customers and Bollywood fans. The actress's large number of fans and followers would enhance EaseMyTrip's brand image.Powered by Capital Market - Live

Net profit of Easy Trip Planners rose 24.83% to Rs 32.48 crore in the quarter ended June 2024 as against Rs 26.02 crore during the previous quarter ended June 2023. Sales rose 23.01% to Rs 152.60 crore in the quarter ended June 2024 as against Rs 124.05 crore during the previous quarter ended June 2023. ParticularsQuarter EndedJun. 2024Jun. 2023% Var. Sales152.60124.05 23 OPM %30.7828.14 - PBDT49.4436.05 37 PBT47.1835.08 34 NP32.4826.02 25 Powered by Capital Market - Live

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

- EASY TRIP PLANNERS LTD.

Easy Trip Planners Ltd.

NSE: EASEMYTRIP | BSE: 543272

40.46 -0.53 ( -1.29 %)

25.07% Fall from 52W High

12.1M NSE+BSE Volume

NSE 19 Sep, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

0 active buys

Broker 1Year sells

0 active sells

Broker 1Year neutral

0 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

Easy Trip Planners Ltd. share price target

Latest broker research reports with buy, sell, hold recommendations along with forecast share price targets and upside. browse thousands of reports and search by company or the broker..

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Easy Trip Planners share price

NSE: EASEMYTRIP BSE: 543272 SECTOR: Travel Services 369k 2k 336

Price Summary

₹ 41.64

₹ 39.81

₹ 54

₹ 37.01

Ownership Below Par

Valuation expensive, efficiency excellent, financials very stable, company essentials.

₹ 7167.9 Cr.

₹ 7093.25 Cr.

₹ 3.79

₹ 74.72 Cr.

₹ 0.06 Cr.

₹ 0.72

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 12 Indices.

NIFTYMIDSMALL400

NIFTYSMALLCAP250

NY500MUL50:25:25

NIFTYTOTALMCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The company has shown a good profit growth of 24.1449884376908 % for the Past 3 years.

- The company has shown a good revenue growth of 51.4968364914288 % for the Past 3 years.

- The company has significantly decreased its debt by 65.352 Cr.

- Company has been maintaining healthy ROE of 41.015551009914 % over the past 3 years.

- Company has been maintaining healthy ROCE of 50.5767180079729 % over the past 3 years.

- Company is virtually debt free.

- Company has a healthy Interest coverage ratio of 31.8933 .

- The Company has been maintaining an effective average operating margins of 27.6631400597583 % in the last 5 years.

- Company has a healthy liquidity position with current ratio of 2.8139 .

- The company has a high promoter holding of 64.3 %.

Limitations

- The company is trading at a high PE of 56.31 .

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2021 15 Sep 2021

Ratings & Research Reports

- Research Monarch Networth Capital 29 Sep 2022

- Research Edelweiss 9 Mar 2022

- Research Edelweiss 29 Sep 2022

- Research Edelweiss 28 Jun 2022

- Research Edelweiss 24 Nov 2021

Company Presentations

- Concall Q4FY22 7 Jun 2022

- Concall Q4FY21 23 Jul 2021

- Concall Q3FY24 15 Feb 2024

- Concall Q3FY22 25 Feb 2022

- Concall Q2FY23 14 Dec 2022

- Concall Q2FY22 17 Nov 2021

- Concall Q1FY25 20 Aug 2024

- Concall Q1FY23 20 Sep 2022

- Concall Q1FY22 31 Aug 2021

- Presentation Q4FY24 6 Jun 2024

- Presentation Q4FY22 27 May 2022

- Presentation Q4FY21 30 Apr 2021

- Presentation Q4FY21 17 Jun 2021

- Presentation Q3FY24 12 Feb 2024

- Presentation Q1FY23 29 Sep 2022

Company News

Easy trip planners stock price analysis and quick research report. is easy trip planners an attractive stock to invest in.

Stock investing requires careful analysis of financial data to determine a company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement, which can be time-consuming and cumbersome.

Examining a company's financial ratios is an easier way to determine its performance, which can help to make sense of the overwhelming amount of information in its financial statements.

Easy Trip Planners stock price today is Rs 40.57 . Here are a few indispensable ratios that should be a part of every investor’s research process, or, in simpler words, how to analyse Easy Trip Planners .

PE ratio : Price to Earnings ratio, which indicates how much an investor is willing to pay for a share for every rupee of earnings. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Easy Trip Planners has a PE ratio of 56.4727171492205 which is high and comparatively overvalued .

Share Price : - The current share price of Easy Trip Planners is Rs 40.57 . One can use valuation calculators of ticker to know if Easy Trip Planners share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Easy Trip Planners has ROA of 16.0347 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Easy Trip Planners has a Current ratio of 2.8139 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders' investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. Easy Trip Planners has a ROE of 23.2636 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. Easy Trip Planners has a Debt to Equity ratio of 0.0001 which means that the company has low proportion of debt in its capital.

Sales growth : - Easy Trip Planners has reported revenue growth of 12.0271 % which is poor in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of Easy Trip Planners for the current financial year is 45.9616842323867 % .

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for Easy Trip Planners is Rs 0.1 and the yield is 0.2462 % .

Earnings Per Share : - It tells us how much profit is allocated to to each outstanding share of a common stock. The latest EPS of Easy Trip Planners is Rs 0.7184 . The higher the EPS, the better it is for investors.

One can find all the Financial Ratios of Easy Trip Planners in Ticker for free. Also, one can get the intrinsic value of Easy Trip Planners by using Valuation Calculators, which are available with a Finology ONE subscription.

Brief about Easy Trip Planners

Easy trip planners ltd. financials: check share price, balance sheet, annual report, and quarterly results for company analysis.

Easy Trip Planners Ltd. is a leading online travel agency that offers a wide range of travel services, including flight and hotel bookings, holiday packages, rail tickets, and bus tickets. The company leverages technology to provide convenient and efficient travel solutions to its customers. With a strong focus on customer satisfaction and technological innovation, Easy Trip Planners has established itself as a prominent player in the travel industry.

Easy Trip Planners Ltd. Share Price Analysis

Easy Trip Planners Ltd.'s share price reflects the market's perception of the company's performance and future prospects. Ticker's pre-built screening tools provide an in-depth analysis of the share price, enabling investors to make informed decisions based on the company's market valuation and price movements.

Easy Trip Planners Ltd. Balance Sheet

The balance sheet of Easy Trip Planners Ltd. provides a snapshot of the company's financial position, including its assets, liabilities, and shareholders' equity. Investors can access the company's annual reports on our website to gain insights into its financial health and stability. Ticker's premium features offer tools such as DCF Analysis, BVPS Analysis, Earnings multiple approaches, and DuPont analysis to evaluate the fair value of the company based on its balance sheet.

Easy Trip Planners Ltd. Annual Report

Easy Trip Planners Ltd.'s annual reports offer a comprehensive overview of its performance and operations throughout the year. Investors can download these reports from our website to delve into the company's strategic initiatives, financial results, and future outlook. Analyzing the annual reports can provide valuable insights for long-term stock investors.

Easy Trip Planners Ltd. Dividend Analysis

Dividends are an essential aspect of a company's financial performance and can be indicators of its stability and growth. Investors can evaluate Easy Trip Planners Ltd.'s dividend history and policies to assess its commitment to rewarding shareholders. Ticker provides research reports and credit ratings to assist investors in their dividend analysis.

Easy Trip Planners Ltd. Quarterly Results

Understanding Easy Trip Planners Ltd.'s quarterly results is crucial for investors to track the company's performance and growth trajectory. Utilizing our premium tools, investors can perform a fair value calculation based on the company's quarterly results, enabling them to make informed investment decisions.

Easy Trip Planners Ltd. Stock Price Chart

Ticker offers stock price charts that provide a visual representation of Easy Trip Planners Ltd.'s stock performance over time. By analyzing historical price movements, investors can identify trends and patterns, aiding in their investment strategies and decisions.

Easy Trip Planners Ltd. News

Staying abreast of recent developments and news related to Easy Trip Planners Ltd. is essential for investors. Ticker provides access to the latest news and market updates, empowering investors with valuable information for stock analysis and decision-making.

Easy Trip Planners Ltd. Concall Transcripts

Concall transcripts offer valuable insights into management discussions, strategies, and future plans of Easy Trip Planners Ltd. Investors can access these transcripts on our website to gain a deeper understanding of the company's direction and performance.

Easy Trip Planners Ltd. Investor Presentations

Easy Trip Planners Ltd.'s investor presentations provide a detailed overview of the company's business model, financial performance, and growth strategies. Our website offers downloadable access to these presentations, allowing investors to analyze the company's prospects and investment potential.

Easy Trip Planners Ltd. Promoters and Shareholders

Understanding the key stakeholders, including promoters and major shareholders, is vital for investors analyzing Easy Trip Planners Ltd. Ticker provides insights into the company's ownership structure, enabling investors to assess the level of insider confidence and institutional support.

Ratio Delete Confirmation

NIFTY, BANKNIFTY, FINNIFTY

Quick links for NSE

- Daily NEWS headlines

- DailyNewsletter in inbox

- Latest upcoming Dividends

- FII DII activity, what they are buying and selling

- Most active option calls and puts

- Intraday stocks below 100 rupees for NSE

- Intraday stocks below 50 rupees

- Intraday stocks below 20 rupees

- All Best intraday tips for NSE

- Best investment ideas 2024

- Quick gain trading ideas

- Today gainers for NSE

- 3 day gainers

- 5 day gainers

- 10 day gainers

- This month gainers for NSE

- 2 month gainers

- 3 month gainers

- 6 month gainers

- Weekly gainers for NSE

- 2 Week gainers

- 3 Week gainers

- 6 Week gainers

- Stocks reversing trend

- Stocks near support in NSE

- Stocks near resistance in NSE

- Stocks above 12 day DMA

- Stocks above 20 day DMA

- Stocks above 50 day DMA

- Stocks above 200 day DMA

- Stocks forming DOJI candle

- Stocks forming Hammer candle

- Stocks forming inverted hammer candle

Join famous MunafaSutra stock market newsletter! Get Daily Best Stocks in Email!

Enter email:

NSE BSE COMMODITY NASDAQ NYSE FOREX INDICES AMEX USA Find Stock Android App

Easy Trip (EASEMYTRIP) Forecast & Share price [target] (2024) | Forecast share price (forecast) & targets | EASEMYTRIP Forecast share price target NSE stock exchange

Easy Trip short, mid, long term forecast and share price targets

NSE stock EASEMYTRIP Easy Trip forecast & share price targets are below. These share price targets & forecast are valid from short-term to mid-term to long-term. If you just want tomorrow's movements predictions for Easy Trip then click here or Easy Trip share price targets or view what Experts say about Easy Trip or Announcements & NEWS by Easy Trip

Easy Trip EASEMYTRIP share price targets

As on 19 Thu Sep 2024 Easy Trip EASEMYTRIP is trading at 40.46 and its nearest share price targets are 39.43 and 40.86. Click here for weekly, monthly, and yearly price targets

Share price targets above are based on chart movements and levels where stock showed a significant price action. Click here for Intraday,weekly,monthly share price targets for Easy Trip EASEMYTRIP

Easy Trip EASEMYTRIP forecast & targets

Easy trip easemytrip share price forecast & targets for intra day are 39.43, 39.77, 39.08 on the downside, and 40.86, 41.2, 41.94 on the upside..

These intraday share price levels are calculated using pivot point calculations and valid only for tomorrow's session on a 5-15 minute chart.

Detailed analysis of what to do in Intraday & BTST tips for Easy Trip are here

Easy Trip EASEMYTRIP share price forecast & targets for short-term is a uptrend, and nearest possible share price target is 44

The share price is currently trading at 40.46 However, if the trend reverses from this point, then a possible future share price target could be 39 These share price targets are working as support & resistance levels as well.

Easy Trip EASEMYTRIP share price forecast & targets for mid-term is a uptrend, and nearest possible future share price target is 47 or 44.38

Easy Trip is currently trading at 40.46 However, if the trend reverses from this point, then a possible future share price target could be 39 or 38.00 These share price targets are working as support & resistance levels as well for Easy Trip

Easy Trip EASEMYTRIP share price forecast & targets for long-term is an uptrend, and nearest possible share price targets are 44, 47, 50, 53, or even 54.00

The stock price is currently trading at 40.46 However, if the trend reverses from this point, then possible future share price targets could be 39, or even 37.00 These share price targets are working as long-term support & resistance levels as well.

Easy Trip EASEMYTRIP Weekly share price targets

- Easy Trip Weekly share price target downside target 1: 40.35

- Easy Trip Weekly share price target downside target 2: 38.71

- Easy Trip Weekly share price target upside target 1: 43.37

- Easy Trip Weekly share price target upside target 2: 44.75

If the price of Easy Trip is trading below 41.73 then possibility of downside targets getting achieved is higher. If the price of Easy Trip is trading above 41.73 then possibility of upside targets getting achieved is higher.

Easy Trip EASEMYTRIP Monthly share price target

- Easy Trip Monthly share price target downside target 1: 38.1

- Easy Trip Monthly share price target downside target 2: 36.47

- Easy Trip Monthly share price target upside target 1: 42.05

- Easy Trip Monthly share price target upside target 2: 44.37

If the price of Easy Trip is trading below 40.42 then possibility of downside targets getting achieved is higher. If the price of Easy Trip is trading above 40.42 then possibility of upside targets getting achieved is higher.

Easy Trip EASEMYTRIP Daily share price target

- Easy Trip Daily share price target downside target 1: 39.77

- Easy Trip Daily share price target downside target 2: 39.08

- Easy Trip Daily share price target upside target 1: 41.2

- Easy Trip Daily share price target upside target 2: 41.94

If the price of Easy Trip is trading below 40.51 then possibility of downside targets getting achieved is higher. If the price of Easy Trip is trading above 40.51 then possibility of upside targets getting achieved is higher.

Easy Trip share price targets

Further share price targets & forecast with buy and sell signals and experts views for Easy Trip are here

Also read Tomorrow's movement predictions for EASEMYTRIP Easy Trip here Daily charts Daily candle stick charts Weekly charts Monthly charts Moving Averages charts MACD charts

EASEMYTRIP Easy Trip current prices:

Easy Trip share price opened at: 41.25 Easy Trip share price closed at: 40.46 Easy Trip share price made a High of: 41.25 Easy Trip share price made a low of: 39.82 52 week High: 54.00 52 week Low: 37.00 EASEMYTRIP is trading in the lower range of yearly prices. Went as high as 44.38 in the last three months (quarter) Went as low as 38.00 in the last three months (quarter) EASEMYTRIP is trading in the lower range of the quarterly prices.

The session was a bearish session and prices moved within a range of 39.82 and 41.25, with a volume of -25.35% compared to average volume that Easy Trip normally has.

Share on: WhatsApp @Hash Facebook Tweet

Further technical analysis for EASEMYTRIP Easy Trip

Easy Trip share price targets or Easy Trip Support & Resistance Levels

Experts Views on Easy Trip Tomorrow's movement predictions for EASEMYTRIP Easy Trip are here Daily charts for EASEMYTRIP Daily candle stick charts for EASEMYTRIP Weekly charts for EASEMYTRIP Monthly charts for EASEMYTRIP Moving Averages charts for EASEMYTRIP MACD charts for EASEMYTRIP

Videos related to: Easy Trip (EASEMYTRIP) Forecast & Share price [target] (2024) | Forecast share price (forecast) & targets | EASEMYTRIP Forecast share price target NSE stock exchange

Hindi video correct way of technical analysis how to find entry exit points on charts.

Hindi Video What Is Needed To Succeed In Stock Markets

![easy trip share price prediction Easy Trip (EASEMYTRIP) Forecast & Share price [target] (2024) | Forecast share price (forecast) & targets | EASEMYTRIP Forecast share price target NSE stock exchange](https://munafasutra.com/images/MunafaBookCover.png)

Terms of Use Privacy policy Contact About Cancellation policy Stock Market News! © MunafaSutra.com 2024 All Rights reserved.

NSE India National Stock exchange BSE India Bombay Mumbai Stock exchange COMMODITY India commodity Stock exchange NASDAQ NASDAQ Stock exchange NYSE New York Stock exchange FOREX FOREX Stock exchange INDICES Global indices Stock exchange AMEX American Stock exchange USA USA Stock exchange

Back to top

Market News

- Latest Investing News

- Free Investing Reports

Learn How To Invest

- How The Stock Market Works

- Investing Definitions to Know

- Types of Shares

- Guide to Market Sectors

Start Investing in the UK

- How to Get Started Investing

- What to Invest In

- How To Buy Shares

- Get Our Latest Recommendations

Compare Brokers

- Compare Share Dealing Accounts

- Compare Stocks and Shares ISAs

- Compare Robo-Advisors

- Compare Trading Apps

Learn More About Pensions

- How do pensions work?

- Do you need a financial advisor for your pension?

- Pensions vs. ISAs

- Are pensions taxable?

Build Wealth

- How to generate passive income in retirement

- The FIRE Movement

- Free Report: 5 Stocks For Trying To Build Wealth After 50

- Latest Retirement News

Premium Investing Services

- Share Advisor