- Digital Assets

- Asia’s Fintech Startup Reports

- Asia’s Fintech Startup Directory

- Top 20 Fintechs in SG

- Fintech Resource For Asia

- Top Fintech Startups in Asia

- Accelerators in Singapore

- Fintech Books

- Fintech Podcasts

- Open Banking

NTUC Income Launches Travel Insurance Plan for Protection by the Hour

Get the hottest Fintech Singapore News once a month in your Inbox

NTUC Income, an insurance cooperative in Singapore, launched its new travel insurance offering called “FlexiTravel Hourly Insurance” .

As indicated by its name, this insurance enables travellers to purchase travel protection as needed by the hour.

Available for those who are travelling only to Bintan and Batam (Indonesia) as well as Malaysia, this is a flexible and affordable way for travellers to insure themselves for short or impromptu regional trips by land or sea that range from a few hours to a full weekend.

The FlexiTravel Hourly Insurance charges a minimum of SG$1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of SG$0.30 for every additional hour, capped at a maximum charge of SG$3 per day.

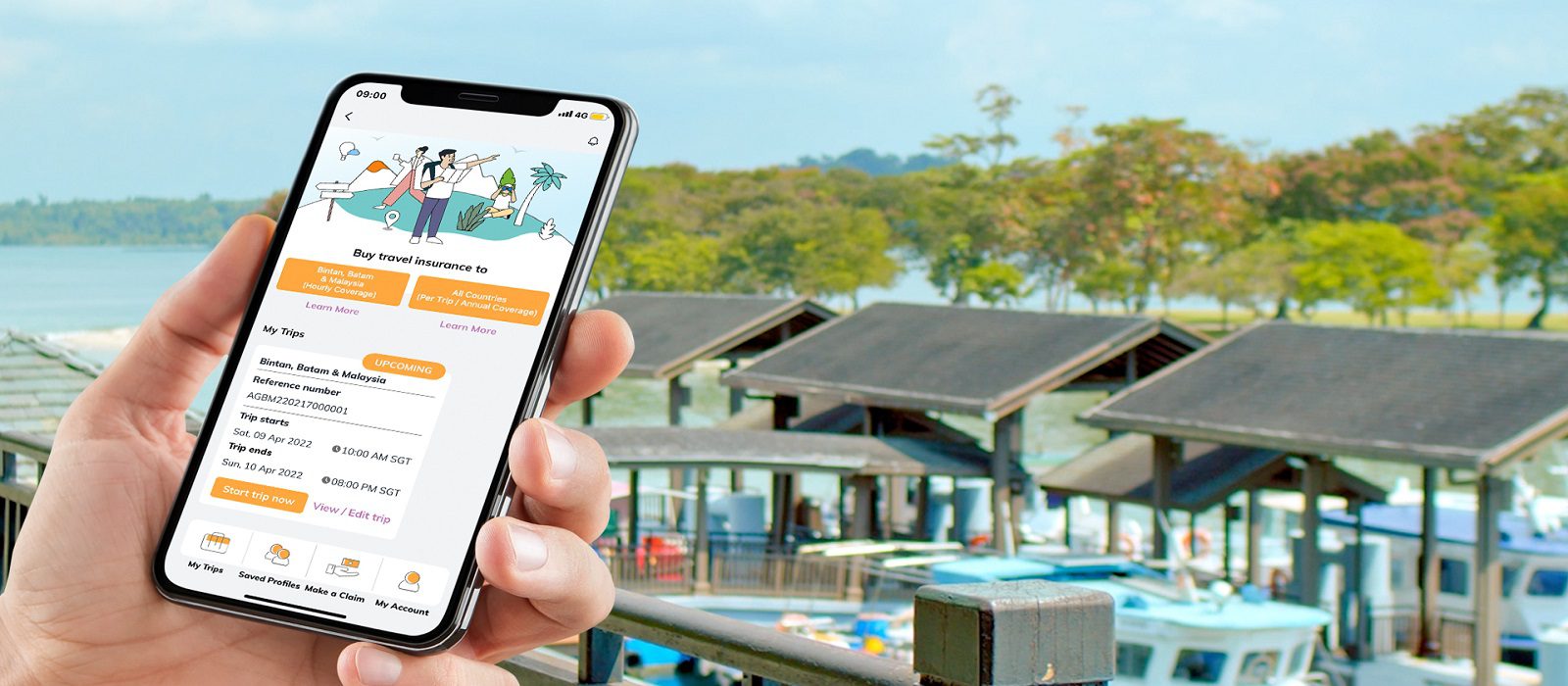

Accessible via the ‘My Income’ mobile app, travellers can activate and stop their insurance coverage at anytime.

With its geolocation feature, the app is designed to push notifications to travellers and remind them to activate their insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore.

Alternatively, travellers can update their travel details manually in the app without the need to turn on the geolocation feature.

Annie Chua, Vice President and Head of Personal Lines, NTUC Income said,

“Travelling always involves a certain level of risk, be it short or long trips as unforeseen circumstances can occur any time. Based on a recent survey we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected.”

Related Posts

Msig’s sumo insurance for smes now available through whatsapp, truemoney app users can now buy health, accident insurance powered by igloo, prudential, google cloud deepen partnership on ai-driven products, mas weighs in on allianz-income deal, focus on consumer protection, ntuc and income insurance defend allianz sale, call former ceo’s claims “unfair”, income says chairman recused from morgan stanley selection in allianz deal, income insurance’s competitiveness to get boost from allianz’s majority stake bid, allianz plans to acquire 51% stake in income insurance for s$2.2 billion.

Type above and press Enter to search. Press Esc to cancel.

Insurance Asia website works best with Javascript enabled. Please enable your javascript and reload the page.

- Sections Co-Written / Partner Insurance

- Events Asian Banking & Finance and Insurance Asia Summit - September 3, 2024 Asian Banking & Finance and Insurance Asia Forum - Manila - October 1, 2024

- Advertising Advertising Digital Events

NTUC Income launches new travel cover that protects by the hour

Premiums start at S$1.80 for a six-hour coverage.

NTUC Income has launched a new travel insurance product, FlexiTravel Hourly Insurance, that enables travellers to buy insurance by the hour with premiums starting at S$1.80 for the first six hours.

Currently, FlexiTravel Hourly Insurance is only available for those who are travelling to Bintan, Batam and Malaysia.

The new product is targeting Singaporeans who do short impromptu regional trips like driving to Malaysia for a few hours to golf, shop, eat, or visit attractions such as Legoland for a day with family.

According to vice president and head of personal lines at NTUC Income, Annie Chua, travellers often find it expensive or a hassle to purchase travel insurance for such short trips as they are perceived to be less risky and many often end up travelling uninsured.

FlexiTravel Hourly Insurance is designed to give control to customers while protecting them on short trips. It charges a minimum of S$1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of S$0.30 for every additional hour, capped at a maximum charge of S$3 per day.

Accessible via the ‘My Income’ mobile app, travellers can easily activate and stop their FlexiTravel Hourly Insurance coverage anytime at their fingertips. With its geolocation feature, FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications to travellers and remind them to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore.

Alternatively, travellers can update their travel details manually on the app to terminate or extend their travel insurance plan accordingly without the need to turn on the geolocation feature.

“The recent relaxation of travel-related measures has injected fresh enthusiasm among Singaporeans over the possibility of travelling again. The launch of FlexiTravel Hourly Insurance is timely in catering to the evolving needs of travellers, such as short trips to nearby destinations and travelling amidst the pandemic, so they can now travel with peace of mind as they stay protected by the hour as needed,” Chua said.

You may also like:

Prudential’s health app can now scan people’s faces for stress

Malaysia general insurance industry to reach $5.5b in 2026

DBS, Manulife Singapore launch insurance starter plan ProtectFirst

Follow the links for more news on

Life Insurance Corporation of India’s Q1 profit up 9.6% YoY

Swiss Re targets over $3.6b FY24 net income, bags $2.1b in H1

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

AI drives insurance productivity, faces scaling challenges

Insurance Asia Awards 2024 Winner: Zurich Malaysia

How the surge in medical malpractice claims in Singapore affects insurance premiums

Insurance Asia Award 2024: Event Highlights

Resource center, proactive fraud detection: increase profitability, beyond legacy: strategies for successful insurance transformation in asean, the financial services world of the future, re-wiring financial services operations for a bold future, the innovation paradox in property and casualty insurance, insurance asia digital conference, print issue.

Asian Banking & Finance and Insurance Asia Summit - September 3, 2024

Asian banking & finance and insurance asia forum - manila - october 1, 2024, partner sites.

Heightened geopolitical risks in Asia and the Middle East keep global firms on edge

A complement, not replacement: understanding parametric insurance.

Switch language:

NTUC Income launches new travel insurance to protect customers by the hour

- Share on Linkedin

- Share on Facebook

NTUC Income has launched a new offering in Singapore that allows customers to get travel insurance by the hour.

The new product, called FlexiTravel Hourly Insurance, aims to offer cover to travellers going on a short or impromptu regional trip by land or sea that last for a few hours to a full weekend.

Go deeper with GlobalData

How Customers Purchase Income Protection Insurance?

Data insights.

The gold standard of business intelligence.

Find out more

Currently, FlexiTravel Hourly Insurance is available only for customers who are travelling to Bintan, Batam and Malaysia.

The travel insurance plan charges a minimum of S$1.8 for six hours of cover, with the ability to get additional coverage at S$0.3 per hour, which is capped at S$3 per day.

Income’s travel insurance offering can be accessed and toggled on/off via the ‘My Income’ app.

The FlexiTravel Hourly Insurance also uses geolocation data to remind customers to activate or terminate their insurance cover depending on where they are.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

According to a survey conducted by NTUC Income, most travellers are concerned about getting help in events such as catching Covid, accidents and losing their belongings.

Despite these concerns, majority of the respondents of the survey found purchasing travel insurance for such short trips expensive or cumbersome.

NTUC Income vice president and head of personal lines said Annie Chua: “With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain points so they can continue enjoying their short trips while staying protected.”

According to the insurer, “FlexiTravel Hourly Insurance also provides COVID-19 benefits such as medical expenses incurred overseas and emergency medical evacuation if required.”

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

PCF Insurance expands further with 360 Insurance acquisition

Swiss re logs net income of $2.1bn in h1 2024, more uk consumers perceive that brokers provide better life insurance deals, encore fiduciary broadens offerings with management liability insurance, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

FlexiTravel Hourly Insurance! Singapore’s first travel insurance that protects travellers by the hour

NTUC Income (Income) launched FlexiTravel Hourly Insurance, Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or impromptu regional trips by land or sea that range from a few hours to a full weekend.

Spontaneous weekend getaways to destinations such as Bintan, Batam and Malaysia have always been popular with Singaporeans. Some examples of favourite activities include driving to Malaysia for a few hours of golf, grocery shopping and dinner, visiting attractions like Legoland with the family for a day or taking a ferry to Bintan for a weekend vacation. However, travellers often find it expensive or a hassle to purchase travel insurance for such short trips as they are perceived to be less risky and many often end up travelling uninsured.

Designed to give control to customers while protecting them on short trips, FlexiTravel Hourly Insurance charges a minimum of $1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of $0.30 for every additional hour, capped at a maximum charge of $3 per day.

Accessible via the ‘My Income’ mobile app, travellers can easily activate and stop their FlexiTravel Hourly Insurance coverage anytime at their fingertips. With its geolocation feature, FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications to travellers and remind them to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore. Alternatively, travellers can update their travel details manually on the app to terminate or extend their travel insurance plan accordingly without the need to turn on the geolocation feature.

Annie Chua, Vice President and Head of Personal Lines, NTUC Income, said, “Travelling always involves a certain level of risk, be it short or long trips as unforeseen circumstances can occur any time. Based on a recent survey[1] we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected.”

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you design and create an advertising campaign

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Yes, contact me I want to download the media kit

Comments are closed.

LATEST STORIES

Israel's El Al shows a second-quarter net profit of USD 147 million

In Q1 TBO Tek’s net profit rose 29% to INR 61 Cr and operating revenue increased 21% to INR 418.5 C

£12 million upgrades to make Billing Aquadrome in Northamptonshire the holiday park to go to

Top six tips for saving money on your next holiday

Welcome, Login to your account.

Sign in with Google

Powered by wp-glogin.com

Recover your password.

A password will be e-mailed to you.

Welcome back, Log in to your account.

SIGN UP FOR FREE

Be part of our community of seasoned travel and hospitality industry professionals from all over the world.

- LOGIN / SIGN UP

- Middle East

- UK & Europe

- USA & Canada

- Annual & Interim Reports

- Hospitality

- HR & Careers

- Luxury Travel

- MICE (Meetings, Incentives, Conferencing, Exhibitions)

- Travel Tech

- Travel Agents

- Airlines / Airports

- Conferences

- Cruising (Ocean)

- Cruising (River)

- Destination Management (DMC)

- Hotels & Resorts

- Hotel Management Company

- HR / Appointments

- Meetings, Incentives, Conferencing, Exhibitions (MICE)

- Travel Agents (all)

- Tech – Travel

- Tech – Hotels

- Tourism Boards

- Global Leaders and Csuite

- Executive Women Series

- Executive Hoteliers

- SEAHIS 2024

- Destination Soundbites

- Industry appointments

- Travel Bloggers

- Podcasts – Features

- How to join

- RSVP Portal

- Event Photos/Videos

- Competitions

- Travel Club

- Middle East – 19Sep

- Thailand – 17Oct

- Malaysia – 21Nov

- Asia – 26Nov

- Hong Kong – 23Jan

- Destination NaJomtien BanAmphur BangSaray *NEW*

- จุดหมายปลายทาง นาจอมเทียน หาดบ้านอำเภอ บางเสร่ *NEW*

- South Australia Reward Wonders *NEW*

- Ponant Yacht Cruises and Expeditions

- Encore Tickets (Chinese Guide)

- Affordable Luxury in Thailand by Centara Hotels

- Rising Above the Oridinary by Conrad Bangkok

- The Best of Thailand

- Who is IWTA

- Philippines

- Recommend Someone

- Recommend yourself

- IWTA Awards

- Advertise with us

- 2024 Media Kit

- Gary (Founder/CEO)

- Chris (GM & Managing Editor)

- Kanchan (Snr Editor)

- Marga (Editor)

- Megha (Freelance Editor)

- Charmaine (Freelance Editor)

- Philipp (Freelance Editor)

- Mark (Freelance Editor)

- Anthony (Sales)

- Paul (Sales)

- Upload your Travel Blog

- Upload your Event

- Health x Wellness

The Gen XY Lifestyle

- Insights + interviews

- Gen XY News

- Gen XY Updates

NTUC Income launches FlexiTravel Hourly Insurance

Flexitravel hourly insurance is singapore’s first travel insurance that protects travellers by the hour, with premiums starting from as low as sgd 1.80 for 6 hours of coverage.

FlexiTravel Hourly Insurance is a newly launched travel insurance plan that provides travel protection by the hour. Available only for travellers headed to Bintan, Batam and Malaysia, the insurance plan provides a flexible and affordable way for them to insure themselves.

Travellers that are looking to do a short or impromptu trip – by land or sea – that ranges from a few hours to a full weekend can benefit from using this travel insurance plan and coverage.

How does FlexiTravel Hourly Insurance work?

FlexiTravel Hourly Insurance charges a minimum of SGD 1.80 for six hours of protection.

Travellers can add on coverage at a rate of SGD0.30 for every additional hour, capped at a maximum charge of SGD 3 per day. Policyholders who need to extend their trip while overseas can easily extend their coverage up to 7 days.

The insurance plan is accessible via the ‘My Income’ mobile app. Activating and stopping the coverage is also done through the mobile app.

An interesting feature that taps on the app’s geolocation function are the push notifications sent through the app to remind travellers to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore. There is also a manual function to update their travel details and terminate the coverage.

Based on a recent survey we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected. Annie Chua, Vice President and Head of Personal Lines, NTUC Income

What are some of the benefits designed for trips to Bintan, Batam and Malaysia?

FlexiTravel Hourly Insurance benefits are specially designed to cover the common needs and concerns of short-term travellers to Bintan, Batam and Malaysia by land or sea.

According to Income, here are examples of some key benefits of FlexiTravel Hourly Insurance:

- Golfer’s cover, including stolen golf equipment from locked car and subsequent rental of golf equipment

- Reimbursement for unused entertainment ticket purchased for your trip

- Loss of baggage and personal belongings due to robbery or snatch theft and fraudulent use of bank card while overseas

- Relief for additional transport expenses due to snatch theft, robbery, or road accident

FlexiTravel Hourly Insurance provides COVID-19 benefits such as medical expenses incurred overseas and emergency medical evacuation if required.

Access to FlexiTravel Hourly Insurance

Interested travellers can find more information about FlexiTravel Hourly Insurance on the Income website . They can also download the ‘My Income’ mobile app from the App Store or Google Play.

For first time FlexiTravel Hourly Insurance customers, Income is offering complimentary first-trip coverage for the first 1000 customers until 26 July 2022. Travellers that qualify can register via the “My Income” mobile app and key in the promo code “1STTRIPONUS” to enjoy complimentary travel insurance.

Images credit to Income

You may also like...

Word from our advertisers, recent post, discover the three essential pillars of childcare for your child’s optimal development.

Morinaga Milk, a leading brand under Kalbe Nutritionals, has unveiled its latest campaign focusing on the three key...

INC Unveils Gen Z Preferences for Nuts and Dried Fruits and Snacking in Latin America

The International Nut and Dried Fruit Council (INC) has conducted an extensive study on the dietary preferences of...

ACUVUE® OASYS MAX 1-Day: Johnson & Johnson’s Answer to Presbyopia

Johnson & Johnson has launched its newest innovation in Singapore: ACUVUE® OASYS MAX 1-Day and ACUVUE® OASYS MAX 1-Day MULTIFOCAL contact lenses....

Run For Hope 2024: Join the Fight Against Cancer at the Annual Event

Mark your calendars and lace up your running shoes! Registration for Run For Hope 2024 is officially open,...

Breast Cancer Screening Rates Lowest among Malay Women in Singapore: Collaborative Efforts to Improve Breast Health

Breast cancer remains a significant health concern worldwide, affecting millions of women each year. In Singapore, where breast...

- About the Active Age

- Working with the Active Age

- Code of Conduct at the Active Age

- Privacy Policy

- Terms of Service

The Active Age is an online magazine that shares content about trends, insights, features, products and services that revolve around the Generation XY lifestyle.

Copyright © 2019 The Active Age

Latest Posts

Intellect launches first flagship clinic to integrate online-to-offline mental wellbeing support.

NTUC Income launches FlexiTravel short trip travel insurance product

Singaporean insurance cooperative ntuc income has launched a new travel insurance product for short trips which enables travellers to purchase insurance by the hour.

Premiums for the new product, known as FlexiTravel Hourly Insurance, start at S$1.80 for the first six hours, with additional hours of coverage being charged at a rate of $0.30 per hour, capped at a maximum charge of $3 per day.

The policy is currently only available to travellers visiting Malaysia and the Indonesian Bintan and Batam, and is targeted at Singaporeans planning short, impromptu regional trips such as driving to Malaysia for a few hours.

The policy is purchasable via NTUC Income’s My Income app, enabling travellers to easily activate or stop their coverage when it is no longer required. In addition, the app’s geolocation functionality enables users to receive notifications reminding them to activate the plan when it detects that they are entering or leaving Singapore. Travellers can also update their travel details via the app to terminate or extend the plan manually.

The policy is intended to make it easier for Singaporeans who feel it is expensive or a hassle to purchase travel insurance for such short trips.

Vice President and Head of Personal Lines at NTUC Income Annie Chua, said:Top of FormBottom of Form “The recent relaxation of travel-related measures has injected fresh enthusiasm among Singaporeans over the possibility of travelling again. The launch of FlexiTravel Hourly Insurance is timely in catering to the evolving needs of travellers, such as short trips to nearby destinations and travelling amidst the pandemic, so they can now travel with peace of mind as they stay protected by the hour as needed.”

A recent survey by MSIG and Ancileo, also found that three in five Singaporeans plan to travel abroad in 2022 , with the vast majority also interested in purchasing travel insurance for their trip.

Advertisement

Recent searches, trending searches.

Now Available: Hourly Travel Insurance From $1.80 For 6 Hours For JB Day Trips Or Bintan Or Batam Weekend Getaways

It’s much cheaper than conventional travel insurance. So what’s the catch?

The days of impromptu JB jaunts or spontaneous Bintan weekend getaways are finally back.

But if we’ve learnt anything from the pandemic, it’s that travel insurance is a must-buy for overseas trips, whether you’re going for a long European vacay or a day trip to Legoland in JB. For the latter, there’s now a travel insurance policy that lets you buy travel protection on an hourly basis.

NTUC Income has just launched FlexiTravel Hourly Insurance for travellers to Bintan, Batam and Malaysia which not only costs a fraction of the price of conventional travel insurance policies, it comes with Covid-19 coverage as well.

How much does it cost?

The minimum charge is $1.80 for six hours of protection, while additional coverage costs $0.30 per hour, and this is capped at a maximum charge of $3 for 24-hour coverage. In other words, for a short weekend getaway, you could be paying $6 for two days with this plan, compared to $32 for Income’s classic travel insurance plan.

Of course, with such a big difference in pricing, the benefits are largely different from regular travel insurance plans as well. The newly-launched pay-by-hour travel insurance is designed to cover short-term trips via land or sea up to a maximum of seven days. In comparison, conventional travel insurance policies have more comprehensive coverage that includes flights, and offer travel protection for up to 180 days.

The key benefits of the FlexiTravel Hourly Insurance include loss of baggage and personal belongings due to robbery or snatch theft, fraudulent use of bank card while overseas, relief for additional transport expenses due to snatch theft, robbery or road accidents, and reimbursement for unused entertainment tickets purchased for your trip.

Folks heading out for nearby golfing day trips will also be pleased to know that it also includes golfer’s cover (including stolen golf equipment from a locked car and subsequent rental of golf equipment).

Covid-19 coverage benefits include medical expenses incurred overseas and emergency medical evacuation if required.

Income FlexiTravel Hourly Insurance key benefits

To be eligible for the FlexiTravel Hourly Insurance, you have to be living or working in Singapore and have a valid Singapore identification document. You also need to be starting and ending your trip in Singapore, and have bought the policy before leaving Singapore.

The travel insurance plans are accessible via the My Income mobile app, and plans are purchased based on date and time of travel. The app has a geolocation feature which detects when you’re departing or arriving in Singapore, and will send push notifications to remind you to activate or terminate the plan according to your location. However, if you don’t want to turn on the geolocation feature, this can be done manually on the app as well.

More info here . Photos: NTUC Income

Related Stories

You Can Now Fly Direct From Seletar Airport To Redang Island; All-In Resort & Flight Packages Available

These Travel Insurance Policies Come With Covid-19 Coverage — Absolutely Essential If You're Planning A VTL Trip

Travel Insurance: To Buy Or Not To Buy?

This Multipurpose Instax Camera Lets You Shoot & Print Photos On The Spot — And It's On Sale Now

Best Special Edition Monopoly Sets For Pop Culture Fans & Game Nights: Harry Potter, Game Of Thrones, Friends & More Themed Sets

How To Clean Airpods, Earbuds Or Headphones Without Damaging Them — Do It Regularly ’Cos They’re Full Of Germs

Subscribe to the 8days weekly e-newsletter to receive the latest entertainment, celebrity, food and lifestyle news!

Terms & Conditions!

I consent to the use of my personal data by Mediacorp and the Mediacorp group of companies (collectively “Mediacorp”) to send me notices, information, promotions and updates including marketing and advertising materials in relation to Mediacorp’s goods and services and those of third party organisations selected by Mediacorp, and for research and analysis, including surveys and polls.

Want More? Check These Out

Emirates Business Class Review: What It’s Like Flying Singapore-Phnom Penh On Emirates’ Boeing 777-300ER

Best Stylish & Practical Shoes For Travel, According To Shoppers – Including TikTok-Viral Sneakers & Popular Dad Trainers

What To Know Before Travelling With The Dyson Airwrap, Airstrait Or Corrale — And Where Can You Use Hair Devices Abroad?

You May Also Like

This browser is no longer supported.

We know it's a hassle to switch browsers but we want your experience with 8 Days to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser.

Upgraded but still having issues? Contact us

International Cooperative and Mutual Insurance Federation

NTUC Income launches FlexiTravel Hourly Insurance, Singapore’s first travel insurance that protects travellers by the hour

ICMIF member NTUC Income (Income) has launched FlexiTravel Hourly Insurance , Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or impromptu regional trips by land or sea that range from a few hours to a full weekend.

Spontaneous weekend getaways to destinations such as Bintan, Batam and Malaysia have always been popular with Singaporeans. Some examples of favourite activities include driving to Malaysia for a few hours of golf, grocery shopping and dinner, visiting attractions like Legoland with the family for a day or taking a ferry to Bintan for a weekend vacation. However, travellers often find it expensive or a hassle to purchase travel insurance for such short trips as they are perceived to be less risky and many often travel uninsured.

Designed to give control to customers while protecting them on short trips, FlexiTravel Hourly Insurance charges a minimum of SGD 1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of SGD 0.30 for every additional hour, capped at a maximum charge of SGD 3 per day.

Accessible via the ‘My Income’ mobile app, travellers can easily activate and stop their FlexiTravel Hourly Insurance coverage anytime at their fingertips. With its geolocation feature, Income says FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications to travellers and remind them to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival back in Singapore. Alternatively, travellers can update their travel details manually on the app to terminate or extend their travel insurance plan accordingly without the need to turn on the geolocation feature.

Annie Chua, Vice President and Head of Personal Lines, NTUC Income, said, “Travelling always involves a certain level of risk, be it short or long trips as unforeseen circumstances can occur any time. Based on a recent survey we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected.”

Latest news

NFU Mutual Charitable Trust delivers GBP 500,000 to UK rural causes in first round of 2024 funding

Vaudoise Assurances earns top customer satisfaction ratings in 2024

African Risk Capacity makes insurance payout to the Government of Malawi and UNHCR following the 2023/24 El Niño-driven drought

For member-only strategic content on the cooperative/mutual insurance sector, ICMIF members have exclusive access to a range of online resources through the ICMIF Knowledge Hub .

Related content

News article.

NTUC Income launches Pinfare to safeguard travellers against airfare fluctuations

Read More »

New insurtech partnership to provide on-demand insurance in Canada

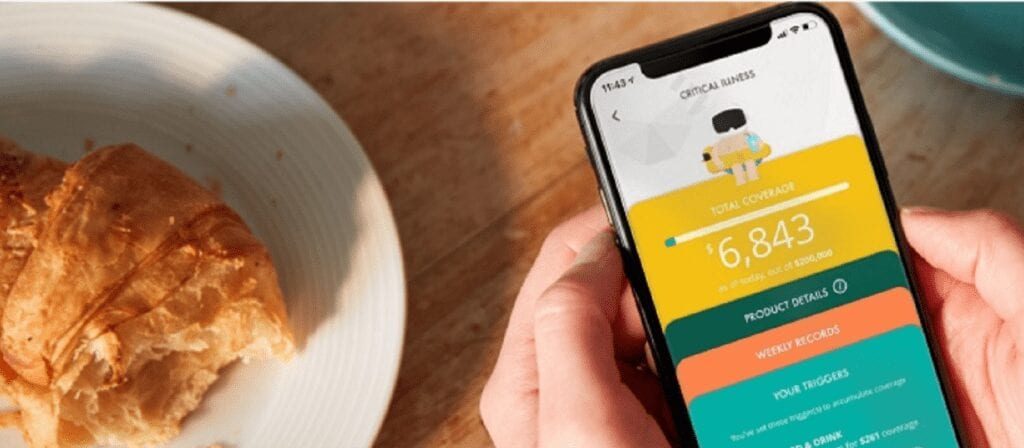

NTUC Income launches SNACK, Singapore’s first bite-sized, stackable insurance

- Latest Articles

- Market Review and Trends

- Shares & Derivatives

- Technical Analysis

- Career & Education

- Saving & Spending

- Side Hustle

- Travel & Lifestyle

- Cryptocurrency

- Sponsored Post

Cancel reply

Your email address will not be published. Required fields are marked *

Your Email Address will not be published *

Save my name, email, and website in this browser for the next time I comment.

TheFinance.sg

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Income Travel Insurance: Is It a Good Deal?

- Covers pre-existing conditions

- Provides COVID-19 hospitalisation and evacuation coverage for certain countries

- Expensive, especially annual plans

- Low personal accident and medical benefits

Like many other insurers, NTUC Income offers three levels of travel insurance policies to cater to the tastes and budgets of all kinds of consumers. Ultimately, its plans tend to be priced quite close to the industry average and feature a medium degree of coverage in most areas with two main weak points. While Income's plans are priced fairly given the level of coverage provided, deal-seekers will not be particularly wowed. However, Income's travel insurance policies stand out because they are one of the only insurers in Singapore that cover pre-existing medical conditions.

Table of Contents

- Income Enhanced Travel Insurance: What You Need to Know

- Income Enhanced PreX Travel Insurance

Sports Coverage

Claims & contact information.

- Income Coverage & Benefits

NTUC Income Travel Insurance: What You Need to Know

NTUC Income's travel insurance plans are best for travellers who aren't price sensitive and want coverage for their pre-existing conditions. You can choose from 3 tiers of plans for both the Enhanced and Enhanced PreX plans: Classic, Deluxe and Preferred for the standard plans and PreX Basic, PreX Superior & PreX Prestige for the pre-ex coverage plans. We found that Income's single trip plans generally cost 15-30% below average compared to its competition, while its annual plans cost between average to 20% above average. For those prices, the coverage is more competitive when it comes to travel inconvenience benefits (cancellations, delays, luggage loss), but sinks to below average overseas medical and personal accident coverage.

NTUC Income offers the standard array of travel insurance benefits, ranging from medical and personal accident to trip inconvenience benefits like trip cancellation, postponement, delays and baggage loss. While most of the benefit limits are slightly below average, Income does boast above average limits for medical coverage in Singapore, trip delay and baggage loss coverage. However, these plans may fail to impress some types of travellers. For instance, Income's Basic plan provides average levels of coverage but won't impress budget travellers since its possible to find cheaper basic plans. The premium tier plan (Preferred) boasts above average coverage for a small amount of benefits, but won't stand out to travellers who equate premium-level plans with market beating coverage.

Income's annual policies cost above average for all 3 plans, so it won't be the best option for frequent travellers who are hoping to save on an annual travel insurance plan. However, as Income is the only insurer that is currently providing COVID-19 medical and hospitalisation coverage as long as you take the mandatory PCR test and test negative pre-departure and won't be travelling to a high-risk nation, it is the best option for travel during the COVID-19 period. Overall, Income's travel insurance plans are just enough for the average traveller and can provide sufficient additional coverage if that traveller needs coverage for pre-existing coverage. Otherwise, Income's Enhanced travel insurance plans may not sway budget travellers or travellers who like high levels of coverage.

Notable Exclusions

NTUC Income only covers pre-existing conditions if you purchase their Enhanced PreX plans. Besides that, the exclusions are pretty standard, including no cover for travelling for medical conditions, items lost or damaged while unattended, travelling to participate in professional or compensated sports, being a victim of war, riots, or rebellion and travelling against the advice of the Singapore Government.

NTUC Income Enhanced PreX Plans Travel Insurance

If you are not limited by budget and just want a plan that will give you ample protection for your pre-existing coverage, Income will be a good choice. However, budget travellers with pre-existing conditions may find Income to be an expensive option. We found that Income's PreX travel insurance plans cost around 3 times as much as Income's standard plans, making them quite expensive considering that Income isn't competitively priced to begin with. As one of the 3 insurers who provides extensive coverage for your pre-existing coverage, it settles somewhere in the middle, with MSIG's plans costing 10-22% less but Etiqa's Tiq plans costing around 15% more.

Besides the pricing, you should also consider the extent of Income's pre-existing coverage benefits. Its PreX plans also combine medical and emergency evacuation coverage under one limit, which brings down the value of these plans considerably (for instance, MSIG's PreX and Tiq's PreX plans have separate limits for medical and emergency evacuation, resulting in more coverage than Income). On the other hand, Income does let you claim for trip inconvenience (cancellations and postponement) due to your pre-existing conditions if you buy its Superior or Prestige plans, which can be a useful benefit for people who book their trips far in advance and have somewhat risky conditions. You should just be aware of the 50% copay you'll be responsible for should you use those benefits.

Income includes medical coverage for adventure and sports including skiing, scuba-diving, white water rafting and motorcycling. There's no golf coverage and no cover for extreme sports such as bungee jumping, skydiving and mountaineering.

Income lets you submit your claim online or via post. Both options require you to submit the proper documentation, which they list when you indicate the type of claim you want to submit. You should read the policy wording before buying the policy so you are aware of what you can and can't claim for.

Summary of NTUC Income Travel Insurance Benefits & Coverage

With so many options for travel insurance plans in Singapore, it's no wonder that picking the right one for your next business trip or holiday can seem like a daunting task. Below, we've compiled a summary of NTUC Income's premiums and coverage and how it compares to the industry average. If you'd like to learn more about how Income compares to other insurers, you can read our top picks for the best travel insurance plans in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

Income’s Travel Insurance Review (2024): COVID-19 Coverage, Pre-existing Conditions, Promotions, Premiums

When you come across the acronym “NTUC,” the FairPrice supermarket probably comes to mind, as every self-respecting auntie would attest. However, frequent travellers may also associate it with the renowned travel insurance plans offered by NTUC Income. Now rebranded as Income Insurance , how does its travel insurance plans fare in the current market?

There is a prevailing notion that Income’s travel insurance plans come with a hefty price tag. Additionally, certain internet users have voiced grievances about the perceived challenge in filing claims.

Are these rumours accurate? Let’s delve into the truth once and for all.

Income’s Travel Insurance Review 2024

- Income’s Travel Insurance: Summary

- Income’s Travel Insurance Coverage

- Does Income’s Travel Insurance Cover Pre-Existing Conditions?

- What About COVID-19 Coverage?

- The Moment of Truth…How About Extreme Sports?

- Comparing Income vs MSIG vs Etiqa

- Comparing Income vs FWD

- Income Travel Insurance vs Other Travel Insurers

- Ongoing Promotions

- What Do Netizens Think About Income’s Travel Insurance?

- The Verdict: Should I buy Income’s Travel Insurance?

1. Income’s Travel Insurance: Summary

Income has 2 travel insurance plans:

- Standard plans

- Income Enhanced PreX plans (covers pre-existing medical conditions)

Each travel insurance plan is then further sub-divided into 3 plan tiers which provide different amounts of coverage:

- Classic / Basic PreX

- Deluxe / Superior PreX

- Preferred / Prestige PreX (most expensive)

The premiums you will pay for your travel insurance plan largely depend on the country you’re travelling to. Usually, the further your country of destination, the more expensive your travel insurance plan will be. Here are the countries that are covered by Income travel insurance :

- ASEAN : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam

- Asia : All the ASEAN countries, Australia, China (excluding Mongolia and Tibet), Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, Taiwan

- Worldwide : All countries

- Countries not covered : Afghanistan, Iraq, Liberia, Sudan, Syria

Back to top

2. Income’s Travel Insurance Coverage

Here’s a quick look at the premiums and coverage for the Income’s Standard travel insurance plans:

Income travel insurance medical coverage

At $250,000 to $1,000,000, Income’s Travel Insurance overseas medical coverage is generous compared to some of its competitors such as Sompo Travel Insurance’s $200,000 to $400,000 overseas medical limit.

However, do note that for adults aged 70 years and older, the coverage for medical expenses overseas, emergency medical evacuation, and sending you home all share one overall section limit of $300,000 (Classic and Deluxe) / $350,000 (Preferred). If you’re in this age range, this may not be sufficient coverage for you.

For complete peace of mind, you might want to opt for plans that offer unlimited medical evacuation and repatriation coverage. FWD travel insurance’s most basic tier offers $200,000 coverage for o verseas medical expenses and unlimited coverage for emergency medical evacuation:

Total Premium

FWD Premium

[GIVEAWAY | MoneySmart Exclusive] • Enjoy 25% off your policy premium. • Get S$30 Revolut cash reward, S$30 Trip.com Hotel Coupon and Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. Over S$5,900 worth of Apple Gadgets and gifts to be scored on top of existing rewards: • Apple Macbook Pro 13-inch, 256GB (worth S$1,899) and more! T&Cs apply. • S$100 Revolut cash reward when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply .

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

Optional add on coverage available for pre-existing Medical Conditions for Single Trips plans (up to 30 days) with S$50,000 coverage for medical expenses incurred overseas and 50% co-payment for trip cancellation, postponement and more!

Income travel insurance trip disruption coverage

One great advantage of Income’s travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For example, Allianz Travel offers $1,500 to $10,000 for trip cancellation, while Tiq travel insurance offers $5,000 to $10,000.

For travel insurance plans with comparable coverage to Income’s, check out Great Eastern (up to $15,000 coverage) and AIG (up to $15,000).

Great Eastern TravelSmart Premier Classic

[GIVEAWAY | MoneySmart Exclusive] • Enjoy up to 30% off your policy premium. • Get S$30 Revolut cash reward with every policy purchased . T&Cs apply . PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Comprehensive worldwide protection with extensive medical coverage

Extended to coverage for travel inconveniences and medical expense due to COVID-19

One way coverage is available to your destination

Adventurous activities benefit - Complimentary benefits at no extra cost

Coverage for Emergency Dental Treatment, Traditional Chinese Medical (TCM) and Chiropractor treatments

Protect against pregnancy-related conditions while you are overseas

AIG Travel Guard® Direct - Basic

[GIVEAWAY | Receive your cash as fast as 30 days*] • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to $100 worth of rewards with eligible premiums spent. T&Cs apply . PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct.

3. Does Income’s Travel Insurance Cover Pre-Existing Conditions?

Income is one of the few insurers in Singapore providing comprehensive travel insurance plans that cover pre-existing medical conditions such as asthma, eczema, diabetes, high blood pressure and even heart disease. The other 2 that cover pre-existing conditions are MSIG travel insurance and Etiqa travel insurance .

The most obvious difference between Income’s Enhanced PreX travel insurance plan and its regular Travel Insurance plan is, of course, price. The cheapest Income Enhanced PreX plan costs over twice the price of a regular Income travel insurance plan.

For those who have major health problems, you don’t have much of a choice. There’s no point in buying a cheap normal insurance plan with no coverage for you because you definitely will not be able to claim medical expenses, evacuation costs or travel delays linked to a flare-up of your condition.

It is especially worth the money if your condition is either life-threatening or very expensive to treat overseas.

However, if you have a condition that’s not immediately life-threatening, such as eczema, then it is your choice whether you want to spend more on Pre-Ex travel insurance for better coverage.

It’s important to look at the coverage limits if you’re seriously considering pre-existing travel insurance. Why? If you’re travelling somewhere with really expensive healthcare, like Europe or the US, you might want to upgrade to the Enhanced PreX Prestige plan.

INCOME Enhanced PreX Prestige

[GIVEAWAY | MoneySmart Exclusive] • Enjoy 15% off your policy premium. T&Cs apply. • Get S$30 Revolut cash reward with every policy purchased . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Income's Enhanced PreX Travel Insurance offers coverage for pre-existing medical conditions.

Covers up to S$300,000 overseas medical expenses, emergency medical evacuation and repatriation due to pre-existing medical conditions.

Pre-existing medical conditions that are covered include diabetes, heart conditions, high blood pressure, asthma, eczema and more.

Coverage for overseas medical expenses. Includes treatment relating to COVID-19 while overseas.

The only insurer in Singapore to offer a yearly travel insurance policy that protects you against your pre-existing conditions.

Enjoy exclusive treats for Income policyholders at https://www.income.com.sg/treats

Includes coverage for adventurous activities including scuba diving, skiing, snowboarding, bungee jumping, sky diving, hiking, hot air balloon and more.

Income’s Enhanced PreX Travel Insurance Premiums and Coverage

Is Income’s travel insurance for pre-existing medical conditions any good? Yes. For one, Income PreX travel insurance covers COVID-19 while MSIG TravelEasy Pre-Ex and Tiq Travel Insurance Pre-Ex don’t cover you for COVID-19. So, if you want both pre-existing medical conditions and COVID-19 coverage in your travel insurance, Income Enhanced PreX is your only choice.

Even though Income Pre-Ex Travel Insurance offers you COVID-19 coverage, the downside is that they’ve lowered the medical benefits you get if you’re aged 70 and above. For example, for those aged 70 and above, Income Enhanced PreX’s overseas medical and emergency medical evacuation coverage share a total claim limit of $300,000 for its basic plan tier (as opposed to up to $500,000 in overseas medical expenses and unlimited medical evacuation coverage for under 70s).

By comparison, MSIG TravelEasy Pre-Ex Standard (the basic tier) offers $250,000 / $50,000 medical coverage (below 70 / above 70) and $1,000,000 evacuation regardless of age, while Tiq basic pre-ex travel insurance plan offers $200,000 overseas medical coverage and $1,500,000 combined coverage for evacuation and repatriation of mortal remains.

Otherwise, Income Enhanced PreX’s miscellaneous trip cancellation and baggage delay benefits are pretty good. Travel inconvenience benefits for the Basic PreX plan are higher than those for the Classic standard plan, while benefits for the Superior PreX and Prestige PreX plans match those for the Deluxe and Preferred standard plans respectively.

4. What About COVID-19 Coverage?

Whether you buy an Income Travel Insurance Standard or an Income Enhanced PreX Travel Insurance plan, you’ll be relieved to know that all Income Travel Insurance plans automatically come with COVID-19 coverage.

You can find the COVID-19 coverage details at the very bottom of the usual Income travel insurance coverage tables for Standard plans and PreEx plans . There’s also a separate Income Travel Insurance COVID-19 policy wording document that you can refer to. Here are the most important bits:

Most of us will not scrutinise the individual coverage limits on our travel insurance. We place a whole lot of trust in insurance companies to cover the bare essentials.

The good news is that Income’s Travel Insurance COVID-19 extension is simple and adequate. Take COVID-19 overseas medical coverage, for example. Income offers $150,000 while MSIG TravelEasy’s basic plan offers $75,000 and Etiqa’s basic plan offers $100,000.

Then, there’s overseas COVID-19 quarantine cash allowance, for which Income offers $100 per day, up to $1,400. In contrast, Etiqa’s basic plan offers $100 per day up to $500, and MSIG’s basic plan offers $50 per day up to $700.

Perhaps the most important distinction is that Income’s COVID-19 coverage applies to both their Standard plans and the PreEx ones. That’s rarer than you might think. For example, Etiqa’s Pre-Ex plans and MSIG’s TravelEasy Pre-Ex plans don’t cover COVID-19 disruptions at all; their COVID-19 add-ons apply only to their standard plans. So if you have pre-existing conditions and want COVID-19 coverage, Income travel insurance is your best choice by a mile.

5. The Moment of Truth…Does Income’s Travel Insurance Cover Extreme Sports?

Income’s Travel Insurance covers common vacation activities like scuba diving and skiing. It’s also adequate if you’re just looking to snorkel or participate in an easy trek with a guide or tour group with a licensed outdoor adventure operator. Here are a few outdoor adventure activities that are included in their coverage:

* For scuba diving: On top of the 30m depth limit, you must also:

- hold a PADI certification (or similar recognised qualification) and be diving with someone who is also certified; or

- dive with a qualified instructor

The coverage above applies to their Income PreEx plans as well as the Standard ones. That makes for very comprehensive travel insurance plans, if you ask me.

6. Comparing Income vs MSIG vs Etiqa

If you’re considering Income’s Travel Insurance, you should be comparing it against established household insurance providers such as MSIG and Etiqa.

Income and MSIG automatically include COVID-19 coverage in their standard travel insurance plans, while this is an optional add-on for Etiqa. Other plans that include automatic COVID-19 coverage include Starr TraveLead Comprehensive, Bubblegum Travel Insurance, Singlife Travel Insurance and DBS Chubb Travel Insurance. However, if we look at pre-existing plans, only Income travel insurance offers COVID-19 coverage.

In terms of overseas medical expenses, all 3 insurers offer quite comparable coverage. When it comes to other travel and logistics-related coverage such as trip cancellation and baggage loss, Income and MSIG travel insurance plans’ coverage are pretty much on par while Etiqa’s falls slightly short.

All things considered, Income, MSIG and Etiqa’s travel insurance plans are surprisingly similar and competitive. The one key difference is emergency medical evacuation coverage for people aged 70 and over—Income’s Travel Insurance parks that under the overall overseas medical expense limit as we discussed above .

7. Comparing Income vs FWD

When you pit Income Travel Insurance against one of the most popular “budget” travel insurance providers, FWD, you’ll realise that the travel insurance offerings are very similar and competitive.

Between Income Travel Insurance and FWD travel insurance, coverage is largely on par if you’re considering a basic travel insurance plan with COVID-19 coverage. However, FWD’s prices are lower even if you purchase the COVID-19 add-on.

8. Income Travel Insurance vs Other Travel Insurers

At a glance, here’s how Income’s travel insurance stacks up compared to the other major travel insurers in Singapore.

9. Income travel insurance—Ongoing promotions

Even though many Singaporeans probably don’t mind paying more for Income travel insurance just because it’s a household brand name, their travel insurance plans aren’t the most affordable.

However, with ongoing promotions like the current 55% discount promo, it can be value for money. All standard per-trip plans qualify for the promo. For example, if you wanted to go temple-hopping for a week in Myanmar, the cheapest Classic plan would cost just $31 after the discount. Here are the premiums you’ll be paying with the current 55% discount promo:

In addition, Income is offering an additional 15% off Enhanced PreX per-trip plans. These start from $88 per week. Pricey, yes, but their pre-existing condition plans offer the best coverage compared to others .

10. What Do Netizens Think About Income’s Travel Insurance?

If you follow insurance threads on forums or even talk to your friends about insurance claims over kopi , you might have gotten wind of Income’s bad claims reputation .

Unfortunately, online forums such as Hardwarezone and Reddit are full of similar stories from users claiming that their Income insurance claims were slow, long-drawn-out and plagued with difficulties. According to the users’ Income claim experiences, there was a lot of emphasis on the need for original invoices to be submitted.

To be fair, between these nasty stories, you’ll also find users who managed to claim from Income smoothly and received their cheques in the mail.

So, how do you make a claim? Your first port of call should be to get in touch with Income ASAP.

Income Travel Insurance Emergency hotline: Call the Income emergency assistance hotline at +65 6788 6616

Here’s where it gets confusing. You have to identify the type of claim that you’re making and the “correct” way to submit it. Super important: all claims must be made within 30 days of the event or incident.

Income Travel insurance online claims: Submit Income Travel Insurance claims online with supporting documents such as invoices, flight itineraries, police reports, etc. through their website. You can do so for the following benefits:

- Trip cancellation

- Trip shortening

- Travel delay

- Baggage delay

- Loss and damage of baggage or personal belongings

Income Hard copy claims: For medical expenses, you need to fill in the Income Travel Insurance claim form and drop off the hard copy form with the supporting documents such as hospital bill, medical report, boarding pass, etc. at an Income branch.

Income Email claims: For claims that do not involve travel inconveniences (see above) and medical expenses (see above), you’ll need to fill in Income’s Travel Insurance claim form digitally, and email it together with your supporting documents to [email protected] . Include your travel policy number in the subject line.

Income Claims settlement time: If there is no dispute, Income will settle your claims within 10 working days or longer during high-volume travel periods like school holidays.

11. The Verdict: Should I buy Income’s Travel Insurance?

Income Travel Insurance isn’t the absolute cheapest around, but their regular travel insurance plans are very affordable and value for money when there’s a 55% promotion going on.

However, just because it’s a brand name doesn’t mean that its coverage is the highest in town, especially when you compare it with value-for-money providers like FWD. That’s not a problem for most travellers though, unless you’re going to a super expensive country or encounter some unusual scenario.

For most Singaporeans who just want to eat, chill and relax on holiday, Income’s travel insurance is more than adequate especially as it also provides COVID-19 coverage—even for pre-existing conditions. However, daredevils should take note that it does not cover more thrilling activities like mountaineering and other extreme sports.

If you have a pre-existing medical condition , Income Enhanced PreX is one of the very few travel insurance options suitable for you. It is pricey for sure, but probably worth the money if you have a life-threatening condition like asthma or heart disease. Make sure that the plan is sufficient to cover your overseas expenses and/or evacuation.

Still looking for travel insurance? Compare the best travel insurance in Singapore here .

Related Articles

6 Best Travel Insurance with COVID-19 Coverage in Singapore (May 2024)

Are Travel Aggregators Secure? Harder to Claim From?—Your Questions About Travel Aggregators, Answered.

6 Things to Know About Travel Insurance for Extreme Sports and Outdoor Adventure Coverage (2024)

The impediments to AI adoption

SIRC Connect

Developments in the vibrant Asian reinsurance market

Reinsurance pricing continues to remain positive

The real value of reinsurance meetings

The climate's toll on agriculture insurance: A pricing paradigm shift

As climate litigations surge, insurers need to get proactive

Enhancing insurance for battery risks

Though complex, digitalisation offers insurers growth opportunities

Digital trading platforms can boost efficiency for insurers

Life & health

Tough decisions ahead for life insurers

Commitment to fostering a thriving lifestyle for all

Malaysia's insurance regulator keeps pace with technology

Malaysian regulation tightens as insurance industry rebounds

Encouraging results from Malaysian life despite challenges

Malaysia: Takaful growth fuelled by EVs and ageing population

Flood still a big concern for Malaysian reinsurers

Malaysia: Motor to dominate general insurance

Insuring new energy vehicles in China can be sustainable

Geographic expansion of a Chinese insurance platform

Australian agriculture insurance grows in importance

Insurance affordability a lingering issue for Australian consumers

Indonesia's takaful operators see a healthy future

South Asia is largely unchartered territory for takaful

The practicality of AI in insurance

AI avatars could be a game-changer in APAC insurance claims

View from India - AI for better customer experience and fraud detection

Training and development

The role of AI in insurance training and development

Insurance training for AI

Demystifying AI in insurance

How InsurTechs, reinsurance brokers and insurers make staff AI-proof

New skills for insurance employees adapting to AI

Creating an understanding of AI in insurance

Climate crisis between APAC insurers and reinsurers

Technology that could change Asia-Pacific insurance

Australia: Super funds show only incremental progress in measuring retirement income strategies

China: Floods lead to insurance claims exceeding $335m

India: Insurers call for tax changes to increase market penetration

Singapore Reinsurers' Association elects new EXCO, unveils new logo and website

Singapore: Private health insurers in 'race to the bottom'

Taiwan: Fourth phase of localisation and transitional measures for ICS adoption

Sun Life Singapore introduces life insurance plan for HNW and UNNW clients

Australia supermarket giant ALDI launch insurance products

AXA Hong Kong and Macau launches new CI series

FWD Life Philippines launches new investment-linked insurance product

Manulife Malaysia launches health insurance for Gen Z

India's HDFC ERGO and global communications company Truecaller partner to launch fraud insurance

People on the move

Leveraging big data insights in (re)insurance

Magazine table of contents, product bites, singapore: ntuc income launches travel insurance that protects travellers by the hour, archived articles are available to magazine subscribers only..

If you are already a subscriber

To read this news article only BUY

Note that your comment may be edited or removed in the future, and that your comment may appear alongside the original article on websites other than this one.

Recent Comments

There are no comments submitted yet. Do you have an interesting opinion? Then be the first to post a comment.

- Meet The Team

- Privacy policy

- Terms of use

- ARM eWeekly

- MEIR eDaily

- eWeekly China

- Press releases

Conferences

- AIR Conferences

- MEIR Conferences

- Other Industry Events

- Asia Insurance Review

- Middle East Insurance Review

- Insurance Directory of Asia

- Asean Insurance Directory

- Reinsurance Directory of Asia

- MENA Insurance Directory

- World Islamic Insurance Directory

Receive Free Newsletters From Asia Insurance Review

[Review] Unique Stay at Citadines Rochor with an Exclusive Tour at Kim Guan Guan Coffee Roastery for International Coffee Month

- Contest / Promotion

- Family & Kids

- Singapore heartland

“SING浪 The SINGAPO人 Concert 2024” to Rock Singapore with Mandopop and EDM Fusion

- Entertainment

Pernod Ricard Launches Digital Labels in Singapore to Promote Responsible Drinking

- Food & Drinks

Hyundai’s IONIQ Brews & Drives Returns to Wheeler’s Estate for a Family-Fun Weekend

- 간통을 기다리는 남자

- 龚琳娜原生态民歌《忐忑》

![[PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage [PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage - Alvinology](https://media.alvinology.com/uploads/2022/05/NTUC-Income-Flexi-Hour-Travel-Insurance.jpg)

[PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage

NTUC Income (Income) launches FlexiTravel Hourly Insurance, Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for you to insure yourself on short or impromptu regional trips by land or sea that range from a few hours to a full weekend.

Designed to give you control while protecting you on short trips, FlexiTravel Hourly Insurance charges a minimum of $1.80 for six hours of protection, with the option to add on coverage at a rate of $0.30 for every additional hour, capped at a maximum charge of $3 per day.

Accessible via the ‘My Income’ mobile app, you can easily activate and stop your FlexiTravel Hourly Insurance coverage anytime at your fingertips.

![[PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage [PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage - Alvinology](https://media.alvinology.com/uploads/2022/05/NTUC-Income-Flexi-Hour-Travel-Insurance-1.jpg)

With its geolocation feature, FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications and remind you to activate your FlexiTravel Hourly Insurance plan when it detects that you are departing Singapore, and to terminate your plan upon arrival in Singapore.

Alternatively, you can update your travel details manually on the app to terminate or extend your travel insurance plan accordingly without the need to turn on the geolocation feature.

Cost-effective & Flexible Insurance Protection Tailored for Short-Term Travel

For a weekend trip to Bintan, Batam or Malaysia, FlexiTravel Hourly Insurance offers a cost-effective option to stay protected when compared to conventional travel insurance with COVID-19 coverage.

![[PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage [PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage - Alvinology](https://media.alvinology.com/uploads/2022/05/NTUC-Income-Flexi-Hour-Travel-Insurance-rates.jpg)

The benefits for FlexiTravel Hourly Insurance are different from conventional travel insurance, which provides more comprehensive coverage including for flights.

If you need to extend your trip while overseas, you can easily extend your coverage up to 7 days via the mobile app.

The benefits of FlexiTravel Hourly Insurance are specially designed to cover your common needs and concerns of short-term to Bintan, Batam and Malaysia by land or sea. Here are examples of some key benefits:

- Golfer’s cover, including stolen golf equipment from locked car and subsequent rental of golf equipment

- Reimbursement for unused entertainment ticket purchased for your trip

- Loss of baggage and personal belongings due to robbery or snatch theft and fraudulent use of bank card while overseas

- Relief for additional transport expenses due to snatch theft, robbery, or road accident

FlexiTravel Hourly Insurance also provides COVID-19 benefits such as medical expenses incurred overseas and emergency medical evacuation if required.

FlexiTravel Hourly Insurance Key Benefits

![[PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage [PROMO CODE INSIDE] Travel Safe with NTUC Income’s FlexiTravel Hourly Insurance with premiums as low as $1.80 for 6 hours of travel insurance coverage - Alvinology](https://media.alvinology.com/uploads/2022/05/NTUC-Income-Flexi-Hour-Travel-Insurance-benefits.jpg)

There will not be further cover for claims directly or indirectly caused by or arising from COVID-19 for benefits other than the COVID-19 benefits stated in the table above.

Complimentary First-trip Coverage

For first time FlexiTravel Hourly Insurance customers, Income is currently offering complimentary first-trip coverage for the first 1000 customers from 27 April 2022 to 26 July 2022. Simply register via the “My Income” mobile app and key in the promo code “ 1STTRIPONUS ” to enjoy complimentary travel insurance.

For more information, visit here or download the My Income (Insurance) mobile app from the App Store or Google Play.

Leave a Reply Cancel reply

Related posts.

Decathlon’s Lunar New Year Deals: Sports and Adventure on Sale

Celebrate Love and Reunion this Mid-Autumn Festival with Old Seng Choong Mooncakes

Aston Martin Takes the Las Vegas Grand Prix by Storm in its Largest F1 Marketing Extravaganza

12 Highlights of Sephora Playhouse at Ngee Ann City

- Today's news

- Genshin Impact

- Honkai: Star Rail

- League of Legends

- Mental health

- Relationship and dating

- Entertainment

- My Portfolio

- Commodities

- Budget 2024

- Cryptocurrencies

- Volume Leaders

- World Indices

- Price Gainers

- Price Losers

- Stock Comparison

- Currency Converter

- Business Services

- Computer Hardware & Electronics

- Computer Software & Services

- Consumer Products & Media

- Diversified Business

- Industrials

- Manufacturing & Materials

- Retailing & Hospitality

- Telecom & Utilities

- Privacy dashboard

Yahoo Finance

Ntuc income travel insurance review: covid-19 coverage, pre-existing conditions, premiums.