How Much to Travel to Hawaii: Average Vacation Costs and Budget Tips for Families

To travel to Hawaii, plan for about $4,000 per week. This cost depends on your choices of accommodation, activities, and island selection. Travel costs vary with transportation and dining expenses. Adjust your budget based on the duration of stay and what you want to do while there.

Accommodations vary widely. Budget hotels may charge around $150 per night, while luxury resorts can exceed $500 per night. Dining costs also fluctuate. Families can expect to spend $15 to $30 per person for casual dining, with hotel restaurants averaging higher.

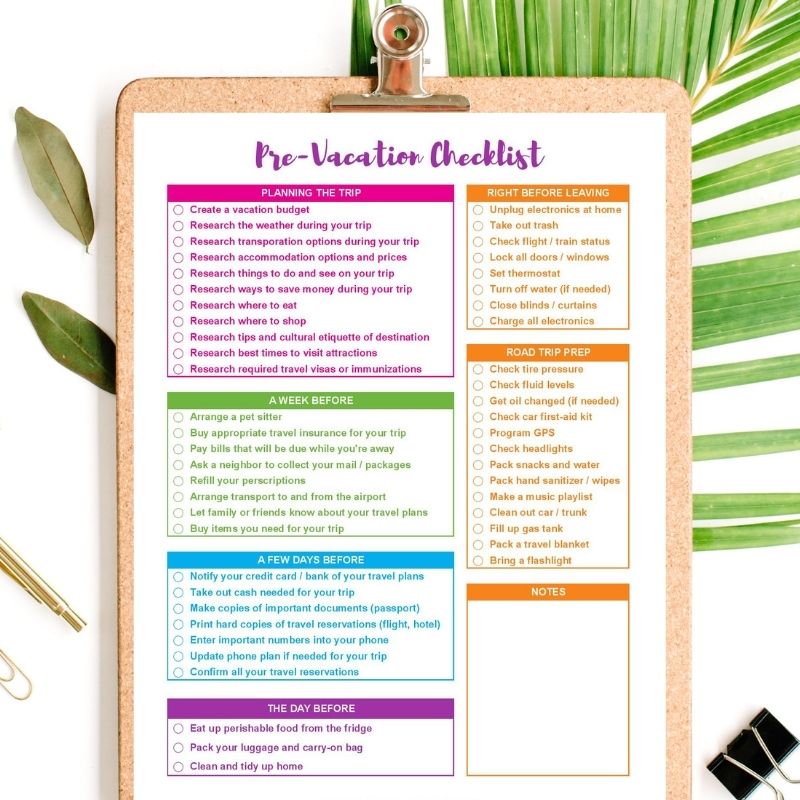

To make traveling to Hawaii more affordable, families should consider several budget tips. Booking flights several months in advance can lead to lower prices. Additionally, traveling during the off-peak season can yield significant savings on accommodations and activities.

Planning activities in advance can help families set a reasonable daily budget. Many attractions offer discounts for children, making family outings more budget-friendly. By understanding these costs and tips, families can enjoy a memorable Hawaiian vacation without overspending.

Next, we will explore specific budget-friendly activities and dining options that families can enjoy while traveling to Hawaii.

What Are the Major Expenses to Consider While Traveling to Hawaii?

Traveling to Hawaii involves several major expenses that travelers should consider. These expenses can vary based on travel style, preferences, and the specific islands visited.

- Accommodation

- Transportation

- Food and Dining

- Activities and Experiences

- Travel Insurance

- Miscellaneous Expenses

Understanding these expenses will help travelers budget effectively and enjoy their trip without unexpected financial stress.

Airfare: Airfare represents one of the largest expenses when traveling to Hawaii. The cost can fluctuate based on the departure city, time of booking, and season. For example, round-trip flights from the U.S. mainland to Hawaii typically range from $300 to $700, depending on the season. Booking in advance can lead to significant savings, while peak seasons during holidays can see prices soar.

Accommodation: Accommodation expenses encompass hotels, vacation rentals, or hostels. Prices can vary significantly. A mid-range hotel in Hawaii can cost between $200 and $400 per night, while luxury resorts may exceed $600 or more. Alternatives like vacation rentals can fit different budgets. According to a 2022 report by the Hawaii Tourism Authority, travelers often seek value, driving the popularity of lower-cost lodging options.

Transportation: Transportation costs include car rentals, public transit, or rideshare services. Car rentals often range from $50 to $150 daily, depending on the vehicle type and rental duration. Public transportation is a budget-friendly option, especially in urban areas. However, some remote locations may require a rental.

Food and Dining: Food costs can vary widely, with casual dining at approximately $15 to $25 per meal and fine dining costing significantly more. Travelers who prefer cooking may save money by dining at home. According to a 2023 survey by WalletHub, dining out in Hawaii can be among the higher costs in the U.S. due to import prices.

Activities and Experiences: Expenses for activities, such as tours, excursions, and admission fees, should also be anticipated. Popular activities can range from free hiking trails to paid experiences like boat tours, which may cost around $75 to $200 per person. Planning ahead and researching free local attractions can help manage these costs.

Travel Insurance: Travel insurance can protect against unexpected events like medical emergencies or trip cancellations. Policies vary, costing from $50 to several hundred dollars based on coverage. According to InsureMyTrip, many travelers consider this a necessary expense for peace of mind while traveling.

Miscellaneous Expenses: Miscellaneous expenses include souvenirs, tips, and unexpected costs. It is advisable to budget an extra 10-15% of the total trip cost for these items. These expenses may vary based on individual habits and preferences.

Considering these expenses will provide a clearer picture of the overall costs involved in traveling to Hawaii, allowing travelers to enjoy the beauty and culture of the islands without financial strain.

How Much Should You Budget for Flights to Hawaii?

You should budget between $400 and $1,200 for round-trip flights to Hawaii, depending on several factors. The average domestic round-trip fare from the U.S. mainland to Hawaii typically falls between $700 and $900. Prices can vary significantly based on the departure city, time of year, and how far in advance you book your flights.

When traveling from the West Coast, such as Los Angeles or San Francisco, you might find lower fares, often ranging from $400 to $600. Conversely, flights from the East Coast, like New York City, may cost between $800 and $1,200 due to the longer distance. Many travelers save money by booking flights during off-peak seasons, which are typically from mid-April to June and September to mid-December.

For example, a family of four traveling from Los Angeles in June might spend around $2,400 on flights, whereas the same family flying from Miami could face a budget closer to $4,800 during peak vacation times.

Several external factors can influence flight prices. Airline competition plays a significant role; more competition usually leads to lower prices. Additionally, special promotion periods or discounts also impact costs. Booking well in advance generally yields better prices. However, last-minute deals can sometimes benefit flexible travelers.

In summary, when budgeting for flights to Hawaii, expect to spend anywhere from $400 to $1,200 per person, influenced by factors such as departure location, time of year, and booking timing. It’s advisable to monitor flight prices and consider various options to find the best deals.

What Is the Average Cost of Accommodation for Families in Hawaii?

The average cost of accommodation for families in Hawaii refers to the typical price range families might expect to pay for lodging during their stay in the state. This price includes hotels, vacation rentals, and other types of lodgings suitable for families.

According to the Hawaii Tourism Authority, the average nightly rate for accommodation in Hawaii can vary significantly based on location, time of year, and type of lodging. In 2023, the average rate ranged from $250 to $500 per night.

Accommodation costs in Hawaii can depend on several factors. These include the season, with peak tourist seasons generally resulting in higher prices, the type of accommodation, and the proximity to beaches or attractions. Families often prefer larger units or homes with kitchens, which can impact the price.

Research from the University of Hawaii indicates that vacation rental prices grew increasingly more expensive from 2020 to 2023, with a notable increase due to high demand. An estimated projection shows prices could rise an additional 5% to 10% over the next few years.

High accommodation costs create significant financial burdens on families, limiting their vacation options. It may also deter potential visitors, affecting the local economy reliant on tourism.

High costs can impact family health due to stress over finances, contribute to environmental concerns related to tourism, and strain local housing markets. For example, residents may face challenges finding affordable housing due to increased demand from short-term rentals.

Recommended solutions include promoting off-peak travel, the development of affordable accommodations, and incentivizing families to visit during less busy times. The Hawaii Tourism Authority advocates for balanced tourism development.

Strategies such as offering discounted family packages and ensuring a diverse range of lodging options can help address high accommodation costs. Employing technology to streamline booking processes may improve accessibility for families.

How Much Do Meals and Dining Typically Cost in Hawaii?

Meals and dining in Hawaii can be quite costly, with average expenses ranging from $15 to $60 per person per meal, depending on the type of restaurant and location. Fast-casual dining typically costs between $15 and $25 per person, while sit-down restaurants generally range from $30 to $60 or more for an entrée.

Grocery store prices in Hawaii are higher than the national average by about 15% to 30%, often leading visitors to spend around $70 to $150 for a week’s worth of groceries for one person. Popular food items, such as fruits and vegetables, can be significantly more expensive due to transportation costs.

Common examples include a simple meal at a fast-food restaurant costing about $10 to $15. In contrast, a seafood dinner at a mid-range restaurant may set you back $40 to $60, with premium places offering dishes priced even higher. A plate lunch of local cuisine, which is a popular option for both locals and tourists, can cost around $10 to $15.

Several factors can influence these costs. For instance, Hawaii’s geographical isolation increases the transportation costs of food supplies, affecting restaurant pricing. Additionally, high tourist demand during peak seasons can inflate prices. On the other hand, chain restaurants may offer more consistency in pricing regardless of location.

In summary, dining costs in Hawaii can vary widely based on meal type and location, with fast-casual meals generally costing between $15 and $25 and sit-down meals averaging $30 to $60. Visitors should consider both restaurant and grocery prices when budgeting their meals. Further exploration could include specific restaurants and local food markets to gain a better understanding of Hawaii’s diverse dining scene.

What Activities and Attractions Should Families Budget For in Hawaii?

Families should budget for a variety of activities and attractions in Hawaii, including outdoor adventures, cultural experiences, and family-friendly attractions.

- Outdoor Activities

- Cultural Experiences

- Water Sports

- Natural Attractions

- Family-Friendly Attractions

- Dining Experiences

- Transportation Costs

Transitioning from budget categories, let’s explore each activity and attraction in detail.

Outdoor Activities : Outdoor activities in Hawaii include hiking, sightseeing, and beach visits. Families can hike to scenic locations like Diamond Head or the Na Pali Coast. Popular beach spots such as Waikiki Beach offer relaxation and free activities like building sandcastles or swimming.

Cultural Experiences : Cultural experiences allow families to learn about Hawaiian history and traditions. Families can visit the Polynesian Cultural Center or attend a luau, which features traditional music, dance, and food. Such experiences can cost between $80 to $160 per person.

Water Sports : Water sports like snorkeling, surfing, and kayaking are popular in Hawaii. Families can rent equipment or join guided tours. Prices for snorkeling tours often range from $50 to $100 per person.

Natural Attractions : Natural attractions include national parks and botanical gardens. For example, Haleakalā National Park showcases unique landscapes and sunrise views. Entrance fees for national parks are typically around $30 per car.

Family-Friendly Attractions : Family-friendly attractions include the Honolulu Zoo and the Maui Ocean Center. These venues usually feature educational exhibits and activities suitable for children. Admission prices can vary, often between $10 to $25 per person.

Dining Experiences : Dining experiences in Hawaii range from food trucks to fine dining. Trying local cuisine like poke and loco moco can enhance the travel experience. Average meal prices typically range from $15 to $50 per person.

Transportation Costs : Transportation costs vary based on travel arrangements within the islands. Renting a car costs about $40 to $70 per day. Alternatively, using public transit or shuttles can be more economical.

Families should consider all these aspects to effectively budget for a fulfilling trip to Hawaii.

How Can Families Reduce Their Travel Costs to Hawaii?

Families can reduce their travel costs to Hawaii by planning ahead, traveling during off-peak seasons, utilizing package deals, and exploring budget accommodations and activities.

Planning ahead allows families to take advantage of lower airfares and accommodation rates. Booking flights and hotels several months in advance can yield significant savings. A study by CheapAir (2023) found that the best time to book flights to Hawaii is about 64 days before departure, securing an average savings of $50 per ticket.

Traveling during off-peak seasons can further reduce expenses. Costs can drop significantly, typically from mid-April to mid-June and again from September to mid-December. According to the Hawaii Tourism Authority (2022), traveling during these months can lower hotel prices by up to 30%.

Utilizing package deals is an effective strategy. Families can save money by booking flights and accommodations together from travel providers. A report from Expedia (2023) indicated that travelers could save up to 25% on overall costs when using bundled offers.

Exploring budget accommodations can also lead to savings. Options such as vacation rentals, hostels, or camping can provide more affordable lodging. A study by Airbnb (2023) showed that families saved an average of $105 per night compared to traditional hotels.

Participating in budget-friendly activities can enhance the travel experience without straining finances. Many beaches, parks, and hiking trails are free or low-cost. According to the Hawaii Department of Land and Natural Resources (2022), 90% of attractions on the islands can be explored without any entry fees.

By implementing these strategies, families can enjoy a memorable and cost-effective trip to Hawaii.

What Are the Best Times of Year to Find Lower Travel Expenses to Hawaii?

The best times of year to find lower travel expenses to Hawaii are during the shoulder seasons, specifically spring and fall. These periods typically offer better deals on flights and accommodations.

- Shoulder Seasons

- Off-Peak Months

- Booking Timing

- Limited Events

- Travel Packages

Transitioning to a more detailed exploration, we will break down each of these points, providing useful insights for prospective travelers.

Shoulder Seasons: The term “shoulder seasons” refers to the periods just before and after the peak tourist seasons. In Hawaii, this is generally from mid-April to mid-June and from September to mid-December. During these times, visitor numbers decrease, leading to lower prices on flights and hotels. A report from the Hawaii Tourism Authority in 2021 indicated that travel bookings during these months dropped by approximately 30%, driving down costs.

Off-Peak Months: Specific off-peak months like September and October see fewer tourists in Hawaii. This results in reduced rates for both flights and accommodations. According to the U.S. Department of Transportation, airfare prices can be up to 20% cheaper in these months compared to the peak summer months. Traveler feedback often highlights experiencing a more relaxed atmosphere during these less crowded times.

Booking Timing: The timing of your booking can significantly affect prices. Research from Skyscanner suggests that purchasing tickets about two to three months in advance can help travelers secure lower fares. Moreover, flexibility with travel dates allows for the possibility of taking advantage of sudden fare drops.

Limited Events: Periods with fewer events and festivals in Hawaii can also lead to lower travel expenses. For instance, major surf competitions and cultural festivals attract crowds and raise prices. Travelers often find better deals during months without such events. For example, February sees higher prices due to the famous Waimea Bay Big Wave season, while March tends to have fewer events.

Travel Packages: Investigating travel packages can offer additional savings. Some airlines and hotels provide bundled offers that include flights, accommodations, and activities. According to a study by The Vacationer in 2022, travelers who booked packages could save up to 30% compared to booking each element separately.

In conclusion, being strategic about the timing and approach to booking can yield significant savings when traveling to Hawaii.

How Can You Locate Discounts for Flights and Accommodations in Hawaii?

To locate discounts for flights and accommodations in Hawaii, use online travel comparison websites, sign up for fare alerts, and consider traveling during off-peak seasons.

Online travel comparison websites: These platforms aggregate information from various airlines and hotels. They allow users to compare prices easily. Websites like Kayak, Skyscanner, or Google Flights often highlight the best deals and provide flexible search options to find discounts.

Sign up for fare alerts: Many travel websites and airlines offer fare alerts through email. This feature allows users to receive notifications when prices drop for specific routes or hotel bookings. Setting up alerts for flights to Hawaii will ensure that you are informed promptly about any discounts.

Traveling during off-peak seasons: Traveling to Hawaii during less popular times can result in significant savings. Generally, off-peak seasons are from mid-April to mid-June and from September to mid-December. During these times, airlines and hotels often reduce prices to attract more visitors.

Utilizing loyalty programs: Joining frequent flyer programs and hotel loyalty programs can also yield discounts. Accruing points through these programs can lead to discounts or free upgrades.

Exploring local deals and promotions: Check websites that specialize in local deals, such as Groupon or Hotwire. These often offer package deals that include both flights and accommodations, which can save you money.

Considering vacation rentals: Platforms like Airbnb and Vrbo offer various accommodations often at competitive rates compared to traditional hotels. This can also provide a more local experience while potentially lowering costs.

By incorporating these strategies, you will enhance your ability to find discounts on flights and accommodations in Hawaii effectively.

What Are Some Free or Low-Cost Activities For Families in Hawaii?

Families in Hawaii can enjoy many free or low-cost activities. Popular options include beach outings, hiking trails, cultural festivals, and local parks.

- Beach Outings

- Hiking Trails

- Cultural Festivals

- Local Parks

- Farmer’s Markets

- Historical Sites

- Community Events

These activities offer various experiences for families, from relaxation to education. Each activity provides unique opportunities to bond and create lasting memories in Hawaii.

Beach Outings : Beach outings in Hawaii provide families with access to beautiful coastlines. The state’s beaches, such as Waikiki Beach on Oahu and Kaanapali Beach on Maui, are free to visit. Families can swim, paddle, or build sandcastles. According to a survey by the Hawaii Tourism Authority (2022), 78% of visitors to Hawaii cite beaches as their favorite activity.

Hiking Trails : Hiking trails offer families an exploration of Hawaii’s natural beauty. Trails like the Diamond Head Summit Trail or the Makapu’u Point Lighthouse Trail provide scenic views. The Hawaii State Parks Department maintains several trails free of charge. As reported by the U.S. Geological Survey (2021), nearly 60% of visitors engage in hiking, highlighting its popularity.

Cultural Festivals : Cultural festivals provide families with insights into Hawaiian traditions. Events like the Merrie Monarch Festival and Aloha Festivals celebrate dance, music, and crafts. Many of these events are free to attend. The Hawaii Arts Alliance (2020) found that participants appreciate how festivals foster community connection and cultural understanding.

Local Parks : Local parks, such as Kapi’olani Park in Honolulu, offer recreational spaces for families. Parks often feature playgrounds, picnic areas, and sports facilities. The National Recreation and Park Association (2019) emphasizes the importance of parks for community well-being, stating that parks contribute to physical and mental health.

Farmer’s Markets : Farmer’s markets showcase local produce and crafts at affordable prices. Families can enjoy fresh fruits, vegetables, and snacks while supporting local farmers. According to the USDA (2022), farmer’s markets promote community engagement and healthy eating.

Historical Sites : Historical sites, like Pearl Harbor and Iolani Palace, educate families on Hawaii’s rich history. Some sites offer free entry or reduced fees for residents and children. The National Park Service (2021) notes that heritage tourism enriches visitors’ understanding of local cultures.

Community Events : Community events, such as concerts and movie nights in parks, offer families entertainment at no or low cost. These events foster a sense of belonging and connection. The Hawaii Community Foundation (2020) reports that community activities enhance social bonds among residents.

Families in Hawaii can find various free or low-cost activities that cater to diverse interests. From enjoying nature to experiencing culture, there are many options available for memorable family outings.

What Other Factors Should Be Considered for a Family Travel Budget to Hawaii?

When planning a family travel budget to Hawaii, it is important to consider various factors beyond just airfare and accommodation.

- Travel Dates and Seasonality

- Accommodation Type

- Daily Expenses

- Activities and Excursions

- Souvenirs and Shopping

- Currency Exchange and Fees

- Travel Restrictions and Regulations

Understanding these factors will help create a balanced and realistic budget for your trip to Hawaii.

Travel Dates and Seasonality: Travel dates and seasonality significantly impact trip costs. Traveling during peak tourist season, typically from mid-December to mid-April, can lead to higher prices for flights and accommodation. Off-peak season visits may result in savings due to lower rates. According to the Hawaii Tourism Authority, average hotel rates can increase by as much as 30% during busy seasons.

Accommodation Type: Accommodation type influences overall expenses. Families can choose between hotels, vacation rentals, or resorts. Hotels may offer convenient amenities but can be expensive, especially for larger families. Vacation rentals provide more space and kitchen facilities, which can save money on meals. A survey by the American Hotel and Lodging Association (2022) shows that vacation rentals offer cost-effective options for families seeking multiple beds and cooking facilities.

Daily Expenses: Daily expenses encompass costs related to local transportation, entrance fees to parks, and miscellaneous costs. Budgeting approximately $50 to $150 per day, depending on activities, is prudent for a family. According to a 2023 report from the National Park Service, many parks charge entrance fees which can add up.

Activities and Excursions: Activities and excursions can vary widely in cost. Popular attractions, such as luaus and helicopter tours, may require significant financial commitment. For instance, a family of four could spend upwards of $400 on a luau. Planning ahead is essential for selecting cost-effective activities that suit different interests.

Transportation Costs: Transportation costs include car rentals, public transport, and inter-island flights. Renting a car can be beneficial for families wishing to explore different islands, but rental fees and fuel prices can accumulate. The Hawaii Tourism Authority suggests comparing various transportation options to find the most economical choice.

Food and Dining: Food and dining expenses can range widely. Dining out in Hawaii can be pricey, with meals often costing $15 to $30 per person. Alternatively, purchasing groceries and cooking at home can significantly reduce costs. A 2022 article from Food & Wine suggests budgeting around $150 per day for a family of four if choosing to dine out for all meals.

Travel Insurance: Travel insurance is a wise investment. It provides financial protection against unexpected events, such as trip cancellations or medical emergencies. According to the U.S. Travel Insurance Association, families should expect to spend between 4% and 10% of their trip cost on insurance.

Souvenirs and Shopping: Souvenirs and shopping can add additional expenses to a budget. Families may want to set aside a specific amount for local crafts and gifts. Setting a pre-determined budget for souvenirs helps avoid overspending.

Currency Exchange and Fees: Currency exchange and fees should not be overlooked. While Hawaii is a U.S. state, travelers using foreign currencies should check rates and possible exchange fees. Using credit cards with no foreign transaction fees can help manage costs effectively.

Travel Restrictions and Regulations: Travel restrictions and regulations may influence travel plans and expenses. Current health guidelines could necessitate additional spending on testing or insurance requirements. Staying updated on local regulations through government sources is crucial for family travel planning.

How Much Should You Allocate for Transportation and Rental Cars in Hawaii?

When planning a trip to Hawaii, you should allocate approximately 15% to 30% of your total travel budget for transportation and rental cars. On average, daily rental car rates in Hawaii range from $40 to $80, depending on the island, season, and vehicle type chosen.

In detail, transportation costs can include several categories. Rental car costs typically make up the largest portion. For example, renting a standard sedan may cost around $60 per day, while larger SUVs or premium vehicles can run $100 or more per day. If you rent a vehicle for a week, expect to spend between $280 and $700.

Public transportation options, such as buses, are generally more affordable but may not be as convenient. Bus fares in Honolulu, for instance, are about $3 for a one-way trip. In contrast, ridesharing services like Uber or Lyft can vary widely based on distance. A standard fare from the airport to Waikiki might cost between $30 and $50.

Additional factors impacting transportation costs include the island you visit and the duration of your stay. Island visits such as Maui or the Big Island may require additional costs for inter-island flights. Seasonal fluctuations also affect prices. For example, summer and winter holidays tend to see higher rental rates.

In summary, when budgeting for transportation and rental cars in Hawaii, consider a 15% to 30% allocation of your travel funds, with daily rental rates averaging between $40 and $80. Factor in your itinerary complexity and the time of year for accurate budgeting. Further exploration of public transit options or alternative transport like biking can also enhance your travel experience while potentially lowering costs.

How Can Travel Insurance Impact Your Overall Budget for Hawaii?

Travel insurance can significantly impact your overall budget for Hawaii by providing financial protection against unexpected events, thus mitigating potential losses.

Travel insurance offers several benefits that can influence your spending during a trip to Hawaii. Here are the key points to consider:

Trip Cancellation Coverage : This policy reimburses non-refundable expenses if you need to cancel your trip for covered reasons. According to the U.S. Travel Insurance Association, nearly 40% of travelers canceled their trips in 2019, indicating the importance of knowing how refund policies work (U.S. Travel Insurance Association, 2020).

Medical Emergency Expenses : Travel insurance can cover medical costs incurred during your trip. Healthcare in Hawaii can be expensive, especially for travelers from mainland U.S. In 2019, the average cost of a hospital stay in Hawaii was around $2,700 per day (Hawaii Department of Health, 2019).

Lost or Delayed Luggage : This coverage provides compensation for lost or delayed luggage. In 2019, approximately 1.24% of checked baggage was either lost or delayed, highlighting the necessity of coverage for your belongings (Airlines for America, 2020).

Emergency Evacuation : In case of a serious health issue or natural disaster, insurance can cover the costs of emergency evacuation. The average cost of an air ambulance service can range from $12,000 to $25,000 (Health Affairs, 2018).

Travel Assistance Services : Many travel insurance policies include assistance services that can offer support in emergencies. These services can help you find local medical facilities or coordinate travel changes.

In summary, although purchasing travel insurance adds to your upfront costs, its benefits can save you significant amounts of money in unforeseen situations, thus making it a valuable part of your overall budget for a trip to Hawaii.

- Is it ethical to travel to hawaii right now

- Is it dangerous to travel to tijuana

- How to travel with a cat

- Is it cheaper to use a travel agent code

- Is it better to book through chase travel

How to budget for your trip

Build a travel budget before you hit the road..

October 19, 2022 | 3 min read

Planning a big trip can be stressful, especially when you’re trying to do it on a budget. But knowing what you can afford, what you’ll need to spend and how to avoid overspending can help maximize the fun and minimize the stress. Here are a few ideas for building a travel expenses budget so you can feel as good about your finances as you do about your itinerary.

Start at home

If you don’t stick to an overall spending budget, you may find it hard to build and keep a travel budget. So start by figuring out exactly how you spend at home, making sure you have enough left over each month to put away in a savings account . If you don’t, search your budget for places to save. If you’re spending too much on á la carte workout classes or a gym membership, try online workout classes or free forms of exercise like running, biking and hiking to help keep costs down. Or hunt your bank statement for subscriptions , digital or otherwise, that you never use and cancel them. Once you’ve started padding your savings account, you’ll feel more confident about planning a big trip and building a budget for it.

Analyze that spending

The simplest way to figure out what you’ll spend on a trip is to look hard at where your money went on a previous trip. Using the website or app for your bank and credit cards, find every expenditure related to the trip, from your airfare to your cab ride home from the airport. Include things you bought for your trip (like new walking shoes or sunscreen) and things you bought during your trip (like souvenirs or dinner). Then, build a spreadsheet that summarizes what you spent in each category. It’s not the most fun evening activity, but analyzing past spending will offer a glimpse into how much you spent on food, drinks, taxis and other categories, helping you plan for your next trip.

If you’ve never traveled or are traveling abroad for the first time, you can still plan your travel budget. Using the categories in the next section and a little online sleuthing, you can do your best to estimate your trip costs. On your next trip, consider getting receipts as emails whenever possible, and take photos of your paper receipts. It can help you analyze your spending the next time around.

What travel expenses to budget for

If you’re not an experienced traveler, you may not know exactly how to budget for travel. So, start with categories. Imagine your trip from start to finish, focusing on how you’ll spend money along the way. As you go, create a travel budget worksheet that puts your spending into buckets. Those buckets will depend on where you’re traveling and how you like to travel. Planning an all-inclusive beach vacation will require different categories than a trip to a national park. But generally, the categories in your trip budget should include:

- Transportation. This includes how you get to and from your destination and how you get around when you get there. These days, many people are opting out of airplanes and trains in favor of more personal forms of travel, like rental cars. Make sure you’re taking these choices into consideration when you budget for things like gas, food pit stops, and prepping your car for a lot of road time. Then check out your options for how you’ll travel when you arrive—taxis, Lyfts, public transportation or just walking. It could be a good idea to add in some cushion in case your transportation needs shift once you get there.

- Lodging, including taxes and fees. This could be a big chunk of change, but luckily, you should know exactly how much it is before you leave.

- Food and drink. This depends on a lot of factors, including how you like to eat, where you’re traveling and how much you expect to tip. If you’re more comfortable grabbing take out or getting delivery, make sure you’re taking those extra fees into account.

- Activities like museum tickets, tours, excursions, golf outings, etc.

- Souvenirs—anything you might buy on your trip that you wouldn’t buy at home.

Look for places to save

Once you see how you spend, you may discover that traveling costs a lot more than you realize. If so, you may want to try traveling more cheaply.

Say your last trip included hundreds of dollars in spending on Lyft or taxis. Price out what it would cost to rent a car for the length of your trip, which is often the cheaper option.

Maybe your dinner bills regularly reached $100 on your last trip. Use local food blogs and magazines to seek out small, local eateries and street food vendors that will capture the local flavor while keeping your dinner tab manageable. Also consider staying near a farmers market or small grocery store, so you can try your hand at cooking meals with local ingredients.

Airfare often is the biggest expenditure on a trip budget, and right now, a lot of people just don’t feel comfortable with it. Instead, think about traveling by car. If you’re traveling with friends, make sure you’re keeping track of gas usage so you can split the cost later. Scope out the parking situation beforehand so you know where you can safely leave your car without racking up too high of a garage fee or getting an unexpected parking ticket.

Consider a staycation instead. If traveling away from home is something you don’t feel comfortable with right now or if it just isn’t in your current budget, planning a staycation could be a good alternative. You can still plan fun activities around the neighborhood, get your favorite take-out or go to your favorite local spot, or even set up a tent in the backyard. Finding some R&R with a staycation can give you the feeling of getting away, while being a lighter touch on your budget.

Adjust on the fly

Analyzing your spending after one trip might help you plan for the next. But it won’t keep you from sticking to your budget while you’re traveling. So, if money is tight, consider tracking your spending while you travel and comparing it daily against your trip budget planner.

One way to rein in your spending is to designate a daily budget for food, drinks and other costs. You may even set aside that amount in cash each day, so you know exactly how much you spend. Just be sure to bring along a debit card or credit card in case of an emergency.

Then, every afternoon, when you’re not wiped out but can use a short break, take a few minutes to see what you’ve spent. If you’ve overspent on food or drinks, consider something lighter for dinner. If you’ve already hit your target for activity spending, plan your next day around free sights. If you’re traveling somewhere that allows access to your favorite banking or budgeting app , use that. If not, bring a printout of your budget and just jot down what you spend in a notebook, then take a few minutes to compare.

If you stay on top of things, you might find it easier to stay on budget until your head hits the pillow the second you arrive home. You may even find that you have enough left over to start planning your next big adventure.

Related Content

A Guide to Tipping Around the World

Are we there yet?

The cheapest ways to access your money overseas

How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Can You Deduct Your Vacation From Your Taxes? Experts Weigh In

Know what’s deductible and what’s not when it comes to submitting travel expenses on your taxes..

- Copy Link copied

If there’s a certain amount of work involved, you may be able to claim travel costs on your taxes.

Photo by GaudiLab/Shutterstock

People are traveling like crazy these days. The Sunday after Thanksgiving 2023 was the biggest single travel day in U.S. aviation history, with TSA screening more than 2.9 million passengers on November 26.

If you’re one of those travelers racking up frequent flier miles as quickly as you can fasten your seat belt, you may be looking for ways to recoup some of the cost. Can you legally write off your trip? If you’re self-employed (for example, if you’re an entrepreneur, freelancer, or consultant, or have an online business) and you did some work while on the road, there’s a good chance you can.

Here’s what it takes to get two thumbs up from the IRS.

Pass these four tests

For starters, your trip must have a business purpose, meaning it must include activities such as client meetings, attending a conference, being a guest speaker at a conference, doing research and development for the business, or holding a board meeting or annual shareholders’ meeting. The activity should have the potential to generate revenue.

“Don’t think you can take a personal trip, talk business for an hour and then try and deduct the whole amount of your trip. The intent of the trip needs to be business,” says Caitlynn Eldridge, founder and CEO of Eldridge CPA .

The second and third requirements deem that the trip must be both “ordinary and necessary,” according to IRS guidelines on business travel expenses . “An ordinary expense means it’s typical in your business, both [in terms of] amount [as well as in] frequency and purpose. Necessary means it actually helps you increase your profits or expand your business,” explains Tom Wheelwright, a certified public accountant and author of the book Tax-Free Wealth (BZK Press, 2018).

Lastly, every expense must be properly documented. To get a deduction for travel, Wheelwright said that you must spend more than half your time during the business day doing business and have everything documented. “So, if you spend four and a half hours a day doing business, it becomes deductible. You also must have documentation, which includes receipts, of what you did, and a log of your expenses,” says Wheelwright.

On receipts, write the name of the client who you had the meal with for further proof. “Save the emailed confirmation and receipt from the hotel reservation or conference ticket payment that show the dates, times, and name of the events as well as the receipts from the travel it took to get there and back [such as for gas or flights],” says Ben Watson, founder of Fiscal Fluency , a personal finance and business coaching company.

Note that for 2024, the IRS mileage reimbursement rate is 67 cents for employees or a self-employed individual traveling for work, up from 65.5 cents in 2023.

Know, too, that you must be away from home overnight—the IRS requires an overnight stay for the trip to qualify as business travel, Wheelwright says.

Domestic travel versus travel abroad

There’s a big difference between how you calculate deductions if the work trip was taken in the United States versus abroad. According to Wheelwright, “It’s an all-or-nothing test in the U.S., so either you spent more than 50 percent of your time on business, and it’s all deductible, or you spent 50 percent or less and none of it’s deductible.”

For international business travel, the deductions work differently. He explained that when you travel to another country, the deduction is proportionate. “For example, if you spent 40 percent of your time doing business in Italy, then 40 percent is deductible,” says Wheelwright.

Stick to the rules

If you normally stay in more modest hotels, trying to deduct a luxe property stay could raise red flags.

Photo by Yokwar/Shutterstock

It has to be a legitimate business trip. “You can’t simply do some work while on the beach and call it a business trip,” says Watson. But if you make it a “bleisure trip” by adding a couple days at the beach onto your preplanned business trip to the coast, you could still write off at least some of your lodging fees, he explained. If you do extend your trip for vacation, you can only deduct the expenses that were directly related to work and took place on the days that you conducted business. If you are traveling to multiple cities, keep in mind that each must have a business purpose.

You do have to work. If you are at a conference, make sure you fully participate, which means not just attending one or two sessions. If you only attend a small number of the business-related events, the entire purpose of the trip would be considered a personal trip with “incidental” business activities, Watson points out. Remember you need a log of what you did, and if it’s thin on details, it could prove problematic. “You don’t want to lose the ability to deduct transportation, lodging, meals, and other expenses,” says Watson.

If it’s a business trip of your own making, be sure it includes meetings with clients or participating in some work-related activity. “To demonstrate evidence of these events, it’s wise to put calendar appointments down in your phone in advance and hold onto receipts when the time comes to file your tax return and claim your deductions. Remember, the primary purpose of this trip is [supposed to be] for work,” says Riley Adams, a CPA and CEO and founder of WealthUp , a financial literacy website.

Don’t try to bend what “ordinary and necessary” means. “If you have the ability to accomplish the same business tasks while staying at a modest hotel as you would at the Four Seasons, you’ll have a hard time justifying the extra cost if you’re ever audited,” Watson cautions.

Stay at a place that is similar to places you normally stay on a business trip, so your expenses are considered “ordinary.” Wheelwright explains that if you usually stay at five-star hotels for your business trips, then the Four Seasons would fall into the same category. However, if you usually stay at hotels like the Comfort Inn, and suddenly switch to a luxury hotel, the high-end venue could raise red flags with the IRS. He says that it doesn’t matter whether you stay at a hotel or a vacation rental, the quality level and price tag should be similar to what is typical for your business trips.

When traveling with non–business companions, such as a spouse or family members, you may only deduct the cost of the lodging you would have paid if you were traveling alone—for example, if a single room costs $150 per night, and you paid $200 for a double room, you could only deduct at the $150 rate.

What can you deduct?

You can deduct 50 percent of the cost of business meals.

Photo by Rawpixel.com/Shutterstock

Personal meals are not deductible, but half the cost of food expenses related to business can be deducted. Expenses for your family’s meals and entertainment cannot be deducted unless they are actively engaged in the business and you can show that their expense is both ordinary and necessary.

Travel expenses are only deductible on the days in which the work-related event occurs. “For example, a taxi ride to the meeting, train to a conference, or plane ride to the event [are deductible],” says Adams. “Lodging, much like travel expenses, is deductible on the days in which business is set to occur.”

Understand too, that if you’re provided with a plane ticket paid for by your company, or you’re riding free because you’re redeeming frequent flier miles, your cost is zero, so you can’t deduct it.

But there are a couple of things you may not be aware of. For example, if you have to ship your baggage, you can deduct that cost; you also can deduct for tips for services, such as a tip to the waiter during a meal with a client.

Be strategic

It’s best to put your “vacation” days in the middle of the business days, advises CPA Greg O’Brien. “For example, if [a] business owner took a seven-day trip to Florida and spent five days meeting with clients or prospects and two days relaxing on the beach, this would still qualify as a deductible business trip. The trick is to stick the ‘vacation’ days in the middle of the business days,” he says.

By placing the vacation days in the middle, the travel days to and from are still considered business related, rather than personal.

Watson offers another tip: “Laundry, dry-cleaning and shoe-shine expenses are perfectly acceptable expenses if incurred shortly after returning home.”

Travel expenses list: A guide to managing your travel budget

Explore our travel expenses list and learn how to optimize your travel budget. Stay organized, track your spending, and make informed decisions with Accrue.

A travel expenses list is essential for mapping and managing your travel budget. It helps ensure you don’t overspend or underestimate the cost of your trip. You can keep track of planned and unplanned expenses, ensuring they fit within your overall budget.

Unfortunately, for most travelers, budgeting isn’t easy. The cost of airfare, accommodation, and meals vary greatly and can quickly add up. Without an organized strategy in place, it’s all too easy to blow your budget and end up with a mountain of debt.

Learn in this comprehensive guide the basics of creating a travel expenses list, including transportation, accommodations, food & beverage, and activities, and offer advice on saving money while traveling.

1. Transportation

Transportation costs refer to all your costs of moving from point A to point B. They account for the biggest chunk of most travel budgets and include:

Many travelers, especially those traveling for business purposes, prefer booking flights due to convenience, speed, and cost-effectiveness. Airfare is the amount you pay for the plane ticket and can vary greatly depending on the airline, route, and time of year. However, there are other additional airport expenses, such as luggage, taxes, and transfers you must factor into your budget.

Car rental and gas

You may need a rental car at the destination to help you get around, especially if you plan to explore the area and take side trips. Depending on where you’re going and for how long, renting a car might be more cost-effective than using public transportation, taxis, or rideshares — factor in the rental cost, insurance, and gas.

Other additional fees include parking fees, tolls, and pit stops on the road. If you’ll be driving a lot, look into getting a fuel-efficient car and research the average cost of gas in the area.

Public transit

Public transportation is typically the cheapest way to get around a city, especially if you plan on taking multiple trips. It includes subways, buses, ferries, and trains, each with its own rate. Buses, metro, and train tickets vary in price depending on the region.

Consider buying a day pass or multipass to save transport money if you plan on taking multiple trips. Most cities also offer rideshare services like Uber and Lyft, which can be more cost-effective than driving a personal vehicle. Research the public transit options available at your destination to see which fits your budget.

Parking fees and tolls

If you plan to drive a lot during your trip, you might have to pay parking fees and tolls. Parking fees vary depending on the city and are usually hourly or daily. Some cities have free street parking but most paid lots and garages charge a fee.

Tolls are charges for using certain roads and bridges. You can pay the tolls in advance or use a toll pass for the duration of your trip. Other expenses associated with car rentals include insurance, gas, and repairs.

2. Accommodations

Accommodation expenses are the costs of staying at a place during your trip. They include hotel stays, Airbnb rentals, hostels, and campsites. The prices vary depending on the accommodation type, amenities, and location — research various options to determine what works best for your budget.

Hotels and resorts

Hotels and resorts are the most common option for short-term stays. They can range from budget-friendly motels to luxurious five-star hotels and offer a range of amenities like swimming pools, spas, saunas, and fitness centers.

Their prices depend on the location, star rating, and amenities. You will incur additional fees for hotel room service, extra beds, laundry, and other services. Book in advance or use hotel rewards and loyalty programs to save money .

Bed and breakfast (B&B) expenses

Bed and breakfast establishments offer a more affordable and intimate experience than hotels. They can range from private rooms in someone’s home to luxurious properties with multiple bedrooms.

Prices usually include bed and breakfast, but you may be charged for extra amenities like housekeeping, dry cleaning, and Wi-Fi. Unlike hotels, you’ll be dealing directly with the owner, so it’s essential to read reviews and ask questions before booking.

Meal expenses also account for a considerable chunk of your travel budget, so it’s important to plan ahead and budget accordingly. How much money you spend on food depends on where you’re going, the type of food you like, and how often you plan to eat out.

Local cuisine is usually the cheapest option, so find places that offer authentic dishes. Bringing snacks such as nuts, energy bars, and trail mix is always a good idea. You can save money by snacking instead of buying expensive meals. Ordinary meal expenses include:

Restaurants and dining out

Restaurant dining is the most common way to eat while on vacation or a business trip, but it can be costly. Prices vary depending on the type of restaurant, cuisine, and location. Fine dining establishments charge premium prices for their food and drinks, while casual eateries and fast food joints are more affordable. Check out local restaurants and read reviews before going out. Deals such as discounts for early birds or happy hours are creative ways to help you save on these expenses.

Street food and vendors

Street food is a popular option for travelers who want to indulge in the local culture and cuisine. Street vendors often serve traditional dishes at low prices. You can find food carts or stalls selling sandwiches, kebabs, tacos, and other dishes. However, be mindful of food safety and hygiene protocols to avoid getting sick. Research average prices for the area to make sure you’re not being overcharged.

Coffee and beverages

Coffee and beverages are usually the least expensive items on the menu. You can find coffee shops and cafes selling specialty drinks, like lattes, cappuccinos, and frappuccinos, at a fraction of the price of restaurants.

Most places also offer tea, smoothies, juices, and other non-alcoholic drinks. Local markets will usually have cheaper options for bottled water and other beverages. For alcoholic drinks, look for local breweries, pubs, and bars and take advantage of happy hours and specials to save money.

Tipping and service charges

Tipping is common in many countries and is expected for certain services, such as restaurant meals and hotel stays. The tip amount varies depending on the quality of service and local customs. It’s usually 15-20% for a meal, but you can check with the restaurant or your server if in doubt.

Service charges come with the bill and should be indicated on the menu. Allocate a portion of your travel budget to cover tips and service charges. Staff at hotels, restaurants, and other establishments rely on tips for their income, so be generous when you can.

4. Activities and entertainment

A vacation wouldn’t be complete without some fun and entertainment. You can find inexpensive or free activities to do depending on where you’re traveling. Museums, galleries, and other cultural attractions are usually free or have discounted admission for students and seniors. Typical expenses for activities and entertainment:

Sightseeing and attractions

Sightseeing is a big part of many people’s travel plans. Historical and cultural attractions, like monuments, churches, and museums, are usually the most popular sightseeing destinations. You can also visit theme parks, zoos, aquariums, and art galleries.

Prices vary depending on the type of attraction, and access passes are usually cheaper than buying tickets for individual attractions. You can pay a small fee to take historical tours from locals, while in certain cities, free walking tours are also available.

Organized tours and excursions

The best and most fun-filled way to see a new place is to join an organized tour or excursion. Most cities have tours that take you to the must-see sights and attractions but you can also book day trips to castles, vineyards, or nature reserves.

An organized tour covers entrance fees, transport, and sometimes meals. Compare rates and read customer reviews to find the best value for your money.

Outdoor activities

Outdoor activities like hiking, biking, and water sports are great ways to explore the local landscape. Many national parks and forests have trails for biking, horseback riding, and climbing.

Some parks offer guided tours with experienced instructors. The guided tours usually include equipment rentals and safety gear, but you may incur park entrance or permit fees for certain activities.

Shows and performances

If you’re looking for a bit of culture, shows, and performances are a great way to spend an evening. Theaters and opera houses often have discounted prices for matinee shows or special performances.

If you’re staying in a city, look out for street performers and enjoy free outdoor concerts. Cinemas are usually cheaper than live performances, so you can taste the local culture without breaking your budget.

Spa and wellness

Spa treatments are a great way to re-energize after a long flight or an intense sightseeing session. Some hotels offer complimentary spa treatments, while others have special deals for guests.

Try a local massage parlor or a yoga studio if you want something more affordable. You will pay from a few dollars to hundreds, depending on your chosen services. Spa services usually include massages, facials, saunas, and steam rooms.

5. Shopping and souvenirs

Bringing back souvenirs is a fun part of any trip, but it can be easy to overspend on gifts for yourself and your loved ones. The cost of souvenirs depends on where you’re traveling and the type of item you want to buy. It’s common to bargain or haggle for lower prices in some places. Research the local currency and market prices to avoid getting ripped off.

Travelers should also be aware of import laws and customs regulations. There may be restrictions on certain items such as food, alcohol, and tobacco.

6. Emergency and unprecedented expenses

Despite how well you plan your trip, there may be unexpected costs. Unforeseen events, such as a life-threatening medical emergency or natural disaster, can result in high expenses. Budget for emergency funds and purchase travel insurance to cover any medical costs or unexpected losses.

Carry enough cash for emergencies, and use a debit or credit card for international purchases. Also, double-check your documents to ensure you have all the necessary visas and permits before your trip.

7. Currency exchange rates

Exchange rates make a huge difference when transferring money or paying in foreign currency. Compare current rates with those from the booking time to ensure you get the best deal. Check with your local bank or credit card provider for their rates and fees.

You can also look up online currency converter tools to see how much you spend in your home currency. Be aware of hidden charges when exchanging money. Such hidden charges include ATM fees, commissions, and other administrative costs that can quickly add up.

Tips for managing travel expenses

Proper travel expense management is critical to a successful and enjoyable trip. Planning ahead and budgeting for each expense will help you manage your travel expenses.

Set daily spending limits and monitor your expenses

Estimate your total budget for the trip and then divide it into daily spending limits. This will help you stay on budget while still allowing you to enjoy the activities and attractions. Monitor your personal expenses throughout the trip to ensure you don’t exceed the budget.

Save money on product purchases with Accrue Savings

Saving money for travel expenses is a challenging feat. Juggling everyday expenses while saving for a trip can be overwhelming. Accrue Savings is a great way to save money for travel without having to scrimp and sacrifice everyday items.

This easy-to-use service allows you to save money for travel expenses by automatically putting aside a portion of your everyday purchases. You only need to create a free Accrue account, fund your wallet, and track your progress. And there is no set amount you must contribute — save as little as $1 weekly or $50 monthly, depending on your flexibility.

Book everything in advance

Book flights, accommodations, and activities in advance to get the best deals and save on travel costs. Check for airline discounts or hotel loyalty programs, and watch for last-minute discounts and deals on attractions and activities.

Traveling during the off-peak season

Flights and accommodation prices tend to be higher during the peak season. Consider traveling during the off-peak season when prices are lower. Hotels usually offer discounts or special packages during this time, saving you money on accommodations. You may have to sacrifice some activities due to fewer available options, but you’ll get more bang for your buck.

Keep an eye out for discounts

Take advantage of discounts and special deals to save on out-of-pocket expenses. Look for coupons, student or senior discounts, and loyalty club memberships that offer discounts on activities and attractions. You can also find discount codes for car rentals, restaurants, and other services online. Business travel expenses, for instance, may be tax-deductible depending on your situation.

Save intelligently on your purchases Accrue Savings

Poor budgeting decisions can quickly put a damper on your trip. Accrue Savings provides a smart and easy way to save money for travel expenses while avoiding the risk of overspending.

It’s a great way to keep your travel expenses in check without missing out on the fun. Once you sign up and fund your wallet, you can track your progress and watch your savings grow. You will also earn rewards along the way to help you realize your travel dreams quickly.

Register today and check out our partners to earn money toward your future travel expenses and purchases.

Latest articles

What is opt-in email marketing, and how does it work?

12 unique wedding ideas to try on a budget

July 22, 2024.

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

The 12 Best Budgeting Apps for Travelers

Ashley Rossi

Ashley Rossi is always ready for her next trip. Follow her on Twitter and Instagram for travel tips, destination ideas, and off the beaten path spots.

After interning at SmarterTravel, Ashley joined the team full time in 2015. She's lived on three continents, but still never knows where her next adventure will take her. She's always searching for upcoming destination hotspots, secluded retreats, and hidden gems to share with the world.

Ashley's stories have been featured online on USA Today, Business Insider, TripAdvisor, Huffington Post, Jetsetter, and Yahoo! Travel, as well as other publications.

The Handy Item I Always Pack : "A reusable filtered water bottle—it saves you money, keeps you hydrated, and eliminates waste—win-win."

Ultimate Bucket List Experience : "A week in a bamboo beach hut on India's Andaman Islands."

Travel Motto : "Travel light, often, and in good company."

Aisle, Window, or Middle Seat : "Window—best view in the house."

Travel Smarter! Sign up for our free newsletter.

While you’re stuck daydreaming about your next bucket-list vacation, why don’t you get a hold of your finances and make it a reality by first budgeting out your travel expenses? Whether it’s a road trip or international vacation that you’re planning, easily forgettable items like parking fees can add up. That’s why you should use a travel-specific budgeting app to help streamline your costs on your next trip. Here are 12 budget apps to help you plan your expenses.

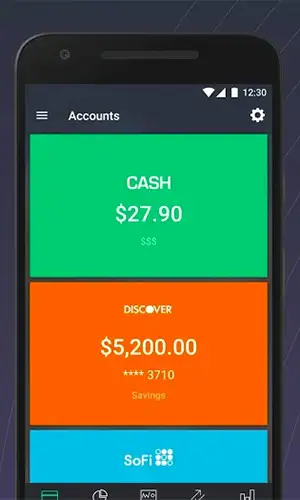

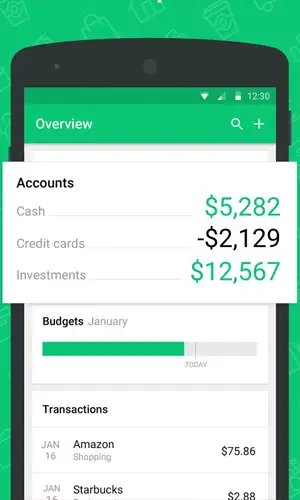

PocketGuard

Link all of your financial accounts and cards to this app, and it will automatically update and categorize your spending in real time. It then tells you what spending money you have with the “in my pocket” feature. It also automatically builds you a spending budget based on income, bills, and the goals you set. It even finds ways to lower some of your monthly bills for you … sign us up.

Download: iOS | Google Play