Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- At the airport

Admirals Club

Special notice.

One-Day Pass access to Admirals Club ® lounges may be limited or not available based on lounge capacity.

Inside the club

Complimentary amenities and services are available to make your travel more productive and relaxing.

House drinks

Made-to-order specialties*

Personal travel assistance

Shower suites*

Business center*

Taking the lounge to the next level

We’re committed to providing you with the best experience possible. New, complimentary enhancements will begin rolling out on July 23, 2023.

Enhanced food

Fill up on a greater variety of premium food and enjoy hearty regional dishes. Plus, select lounges will offer convenient grab-and-go snacks if you’re short on time.

Expanded drink menus

Sip on sparkling wine, local craft beer and spirits. You can also enjoy more complimentary cocktails like mimosas, unique Bloody Marys and signature cocktails inspired by each location.

A new look and feel

Relax in redesigned lounges across the U.S., like the new Admirals Club ® in Washington Reagan (DCA) Terminal E. This new look and feel is also coming to Denver (DEN) and Newark (EWR) later in 2023.

Food and drink

Starting July 23, 2023, you can enjoy the expanded complimentary drink menus at all U.S. locations, with the locally inspired signature cocktails coming soon. Enhanced food will also be available on July 23 at Los Angeles (LAX), Miami (MIA) and Washington Reagan (DCA), and at all U.S. locations by early 2024.

- A unique, premium menu featuring local flavors**

- Standard favorites including oatmeal, hard boiled eggs, whole fruit and cereal also available

- Made-to-order avocado toast compliments of Mastercard*

Lunch and dinner

- Standard favorites including soups, snack mixes, crudité, dip and whole fruit also available

- Grab-and-go snacks*

- Made-to-order guacamole compliments of Mastercard*

- Non-alcoholic drinks including freshly brewed coffee, espresso and lattes, handcrafted artisanal teas, iced tea and soft drinks

- Alcoholic drinks including house beer and wine, local craft beer, sparkling wine, spirits and cocktails

- A locally inspired Bloody Mary and signature cocktail**

Full meals and premium drinks

Hungry for more? Our clubs have bigger meals and premium cocktails available for purchase.

Enjoy Admirals Club® access

Citi ® / AAdvantage ® Executive World Elite Mastercard ® cardmembers enjoy perks like:

- Earn 70,000 bonus miles. Terms apply.

- Admirals Club ® membership (a value of up to $850)

- Earn up to 20,000 additional Loyalty Points after qualifying activities to elevate your AAdvantage ® status

- Learn more Opens another site in a new window that may not meet accessibility guidelines

- Already a cardholder? Learn about your benefits

*At select locations

**Premium food and drink menus at each lounge may differ

You may also like...

- Admirals Club® conference rooms

- Admirals Club® terms and conditions

UponArriving

American Airlines Lounge (Admirals Clubs) Access Guide [2022]

Lounge access can truly be a lifesaver in certain situations as it can provide a much needed spot to refresh and relax. But sometimes the lounge access policies can be a little bit confusing because there are so many different ways to get access.

In this article, I will break down the American Airlines lounge access policies which include both Flagship Lounges and Admirals Clubs. I’ll cover everything including prices, guest policies, and also entrance into partner lounges.

Table of Contents

What are Admirals Clubs?

Admirals Clubs are the standard airport lounges for American Airlines and you can find them all around the globe (keep reading below for a full list of locations).

In these lounges, you may find comfortable places to relax, free food and drink, showers, business meeting rooms, kids room, and sometimes other amenities as well.

In my experience Admirals Clubs are pretty nice but I would not put them on the same level as Amex Centurion Lounges .

I found Admirals Clubs to be pretty basic in terms of what they offer for free but they still get the job done. For example, for breakfast you might find Oikos and Chobanil yogurt along with a selection of fruits including pineapple, cantaloupe, melon, and mixed grapes, and possibly hard-boiled eggs.

If you do want hot food items you can pay for those and you can also pay for premium drinks. For example, a Bloody Mary may cost you $10 and an imported beer may cost $8.

If you are interested in what the full experience is like, you can read my full review of the Admirals Club at Houston IAH . (Just note that that is one of the smaller AA lounges and there are definitely more equipped Admirals Club lounges like those at DFW.)

Don’t Miss out! Find out which American Airlines credit card can set you up with a big bonus, lounge access, free checked bags, and a short-cut to AAdvantage elite status! Read more here!

What are Flagship Lounges?

Flagship lounges are the premier lounges offered by American Airlines. These are only found in a handful of airports and offer a more premium dining and drinking experience.

For example, you can find dishes created in partnership with the James Beard Foundation, a premier American culinary organization. The admission policy for Flagship lounges is a little different but there is some overlap and I will go over the access policy in detail below.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

What is the Admirals Club access policy?

There are several different ways that you can get access to an Admirals Club. For example, you could get access based on a purchased lounge membership, the class of your airline ticket, or certain types of elite status. I will break all of those down in detail below.

Before jumping into the different ways to get admission, it’s worth noting that as of November 2019 American Airlines made changes to their admission policy. Now, you must have a boarding pass for same-day travel on an “eligible flight” to enter a lounge.

An “eligible flight” would include any departing or arriving flight that is marketed or operated by American, any one world airline, or Alaska Airlines.

Different types of Admirals Club admission types

Below I will go into detail about all the different types of admission types for an Admirals Club lounge.

One thing that you need to remember is that the policies for things like documents needed for entry and guest entry can differ based on the type of admission you are granted. So remember to not assume that the guest policies will be the same each time you visit a lounge.

Admirals Club members

The first way to get access to an American Airlines airport lounge is to have an Admirals Club membership . These memberships come in different forms and you might have an annual membership or even a lifetime membership.

One of the easiest ways to get an Admirals Club membership is to get the Citi AAdvantage Executive World Elite MasterCard . This card has some great perks that would interest anybody looking to frequently fly with American Airlines, such as: 2X on purchases on American Airlines, free baggage, and priority boarding privileges.

If you are a primary cardholder on this card you will get a complementary Admirals Club membership.

You might also get an Admirals Club membership if you are a ConciergeKey or AirPass member with Admirals Club privileges.

If you are okay with spending some cash you can also purchase an Admirals Club membership. The price of your membership will be based on the type of elite status you have and also on whether or not you are purchasing an individual membership or a group membership.

Here are the prices. You should keep in mind that the annual fee for the Citi AAdvantage Executive World Elite MasterCard is only $450 so if you get approved for that card you can save a lot of money on your membership.

You can also purchase a membership with miles at the following rates:

Lounges that offer access:

If you have an Admirals Club membership then these are the lounges that you will have access to:

- Domestic and international Admirals Club locations

- All Alaska Airlines Lounges (when departing on flights marketed and operated by American, Alaska Airlines or Virgin America)

- All Qantas Clubs (when departing on same-day flights operated by Qantas, or operated by American out of Auckland, New Zealand or Sydney, Australia)

- Select partner lounges operated by third parties (on same-day flights operated by American)

What you need to enter:

In order to be admitted into the lounge, you will need the following items:

- Government-issued photo ID

- Admirals Club membership card or Citi AAdvantage Executive World Elite MasterCard or AAdvantage elite status card

- A boarding pass for same-day travel on an eligible flight. (Same-day priority verification cards will be accepted.)

What is the guest policy?

You will be allowed to bring in immediate family members which would include your spouse, domestic partner and/or children under 18 or up to 2 guests. It’s worth noting that guests must be accompanied by the eligible member and present boarding passes for same-day travel on American or a partner airline.

- Eligible first class and business class passengers

If you are flying first class or business class then you might get lounge access but it depends on your route.

If you are flying domestically, you can get lounge access if you are flying on certain premium routes like the following:

- New York (JFK) and Los Angeles (LAX)

- JFK and San Francisco (SFO)

Note that if you are flying between other premium routes, you will only get lounge access if you are flying on the right type of aircraft.

- LAX and Boston (BOS) – traveling on A321T aircraft only

- LAX and Miami (MIA) – traveling on Boeing 777-300 aircraft only

If you are flying on an international route then you will get lounge access for the following routes:

Flights between the U.S. and:

- Central America

- Mexico City (MEX)

- New Zealand

South America

It’s worth reiterating that for Mexico you only get lounge access if flying between the US and Mexico City. I have personally flown American Airlines to other Mexican destinations and unsuccessfully persuaded an agent to allow me access. :/

If you meet the criteria above, you can also get access to the American Flagship lounges.

- First or Business boarding pass

You will be able to bring in one guest with you and children over two count as a guest. Also, any guest accompanying the customer must be traveling on a departing oneworld flight.

- Qualifying AAdvantage Executive Platinum, Platinum Pro and Platinum

If you hold elite status with American Airlines you can get lounge access as long as you hold Executive Platinum, Platinum Pro, and Platinum and you are flying on the following routes:

Oneworld Emerald and Sapphire

If you hold elite status with the oneworld alliance you can also get access. This includes customers on all departing flights marketed and operated by American or a oneworld airline (regardless of cabin).

AAdvantage Executive Platinum, Platinum Pro and Platinum customers traveling solely on North American itineraries don’t qualify.

- Qualifying boarding pass with oneworld Frequent Flyer number

Admirals Club One-Day Pass customers

Another route that you can go is to purchase a one day pass at domestic and international Admirals Club locations for $59.

The cool thing about a day pass is that you should be able to use it at multiple Admirals Club lounges if you have a connection. For example, I recently purchased a day pass and I was able to use the lounge in Houston (IAH) and Dallas (DFW) on the same day.

Another cool thing is that the day pass purchases usually trigger airline incidental credits. So if you have a card like the American Express Gold Card that has a $100 airline credit, then you can essentially get into the lounge for free.

Purchasing a day pass can be tricky sometimes because they will only sell you a day pass if they are not at capacity. So if you are flying during busy hours then you might want to have a back up plan.

One thing to keep in mind is that the Citi AAdvantage Platinum Select World Elite does not provide you with a complimentary day pass to lounges. Unlike the United Explorer Card which gives you an annual free day pass for two people, that is not one of the perks of the Platinum Select.

- One-Day Pass

- A boarding pass for same-day travel on an eligible flight

You can bring up to three children that are under 18. Children must be accompanied by the adult day-pass holder and present boarding passes for same-day travel on American or a partner airline.

Citi AAdvantage Executive Card authorized users

If you are an authorized user for the Citi AAdvantage Executive World Elite MasterCard you will not get a complete Admirals Club membership but you will still get entry into Admirals Club lounges.

One of the coolest things about this card is that you can add up to 10 authorized users for free which means that you can give free access to up to 10 individuals which is pretty crazy. Authorized users still get guest access so it is an extremely lucrative deal.

As an authorized user, you will get access to domestic and international Admirals Club locations.

- Valid Citi AAdvantage Executive World Elite MasterCard

An important requirement to remember here is that you will need to have your valid Executive card on you when visiting a lounge in order to get in. Since you won’t have an official Admirals Club membership, that card is the only ticket to your admission.

Admirals Club locations

As mentioned earlier, you can find Admirals Clubs all across the globe. Here are the current locations:

- Atlanta, GA (ATL)

- Austin, TX (AUS)

- Boston, MA (BOS)

- Buenos Aires, Argentina (EZE)

- Charlotte, NC (CLT)

- Chicago, IL (ORD)

- Dallas / Fort Worth, TX (DFW)

- Denver, CO (DEN)

- Honolulu, Hawaii (HNL)

- Houston, Texas (IAH)

- London, England (LHR)

- Los Angeles, CA (LAX)

- Mexico City, Mexico (MEX)

- Miami, FL (MIA)

- Nashville, TN (BNA)

- New York J.F. Kennedy, NY (JFK)

- New York LaGuardia, NY (LGA)

- Newark, NJ (EWR)

- Orange County, CA (SNA)

- Orlando, FL (MCO)

- Paris, France (CDG)

- Philadelphia, PA (PHL)

- Phoenix, AZ (PHX)

- Pittsburgh, PA (PIT)

- Raleigh Durham, NC (RDU)

- Rio de Janeiro, Brazil (GIG)

- San Francisco, CA (SFO)

- Sao Paulo, Brazil (GRU)

- St. Louis, MO (STL)

- Tampa, FL (TPA)

- Toronto, Canada (YYZ)

- Washington D.C. (DCA)

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Parter lounges

You can also get access to partner lounges which again can be found all around the world. The list of partner lounges is pretty long but I will give a rundown of the locations that you can find partner lounges in.

One very important thing to note with partner lounges is that sometimes you might have to have a same-day departure on an American Airlines operated flight to get access. Or if you are flying on certain airlines like Qantas, you may need to show a same-day boarding pass for a Qantas operated flight or an American Airlines marketed flight operated by Qantas.

So just because you see a lounge listed below, don’t assume you’ll get access and instead be sure to check about the requirements for that specific lounge and in particular what type of boarding pass you will need. You should be able to find the requirements here.

- Beijing, China (PEK): Air China Business Class Lounge

- Delhi, India (DEL): Plaza Premium Lounge

- Hong Kong (HKG): Plaza Premium Lounge G35

- Seoul, South Korea (ICN): Asiana Airlines Business Lounge East (Terminal 1 Main)

- Shanghai, China (PVG): Air China Business Class Lounge

- Singapore, Singapore (SIN): The Qantas Club

- Tokyo, Japan (HND): Japan Airlines Sakura Lounge

- Tokyo, Japan (NRT): Japan Airlines Sakura Lounge

- Amsterdam, Netherlands (AMS): Aspire Lounge 41

- Athens, Greece (ATH): Goldair Lounge

- Berlin, Germany (TXL): British Airways Lounge

- Barcelona, Spain (BCN): AENA Lounge

- Dublin, Ireland (DUB): 51st&Green Lounge (operated by the Dublin Airport Authority)

- Dubrovnik, Croatia (DBV): Airport Business Lounge

- Edinburgh, Scotland (EDI): British Airways Lounge

- Frankfurt, Germany (FRA): Japan Airlines First Class and Sakura Lounge

- Lisbon, Portugal (LIS): ANA Lounge

- London, England (LHR): British Airways Galleries Club Lounge (T3 and T5)

- Milan, Italy (MXP): SEA Sala Montale Lounge

- Munich, Germany (MUC): Airport World Lounge

- Prague, Czech Republic (PRG): MasterCard Lounge

- Reykjavik, Iceland (KEF): Icelandair Saga Lounge

- Rome, Italy (FCO): Passenger Lounge

- Shannon, Ireland (SNN): Boru Lounge

- Zurich, Switzerland (ZRH): Primeclass Lounge

Middle East

- Al Safwa – Customers flying in First

- Al Mourjan – Customers flying in Business, one world® Emerald

- Silver Lounge South – one world® Sapphire

- Oryx Lounge – Admirals Club members, Citi® credit cardholders

- Tel Aviv, Israel (TLV): Dan Lounge

- Bogota, Colombia (BOG): El Dorado Lounge

- Buenos Aires, Argentina (EZE): VIP Lounge

- Montevideo, Uruguay (MVD): Aeropuertos VIP Club

- Rio de Janeiro, Brazil (GIG): Plaza Premium Lounge

- Santiago, Chile (SCL): Andes Lounge

South Pacific

- Adelaide, Australia (ADL): The Qantas Club; Qantas International Business Lounge

- Auckland, New Zealand (AKL): Qantas International Business Lounge

- Alice Springs, Australia (ASP): The Qantas Club

- The Qantas Club

- The Qantas Brisbane International Lounge

- Broome, Australia (BME): The Qantas Club

- Cairns, Australia (CNS): The Qantas Club

- Cambridge, Australia (HBA): The Qantas Club

- Canberra, Australia (CBR): The Qantas Club

- Coffs Harbour, Australia (CFS): The Qantas Club

- Darwin, Australia (DRW): The Qantas Club

- Devonport, Australia (DPO): The Qantas Club

- Emerald, Australia (EMD): The Qantas Club

- Gladstone, Australia (GLT): The Qantas Club

- Gold Coast, Australia (OOL): The Qantas Club

- Kalgoorlie, Australia (KGI): The Qantas Club

- Karratha, Australia (KTA): The Qantas Club

- Launceston, Australia (LST): The Qantas Club

- Mackay, Australia (MKY): The Qantas Club

- Qantas International Business Lounge

- Port Hedland, Australia (PHE): The Qantas Club

- Rockhampton, Australia (ROK): The Qantas Club

- Tamworth, Australia (TMW): The Qantas Club

- Townsville, Australia (TSV): The Qantas Club

- Wellington, New Zealand (WLG): The Qantas Club

- Anchorage, U.S. (ANC): Alaska Lounge

- Los Angeles, U.S. (LAX): Alaska Lounge

- New York, U.S. (JFK): Alaska Lounge

- Portland, U.S. (PDX): Alaska Lounge

- San Diego, U.S. (SAN): AirSpace Lounge

- Alaska Lounge – Concourse C

- Alaska Lounge – North Satellite

- Alaska Lounge – Concourse D

Flagship lounge access

There is some overlap with the Admirals Club lounge access. One of the biggest differences is that you don’t get access to Flagship lounges if you have an Admirals Club membership or a Citi Executive Card. But here is a rundown of the people who qualify for Flagship lounge entry.

- oneworld Emerald and Sapphire

- ConciergeKey

You can read more about the Flagship lounges here.

Flagship lounge locations

As mentioned above, the locations for Flagship lounges are much more limited.

- Terminal 3 Concourse H/K

- Daily: 5:00 am – 10:00 pm

- Terminal D Between gates D21 and D22

- Daily: 5:00 am – 10:15 pm

- Terminal 4 Near gate 40

- Daily: 4:30 am – 1:00 am

- Concourse D Near gate D30

- Daily: 5:30 am – 11:00 pm

- Terminal 8 On the mezzanine level after Concourse B security checkpoint

- Daily: 4:30 am – 12:15 am

- Philadelphia (PHL) (COMING SOON)

It’s worth pointing out that you can also get access to the International First Class Lounge – Terminal 3 in London (LHR). However, you only get access if you’re traveling in first on a qualifying international or transcontinental flight marketed and operated by American or a oneworld airline.

American Airlines Lounge FAQ

Yes, you get free food in most lounges but typically you are limited to light dishes, such as yogurts and fruits.

A day pass for Admirals Club locations will cost $59.

Yes, you can get access to Admirals Clubs with the Citi AAdvantage Executive World Elite MasterCard .

You can bring in immediate family members which include people like your spouse and children that are under 18 or you can bring up the two guests.

The price for an individual membership depends on your elite status but they begin at $650 per year for basic members.

Yes, you can get access to many different partner lounges including Alaska Airlines and Qantas.

Business class passengers will get lounge access when flying internationally and on select domestic routes.

Overall, the lounge access policy for Admirals Club and Flagship lounges is pretty clear-cut. If you are looking for an easy way to get access, I would recommend looking to the Citibank Executive Card since that is a great way to save money and give free access to authorized users.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Hello, Is a member of Admirals Club Executive World Elite MasterCard and I have an international flight to the Philippines in June but have a connecting flight in Inchon, South Korea. American Airline told me that I can use the Asiana Business Lounge at the airport. Please do let me know pleaseI’ve been getting different answers. Additionally, I am not flying an AmericanAirlines I’m flying in a Korean Airlines. Hope to hear from you soon.

Sincerely, EdwinL Cunanan

Is there a way to buy day passes without a name on them so I can use them for friends sometime in the upcoming year?

I am flying to Dublin on american, and have a 3 hour layover in Philadelphia. Can I buy a daypass for my 3 hour layover? Also, the paragraph I just read stated you can bring your spouse. This is good for the one fee of $59?

Does the Qatar Airlines privilege club Platinum card give access to Admiral club lounges when I fly ‘domestic flights’ in the USA with an American Airlines business class ticket

Comments are closed.

Privacy Overview

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Complete Guide to the American Airlines AAdvantage Program

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Airlines frequent flyer sign-up

How much are american airlines miles worth, american airlines vs. competitors, how to earn aadvantage miles, how to redeem aadvantage miles, american airlines change, delay and cancellation policies, american airlines partners, aadvantage program elite status, which american airlines fare class should i choose, credit cards that earn aadvantage miles, aadvantage, recapped.

Founded in 1930, American Airlines is one of America’s three “legacy” carriers and one of the most visible brands in aviation. The airline’s loyalty program is called AAdvantage.

American is the dominant carrier at its home airport, Dallas-Fort Worth, and also operates hubs in Charlotte, Chicago-O’Hare, Los Angeles, Miami, New York (LaGuardia and JFK), Philadelphia, Phoenix and Washington-National. Today, the airline operates an average of 6,800 flights every day, serving more than 350 destinations across 50 countries.

In this handy guide, we'll introduce all the different ways you could earn and redeem AAdvantage miles. We will also discuss elite status and AA’s Oneworld and independent airline partners.

Is AAdvantage free? Yes. But before you can start earning miles with American Airlines, you’ll need to sign up for an AAdvantage frequent flyer account. You can register here .

Based on our most recent analysis, NerdWallet values American Airlines miles at 1.7 cents apiece, which is the highest value among its competitors . (Yes, it surprised us , too.)

To determine the value of reward miles, we compared cash prices and reward redemptions for economy round-trip routes across several destinations and dates.

We divided the cost of the cash ticket by the cost of the reward ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates.

» Learn more: Credit cards that earn AAdvantage miles

Value of American Airlines miles over time

The value of American Airlines miles has increased steadily over the last few years.

This is due in part to rising airfare costs, which drive the relative value of miles up, but also due to improvements in the overall value of the miles themselves.

» Learn more: Convert your American miles to dollars

American Airlines came in third place among overall airlines in NerdWallet’s most recent analysis of the best airlines .

Its rewards program, AAdvantage, also came in third place in a second analysis of the best airline loyalty programs .

Here's a closer look at how American competed across subcategories:

Fourth in rewards rate .

American offers the second-best basic economy ticket .

Fourth in operations .

Tied for third with United in elite status benefits .

Fourth in terms of lowest fees .

Fifth in in-flight experience .

Sixth in most pet-friendly airlines .

The most obvious way to earn AAdvantage miles is by flying on American or with one of its partner airlines. But there are actually dozens of ways to earn American Airlines AAdvantage miles , which include hotel stays, car rentals, vacations, cruises, dining, shopping portals , various promotions or simply by buying miles (though that last one is usually a bad idea).

Although they’re called “miles,” you earn them based on how much money you spend on tickets, not how far you fly.

» Learn more: Find the best airline credit card for you

In general, AAdvantage miles will expire if you go 18 months without earning or redeeming miles on American or one of its partner airlines. Members under age 21 are exempt from mileage expiration. Also, if you have an American Airlines-branded credit card, your miles will remain valid as long as you continue to use the card.

» Learn more: Do AA miles expire?

Earning AAdvantage miles when you fly

Earning on American: The number of miles you earn for a flight depends on how much you spend on the ticket (in base fare and carrier-imposed fees).

If you have AAdvantage elite status , you will earn additional bonus miles for your trip.

Note: You earn miles only on airfare and airline fees. Government-imposed taxes and fees do not earn miles.

Earning on other airlines: American’s partner airlines in the Oneworld alliance distribute frequent flyer miles based on which class your tickets are booked in.

The cheapest economy tickets may earn only 25% to 50% of flown miles, while premium economy, business class and first class tickets can earn 100% base miles and a cabin bonus between 10% and 50%.

However, not all routes or flights may qualify. If you buy a flight on a booking code not listed as eligible for awards, you will not earn any award miles for your flight. Also, some routes or affiliate airlines may not earn miles.

To better understand how many miles you could earn with American’s Oneworld partners, visit the American website .

Earning AAdvantage miles with a credit card

American Airlines offers co-branded credit cards through both Citi and Barclays.

NerdWallet's favorite credit card for the AAdvantage program is the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® . It gives you 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases.

You also get a great sign-up bonus to start: Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

The annual fee is $99 — but the checked bag benefit on this card can make up for it rather quickly. The first checked bag is free for you and up to four others traveling on your reservation. You also get preferred boarding, so you can get on the plane relatively early and find space for your carry-on.

» JUMP AHEAD to other credit cards that earn AAdvantage miles .

Earning AAdvantage miles through partners

Hotels: You can earn AAdvantage miles at most major hotel chains. In some cases, you earn 1 or 2 miles per dollar spent; in others, you earn a flat number of miles per stay. See partner hotels and earning rules.

Dining: Register a credit card with AAdvantage Dining , and every time you use that card at a participating restaurant, club or bar, you'll earn 1 to 5 miles per dollar spent. There are more than 11,000 participating locations.

Auto rentals: Several major car rental agencies, including Avis and Budget , offer an option to earn AAdvantage miles. See the rules here.

Fuel: Via a partnership with Shell's Fuel Rewards program , AAdvantage members earn 2 miles for every gallon of gas bought at Shell stations. Members also get 100 miles on their first fill-up after linking their AAdvantage account to Fuel Rewards.

Shopping: When you shop online through the AAdvantage eShopping mall, you earn miles for every dollar you spend at more than 950 retailers.

Vacations: When booking a flight and hotel through AA Vacations , you could earn extra miles.

Cruises: You could earn 3 miles per $1 (up to 30,000 AAdvantage miles) for booking a cruise through AA Cruises .

Buying AAdvantage miles

In most cases, we recommend you stay away from buying miles, as it's an expensive way to accrue them.

How much do AA miles cost? It depends on how many you buy. You have to buy at least 2,000 miles, and at that volume, the price is 3.76 cents per mile. If you buy at least 5,000 miles, you'll get a discount.

Even with any discounts, purchasing miles should be a last resort (e.g., only do this to top up your account for an award redemption or to keep miles from expiring).

» Learn more: The rare times it might make sense to buy AAdvantage miles

Once you’ve got all those miles, you’ll want to redeem American Airlines miles for maximum value. AAdvantage mile redemption options include award flights, upgrades, car rentals, hotel stays, vacations, Admirals Club airport lounge access and much more.

AAdvantage miles are redeemable for flights through American Airlines and its partners in the Oneworld alliance . In most cases, you can redeem by booking through American’s website. Some airlines do not show up on AA.com, and in those cases you need to call American Airlines and ask to waive the phone booking fee.

Award flight redemptions

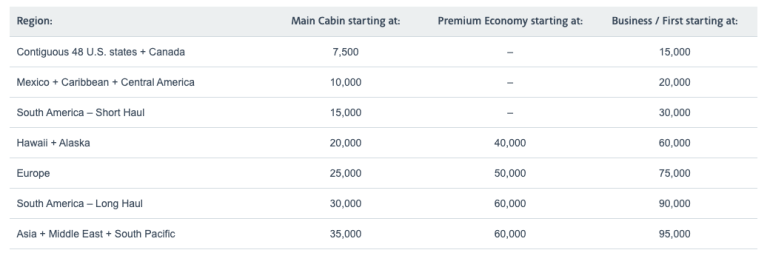

American Airlines now has a fully dynamic award chart , with pricing varied based on demand. Even so, American has published an "award chart" showing what you can expect to pay by region and fare class, but there are no guarantees:

Bad redemption options

Using your AAdvantage miles to book a hotel with points yields a low value.

In one search for a hotel in Miami, the value of using the miles for a hotel room was around 0.8 cent per mile, which is below our 1.7 cents valuation, only a little more than half the value of using the miles for domestic travel. A better bet would be to use hotel points or rewards earned from a cash-back credit card for hotel bookings.

» Learn more: Plan your next AAdvantage miles redemption with our tool

American has loosened its change and cancellation policies , making it easier for flyers to revise their flights.

Change fees

The airline no longer charges change fees for most fares (except basic economy) on domestic flights, short-haul international flights and many long-haul international flights. However, you may still be on the hook for any fare differences if your new flight is more expensive.

For nonrefundable airfares, you get an American Airlines flight credit for unused or canceled tickets.

If you bought a basic economy fare, you will not be able to make changes to your itinerary.

For flights booked with miles, you’ll also be able to change or cancel your reservation without any fees.

AA flight delays

American offers actual refunds — no matter what type of fare you bought — on many flights delayed by more than four hours.

If your American Airlines flight is delayed , you can get your money back if you choose not to go through with the flight. If you wait it out, you might be able to get compensation for a hotel room if the new flight is the following day.

» Learn more: How American's flight delay compensation works

AA flight cancellations

If your American Airlines flight is canceled outright, American typically automatically books you on what it assumes is the next best available flight (though that doesn’t necessarily mean it’s the best for you).

Check the American Airlines app or call American Airlines reservations to make adjustments to the flight you actually want. And as is the case for delayed flights, you are entitled to a full refund for flights that are canceled if you opt not to take another on American Airlines.

» Learn more: How to get an American Airlines refund

American Airlines has dozens of partnerships with other airlines all around the world, opening opportunities to earn and redeem AAdvantage miles on non-American Airlines flights. Plus, if you hold American Airlines elite status, you can sometimes get similar elite status benefits on those partner airlines, too.

Oneworld alliance members

American Airlines is a founding member of the Oneworld Alliance .

Alaska Airlines.

American Airlines.

British Airways.

Cathay Pacific.

Japan Airlines.

Malaysia Airlines.

Qatar Airways.

Royal Air Maroc.

Royal Jordanian.

Sri Lankan Airlines.

Other partner airlines

On airline partners outside the Oneworld alliance, your ability to earn or redeem miles is more limited. You may be able to earn miles but not redeem them, for example, or you may be able to redeem only for certain flights.

Other partner airlines include:

Air Tahiti Nui.

China Southern Airlines.

Etihad Airways.

Fiji Airways.

GOL Airlines.

Hawaiian Airlines.

JetBlue Airways.

Silver Airways.

Although you can redeem miles for most of these partners on AA.com, you will have to call the airline to book some awards. Awards not bookable online include:

The flight award chart for partner airlines tells you how you can earn flights on carriers other than American for no cost.

» Learn more: Getting American award flights for less miles

Anyone can sign up for the AAdvantage program, but basic membership only comes with a frequent flyer number and an account where your points accumulate.

The real goodies come when you earn AAdvantage elite status, of which there are four levels.

AAdvantage Gold .

AAdvantage Platinum .

AAdvantage Platinum Pro .

AAdvantage Executive Platinum .

AAdvantage elite levels and benefits

For many, the best perk of AAdvantage elite status is the opportunity to get an American Airlines upgrade . Sure, you can pay in cash or miles to upgrade your flight to business or first class.

But, once you earn elite status with American, you’re eligible to receive unlimited upgrades for domestic, Caribbean and Central American flights. With Executive Platinum status, you can even get upgraded on award tickets.

Oneworld partners may also offer some benefits to American elite status members.

How to earn elite status in AAdvantage

Say goodbye to elite qualifying dollars, elite qualifying miles and elite qualifying segments. American AAdvantage members now earn status by flying, using an AAdvantage credit card or spending with an American Airlines partner. There is now only one status metric — Loyalty Points — and the earning system is really simple.

Each eligible mile earned equals 1 Loyalty Point. There are three ways to earn Loyalty Points:

Traveling on American Airlines, Oneworld or any other partner airline.

Making purchases on American Airlines AAdvantage credit cards.

Shopping, dining and spending money with American’s partners, including AAdvantage eShopping, AAdvantage Dining, SimplyMiles and more.

How many Loyalty Points do you need to earn status with American Airlines?

Since there are so many more ways to earn status (without even stepping foot on a plane), the number of points needed to reach the top status levels are high.

» Learn more: Guide to American Airlines elite status

You may also be able to earn AAdvantage elite status through a status match , which is where American will grant you elite status if you show proof of your elite status with a different airline or hotel.

For example, Hyatt and American offer reciprocal status to their elite members.

There are more than a half-dozen fare types you can pick from when booking on American Airlines, each with their own benefits. The more expensive the fare class, the earlier you'll get to board . Depending on the seat you pick, you may also be able to avoid American Airlines baggage fees .

The American Airlines fare classes are (in order from swankiest to stingiest) are:

Flagship First.

Flagship Business.

First class.

Business class.

Premium economy.

Main Cabin Extra.

Main cabin.

Basic economy.

American Airlines is unusual among U.S. airlines in that it has credit card agreements with two different issuers — a legacy of its merger with U.S. Airways. Cards that earn AAdvantage miles include:

on Citibank's application

$0 intro for the first year, then $99 .

Earn 15,000 American Airlines AAdvantage® bonus miles after making $500 in purchases within the first 3 months of account opening.

Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

Earn 60,000 AAdvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days.

» Learn more: Is an American Airlines credit card worth it?

If you seek more flexibility in redeeming miles for award flights, consider applying for a more general travel credit card instead. A more general travel credit card differs from an airline card in that you can book flights with multiple carriers, rather than reaping the benefits of staying loyal to a single brand.

Only one American Airlines credit card, the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® , will get you Admirals Club access .

The more high-end (or 'premium' ) the travel credit card, the more benefits you can enjoy, including airport lounge access or automatic elite status in certain programs. That said, a brand-specific airline card can net you benefits like waived baggage fees, which can have meaningful dollar value.

» Learn more: The best airline credit cards

Deciding if a program is worth it depends on your home airport and where you’re looking to fly. American Airlines flies to 50 countries (150 through its Oneworld partners), providing ample opportunity for passengers to use its service. AAdvantage, which is the airline’s loyalty program, offers many opportunities for redeeming its miles for award flights. If American flies to your home airport and reaches the destinations you’d like to visit, it's a great airline to earn miles with.

To contact American Airlines by phone in the U.S., call 800-433-7300 or visit the website at aa.com . You can also reach American Airlines on Twitter at @americanair .

Award flights with American Airlines start at 7,500 AAdvantage miles for a one-way economy flight under 500 miles in the contiguous U.S. and Canada. Longer distance flights in the contiguous U.S. and Canada start at 12,500 miles.

Yes, it is free to join the American Airlines AAdvantage program. Head over to aa.com to register for an account. Doing so will allow you to earn AAdvantage miles when you fly on American Airlines and its Oneworld partners.

To contact American Airlines by phone in the U.S., call 800-433-7300 or visit the website at

. You can also reach American Airlines on Twitter at

@americanair

Yes, it is free to join the American Airlines AAdvantage program. Head over to aa.com to register for an account. Doing so will allow you to

earn AAdvantage miles

when you fly on American Airlines and its Oneworld partners.

We've covered all the basic details of the American Airlines AAdvantage program.

But if you still aren't sure whether a frequent flyer program is worth the effort, see our absolute beginner's guide to frequent flyer programs .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Bank of America® Customized Cash Rewards credit card

Earn 3% cash back when you choose online shopping plus earn a $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

ALREADY A CARDHOLDER?

Special limited-time offer:

Earn up to 75,000 bonus miles terms apply, special limited-time offer: earn up to 75,000 bonus miles terms apply.

Select a category to find the best travel credit card for you:

Select a card category:

- Travel Needs

- Everyday Purchases

- Admirals Club® Membership

- Business Owners

Offers available if you apply here today. Offers may vary and these offers may not be available in other places where the cards are offered.

All your travel needs.

Earn 75,000 American Airlines AAdvantage® bonus miles plus travel benefits

Bonus miles earned after $3,500 in purchases within the first 4 months of account opening, citi® / aadvantage® platinum select® world elite mastercard®, $0 intro annual fee for the first year , then $99 *, variable purchase apr: 21.24% – 29.99% *, *pricing details.

EVERYDAY PURCHASES AND NO ANNUAL FEE*

American Airlines AAdvantage® MileUp® Mastercard®

Earn 15,000 american airlines aadvantage® bonus miles with our no annual fee credit card*, bonus miles earned after $500 in purchases within the first 3 months of account opening, bonus miles earned after $500 in purchases within the first 3 months of account opening, no annual fee *.

BEST VALUE FOR ADMIRALS CLUB® MEMBERSHIP

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000 american airlines aadvantage® bonus miles and enjoy the only credit card with admirals club® membership, bonus miles earned after $7,000 in purchases within the first 3 months of account opening, annual fee $595 *.

BUSINESS OWNERS

Citi® / AAdvantage Business™ World Elite Mastercard®

Earn 65,000 american airlines aadvantage® bonus miles to redeem for business travel, bonus miles earned after you or your employees spend $4,000 in purchases within the first 4 months of account opening, make business travel more rewarding.

International credit cards

Find the country you live in and choose the card for you.

TERMS AND CONDITIONS

Offer availability.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding Puerto Rico and U.S. Virgin Islands.

Bonus miles

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

First checked bag free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on American Airlines purchases

Eligible American Airlines purchases are items billed by American Airlines as merchant of record booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Admirals Club®, American Airlines Vacations℠, Google Flights, and American Airlines airport and city ticket counters). Products or services that do not qualify are car rentals and hotel reservations, purchase of elite status boost or renewal, and AA Cargo℠ products and services. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Double miles at restaurants and gas stations

Earn 2 AAdvantage miles for each $1 spent on purchases at restaurants (including cafes, bars, lounges, and fast food restaurants) and at gas stations. Food and beverage purchases made at the American Airlines Admirals Club® will be awarded 2 AAdvantage miles for each $1 spent as part of the Double Miles on American Airlines purchases benefit.

Certain non-qualifying purchases: Restaurant purchases not eligible to receive double miles include, but are not limited to, supercenters, warehouse clubs, discount stores, restaurants / cafes inside department stores, bowling alleys, public and private golf courses, country clubs, convenience stores, movie theaters, caterers and meal kit delivery services. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

1 mile per $1

AAdvantage® miles are earned on purchases, except balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Preferred boarding

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible credit cardmembers will board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

$125 American Airlines Flight Discount

Earn a $125 American Airlines Flight Discount certificate (the “Flight Discount”) after you spend $20,000 or more in purchases that post to your Citi® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed. To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate. The Flight Discount is redeemable toward the initial ticket purchase of air travel wholly on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. for itineraries originating in the U.S., Puerto Rico, or U.S. Virgin Islands, and sold in US Dollars. The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations. The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards. Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount will not be replaced for any reason. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount.

25% savings on eligible inflight purchases

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Authorized user

Before adding an authorized user to your credit card account you should know:

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Fraud Disclosure

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your Citi® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using your account other than for personal, family or household purposes.

Card Account Disclosure

The Card Account is only available if you have an open AAdvantage® program membership in your name. Citi reserves the right to cancel your Card Account if you or American Airlines terminates or deactivates your AAdvantage® program membership.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage Million Miler℠ status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage » .

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, American Eagle, AAdvantage, AAdvantage Million Miler, MileSAAver, Business Extra, Flagship, Admirals Club, Platinum Pro, AAdvantage MileUp, AA Cargo, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

one world is a mark of the one world Alliance, LLC.

Citibank is not responsible for products or services offered by other companies. Cardmember program terms are subject to change.

Mastercard, World Elite and the circles design are registered trademarks of Mastercard International Incorporated.

© 2021 Citibank, N.A. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

American Airlines AAdvantage MileUp® Mastercard®

Statement credit and American Airlines AAdvantage® bonus miles are not available if you have received a statement credit or American Airlines AAdvantage® bonus miles for a new AAdvantage MileUp® account in the past 48 months.

Double miles on grocery store purchases

Earn 2 AAdvantage miles for each $1 spent on purchases at grocery stores. Grocery stores are classified as supermarkets, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, specialty vendors, and bakeries.

Certain non-qualifying purchases: You won’t earn double miles for purchases at general merchandise/discount superstores, wholesale/warehouse clubs, candy/confectionery stores, cafes, bars, lounges, and fast food restaurants.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

AAdvantage MileUp® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their AAdvantage MileUp® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

No mileage cap

There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your Citi® / AAdvantage® credit card account.

You’re responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user’s name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Executive account in the past 48 months.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on domestic itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® card, up to eight (8) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Enhanced airport experience

For benefits to apply, the Citi® / AAdvantage® Executive World Elite Mastercard® account must be open 7 days prior to air travel AND reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive credit cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4.

These benefits apply when traveling on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. Up to eight (8) companions traveling with the eligible primary credit cardmember will also get priority check-in (where available), priority airport screening (where available), and priority boarding privileges if they are listed in the same reservation. You may check in at any Business Class check-in position or First Class check-in when Business Class is not available, regardless of the class of service in which you are traveling on American Airlines.

These benefits will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Exclusive lanes at security checkpoints are available, subject to TSA approval. Applicable terms and conditions are subject to change without notice.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember’s card account. Applicable terms and conditions are subject to change without notice.

Admirals Club® membership and credit card authorized user access

Only Citi® / AAdvantage® Executive World Elite Mastercard® primary credit cardmembers who are eighteen (18) years of age or older will receive full membership access privileges to Admirals Club® lounges. An authorized user of the Citi® / AAdvantage® Executive World Elite Mastercard® who is eighteen (18) years of age or older will receive access privileges to American Airlines Admirals Club® lounges. Full Admirals Club® membership privileges do not apply to a credit card authorized user. An Admirals Club® membership includes access to other airline lounges and clubs with which American Airlines may have reciprocal lounge or club access privileges. Membership also includes special pricing on conference rooms and other special offers that are available exclusively to Admirals Club® members. Neither membership nor the credit card authorized user access benefit provides access privileges to the Arrivals Lounge, International First Class Lounges, or Flagship® Lounge facilities, including Flagship® First Dining. Additionally, the credit card authorized user access benefit does not provide: (i) access privileges to other airline lounges or clubs with which American Airlines may have reciprocal lounge or club access privileges; or (ii) special pricing on conference rooms or other special offers. To locate a current list of Admirals Club® lounges please visit aa.com/admiralsclub » .

To access an Admirals Club® lounge, primary credit cardmembers and credit card authorized users must present: (i) their (a) active and valid Citi® / AAdvantage® Executive World Elite Mastercard® or (b) with respect to primary credit cardmembers only, AAdvantage® number; (ii) their current government-issued I.D.; and (iii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is (1) marketed or operated by American Airlines, (2) marketed and operated by any oneworld® carrier, or (3) marketed and operated by Alaska Airlines; and (iv) any additional documentation required by American Airlines. Either immediate family members (spouse or domestic partner and children under eighteen (18) years of age) or up to two (2) guests traveling with the primary credit cardmember or authorized user may be admitted for free when accompanied by the primary credit cardmember or authorized user. Family members and guests must present a same-day boarding pass for an eligible flight as defined above. All persons must be of valid drinking age, based on applicable law, to consume alcohol.

If the primary credit cardmember is an Admirals Club® member on the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi® and has sixty (60) or more days remaining on such current Admirals Club® membership, he or she is eligible to receive a prorated refund from American Airlines for any unused portion of his or her current Admirals Club® membership fee. The refund will be a prorated amount of the annual membership fee calculated based on the number of days remaining on such primary credit cardmember’s current Admirals Club® membership as of the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi®. Refunds will be automatically made in the original form of payment within twelve (12) weeks of becoming a Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmember. Memberships redeemed with Business Extra points, Lifetime Admirals Club® members and AirPass members with Admirals Club® privileges are not eligible for a refund.

Upon closure of the Citi® / AAdvantage® Executive World Elite Mastercard® account, all Admirals Club® benefits and access associated with the account will be immediately terminated, including, but not limited to, all benefits afforded to credit card authorized users. All Admirals Club® membership rules, terms and conditions apply. AMERICAN AIRLINES RESERVES THE RIGHT TO MODIFY ANY OR ALL RULES, TERMS AND CONDITIONS AT ANY TIME WITHOUT NOTICE. SUCH MODIFICATIONS SHALL BE EFFECTIVE IMMEDIATELY AND INCORPORATED INTO THIS AGREEMENT. BY ACCESSING ANY ADMIRALS CLUB® LOUNGE YOU SHALL BE DEEMED TO HAVE ACCEPTED THE ADMIRALS CLUB® TERMS AND CONDITIONS. To review the complete Admirals Club® membership terms and conditions, visit aa.com/admiralsclub » .

Global Entry or TSA PreCheck® application fee credit

Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmembers are eligible to receive one statement credit up to $100 per account every five years for either the Global Entry or the TSA PreCheck® program application fee. Credit cardmembers must charge the application fee to their Citi®/ AAdvantage® Executive credit card to qualify for the statement credit. Credit cardmembers will receive a statement credit for the first program (either Global Entry or TSA PreCheck®) to which they apply and pay for with their eligible card, regardless of whether they are approved for Global Entry or TSA PreCheck®. Please allow 1-2 billing cycles after the qualifying Global Entry or TSA PreCheck® fee is charged to the eligible account for the statement credit to be posted to the account. Only fees associated with either the Global Entry or the TSA PreCheck® application fee will be eligible towards the statement credit.

For information on Global Entry, visit globalentry.gov. For information on TSA PreCheck®, visit tsa.gov. Applications are made directly with these organizations, and this information is not shared with Citi, nor does Citi have access to Global Entry or TSA records. Citi does not share account information with Global Entry or TSA. Decisions to approve/deny applications are made solely by these organizations, and Citi has no influence over these decisions. Citi is not notified of approvals or denials of applications.

TSA PreCheck® is a registered trademark of the Department of Homeland Security.

CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a CitiBusiness® / AAdvantage® Platinum Select® account in the past 48 months.

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmember and employee cardmembers. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember’s American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.