- ACS Foundation

- Inclusive Excellence

- ACS Archives

- Careers at ACS

- Federal Legislation

- State Legislation

- Regulatory Issues

- Get Involved

- SurgeonsPAC

- About ACS Quality Programs

- Accreditation & Verification Programs

- Data & Registries

- Standards & Staging

- Membership & Community

- Practice Management

- Professional Growth

- News & Publications

- Information for Patients and Family

- Preparing for Your Surgery

- Recovering from Your Surgery

- Jobs for Surgeons

- Become a Member

- Media Center

Our top priority is providing value to members. Your Member Services team is here to ensure you maximize your ACS member benefits, participate in College activities, and engage with your ACS colleagues. It's all here.

- Membership Benefits

- Find a Surgeon

- Find a Hospital or Facility

- Quality Programs

- Education Programs

- Member Benefits

- E/M Coding and Billing Res...

- Office/Outpatient E/M Visi...

Office/Outpatient E/M Codes

2021 e/m office/outpatient visit cpt codes.

The tables below highlight the changes to the office/outpatient E/M code descriptors effective in 2021.

More details about these office/outpatient E/M changes can be found at CPT® Evaluation and Management (E/M) Office or Other Outpatient (99202-99215) and Prolonged Services (99354, 99355, 99356, 99XXX) Code and Guideline Changes.

All specific references to CPT codes and descriptions are © 2023 American Medical Association. All rights reserved. CPT and CodeManager are registered trademarks of the American Medical Association.

Download the Office E/M Coding Changes Guide (PDF)

Evaluation and management (E/M) services are an essential part of medical practices, especially in family medicine. These services are categorized using Current Procedural Terminology (CPT) codes for billing purposes. Properly documenting and coding for E/M services is crucial to maximize payment and minimize audit-related stress.

There are different levels of E/M codes, determined by the medical decision-making or time involved. It’s worth noting that the guidelines for E/M coding have undergone changes, including the elimination of history and physical exam elements, revisions to the MDM table, and an expanded definition of time for E/M services.

Key Takeaways:

- Understanding E/M codes and guidelines is crucial for accurate billing.

- There are different levels of E/M codes based on medical decision-making or time involved.

- Recent changes to E/M coding include the elimination of history and physical exam elements.

- The definition of time for E/M services has been expanded.

- Proper documentation and coding help maximize payment and reduce audit-related stress.

Overview of Office Visit CPT Code Changes

The CPT Editorial Panel made significant revisions to the documentation and coding guidelines for office visit E/M services in 2021, with further changes introduced in 2023. These updates aim to simplify documentation requirements, reduce administrative burden, and ensure accurate coding for evaluation and management services.

One of the key changes introduced is the addition of add-on code G2211. This code accounts for the resource costs associated with visit complexity inherent to primary care and other longitudinal care settings. The inclusion of this add-on code reflects a more comprehensive understanding of the unique challenges and workload associated with these types of visits.

Additionally, the revisions eliminate the requirement for history and physical exam elements to be considered in E/M code level selection. This change allows healthcare providers to focus more on medical decision-making (MDM) and limits the need for extensive documentation of these elements in the medical record.

The MDM table has also been revised to better reflect the cognitive work required for evaluation and management services. This ensures that the complexity of the MDM is accurately captured in the coding process and supports appropriate reimbursement for the level of care provided.

Furthermore, the definition of time for many E/M services has been expanded. The expanded definition of time includes both face-to-face and non-face-to-face components of care on the day of the encounter. This change recognizes the comprehensive nature of care provided and allows for a more accurate reflection of the time spent in the management of the patient.

Using Total Time for Office Visit CPT Code Selection

When it comes to selecting the appropriate office visit CPT code, total time can be a valuable factor to consider. Total time refers to the sum of all the physician’s or qualified health professional’s (QHP) time spent in caring for the patient, both face-to-face and non-face-to-face, on the day of the encounter. This expanded definition of time allows for a more comprehensive evaluation and management of the patient’s needs.

Total time can be utilized in selecting the level of service for various evaluation and management services, including office visits, inpatient and observation care, consultations, nursing facility services, home and residence services, and prolonged services. It provides a broader perspective on the physician’s involvement in the patient’s care, taking into account all aspects of their interaction.

However, it’s important to note that for emergency department visits, the level of service is still determined primarily by medical decision-making (MDM), rather than total time. This distinction recognizes the critical nature of emergency care and the need for prompt assessment and action.

Accurate documentation of the total time spent is key to ensuring proper code selection and appropriate reimbursement. The total time should be well-documented in the patient’s medical record, including both the face-to-face and non-face-to-face components of the encounter. This documentation serves as a crucial reference point for billing and auditing purposes.

To summarize, total time offers a comprehensive perspective on the physician’s engagement with the patient, encompassing both face-to-face and non-face-to-face interactions. It allows for a more accurate selection of office visit CPT codes and ensures the appropriate level of reimbursement for the provided services. Proper documentation of total time is essential to support the medical necessity of the encounter and maintain compliance with coding and billing guidelines.

Documentation Requirements for Total Time Calculation

When determining the total time for selecting office visit CPT codes, it is essential to adhere to specific documentation requirements. By accurately documenting the time spent on various activities during the encounter, healthcare providers can ensure proper code selection and optimize reimbursement.

To calculate the total time for office visit code selection, the following activities should be included:

- Reviewing external notes/tests

- Performing an examination

- Counseling and educating the patient

- Documenting in the medical record

These activities reflect the time personally spent by the physician or qualified health professional (QHP) on the date of the encounter. However, there are also activities that should be excluded when calculating total time:

- Time spent on activities typically performed by ancillary staff

- Time related to separately reportable activities

It is crucial to specifically document the total time spent on each activity during the date of the encounter, rather than providing generic time ranges. This detailed documentation ensures transparency and accuracy in code selection and reimbursement.

In addition to capturing face-to-face time, it is important to record non-face-to-face time as well. Non-face-to-face time includes tasks performed outside of direct interaction with the patient, such as reviewing test results or consulting with other healthcare professionals.

Example of Total Time Calculation:

Let’s consider an example where a family physician spends the following time on a patient encounter:

- 45 minutes performing an examination and counseling

- 15 minutes reviewing external notes/tests

- 10 minutes documenting in the medical record

- 5 minutes discussing with an ancillary staff

In this case, the total time would be calculated as follows:

By accurately documenting the specific total time spent on each activity and excluding ancillary staff time, healthcare providers can ensure proper code selection and reimbursement. This meticulous documentation of total time in the medical record provides a comprehensive overview of the services rendered and supports accurate billing.

Split or Shared Visit Documentation Guidelines

A split or shared visit occurs when a physician and other qualified health professional (QHP) provide care to a patient together during a single Evaluation and Management (E/M) service. In such cases, the time personally spent by the physician and QHP on the date of the encounter should be summed to define the total time.

However, only distinct time should be counted. This means that overlapping time during jointly meeting with or discussing the patient should not be double-counted. The distinct time should represent the unique contribution of each provider involved in the split or shared visit.

It is important to note that time spent on activities performed by ancillary staff should not be included in the total time calculations. The total time should only reflect the face-to-face time and distinct time spent by the physician and other QHP directly involved in providing the medically necessary services.

Documentation should support the medical necessity of both services reported in a split or shared visit scenario. This includes clearly documenting the need for both physicians or QHPs to be involved and the services each provider contributed to the patient’s care.

Applying Total Time to Specific E/M Services

Total time is a valuable tool for selecting the appropriate level of service for a variety of Evaluation and Management (E/M) services. This method can be applied to different specific E/M services, ensuring that the level of care is clinically appropriate and adequately reimbursed. By considering the total time spent during the encounter, healthcare providers can accurately assign the appropriate office visit CPT code.

The application of total time is not limited to office visit services. It can also be used for inpatient and observation care services, hospital inpatient or discharge services, consultation services, nursing facility services, and home or residence services. This flexibility allows for a comprehensive approach to E/M coding, regardless of the specific type of service provided.

When selecting the visit level based on total time, it is important to ensure that the encounter is counseling-dominated. While total time can be used as the sole determinant for selecting the visit level, counseling should still play a significant role in the encounter. This ensures that the level of service reflects the complexity and intensity of the counseling provided during the visit.

It is crucial to emphasize that total time should be clinically appropriate and supported by documentation in the medical record. This documentation should clearly demonstrate the medical necessity of the services provided and the time spent on the date of the encounter.

Applying Total Time to E/M Services: An Example

To illustrate the application of total time to specific E/M services, let’s consider an example of an office visit for a counseling-dominated encounter:

In this example, the total time spent during the encounter determines the appropriate level of visit code. For a total time of 25 minutes, a level 3 visit (CPT code 99213) is selected. If the total time is 40 minutes, a level 4 visit (CPT code 99214) would be appropriate. Finally, a total time of 60 minutes would result in a level 5 visit (CPT code 99215).

By applying total time to specific E/M services, healthcare providers can ensure accurate coding and appropriate reimbursement for the care provided. This method promotes comprehensive and patient-centered care while maintaining compliance with coding guidelines. Understanding the nuances of applying total time is essential for optimizing billing practices and promoting quality healthcare delivery.

Caveats and Considerations for Time-based E/M Coding

When utilizing time as the basis for selecting E/M codes, there are important caveats and considerations to keep in mind. Time-based coding should only be used in situations where counseling dominates the encounter, and it should not include time spent on separately reportable services. Documentation should clearly indicate that the services provided were not duplicative and were necessary for the management of the patient. Additionally, it is crucial to note that the professional component of diagnostic tests/studies and activities performed on a separate date should not be included in the total time calculation.

Considerations for Time-based E/M Coding

- Use time-based coding only when counseling dominates the encounter.

- Exclude time spent on separately reportable services.

- Ensure documentation supports the necessity of the provided services.

- Do not include the professional component of diagnostic tests/studies.

Implications of Time-based E/M Coding

When selecting E/M codes based on time, it is important to adhere to the specified guidelines and considerations. Failing to do so can lead to inaccurate coding, reimbursement issues, and potential compliance concerns. By understanding the requirements and accurately documenting the relevant information, healthcare providers can ensure proper medical billing and maintain compliance with coding and documentation guidelines.

Documentation Requirements for Time-based E/M Coding

Updates and Changes to CPT E/M Guidelines

The CPT Editorial Panel has recently implemented updates and changes to the Evaluation and Management (E/M) guidelines, specifically focusing on medical decision making (MDM), history, and exam. These updates aim to enhance the accuracy and specificity of E/M coding and documentation.

One significant change in the new guidelines is the emphasis on a medically appropriate history or exam, rather than relying solely on the number or complexity of problems addressed. This shift highlights the importance of gathering comprehensive patient information to guide medical decision making.

The MDM levels have also been revised to align with those used for office visits. This alignment ensures consistency across different types of E/M services and facilitates accurate code selection for medical billing and reimbursement.

By updating and refining the guidelines, the CPT Editorial Panel aims to streamline the coding and documentation process, making it easier for healthcare providers to accurately capture the complexity of patient encounters and facilitate proper reimbursement.

Changes in CPT E/M Guidelines

| Old Guidelines | Updated Guidelines | |—————————-|———————————| | Emphasized number of | Emphasize medically appropriate | | problems addressed | history or exam | | MDM levels differed across | MDM levels align with office | | different E/M services | visit levels | | | |

The updates in the CPT E/M guidelines bring about significant changes in capturing the complexity of patient encounters. Healthcare providers should familiarize themselves with these updates to ensure compliance with the revised guidelines, thereby facilitating accurate coding, billing, and reimbursement.

Guidelines for MDM Selection in E/M Services

In the process of selecting the appropriate E/M codes for evaluation and management (E/M) services, medical decision making (MDM) plays a crucial role. MDM encompasses several factors that need to be considered, including the number and complexity of problems addressed, comorbidities, the amount and complexity of data reviewed and analyzed, and the risk of complications, morbidity, or mortality.

It is important to note that the final diagnosis alone does not determine the complexity of MDM. Rather, the complexity is determined by the impact of the condition on the management of the patient. The more complex the problems, comorbidities, and data analysis, as well as the higher the risk of complications, morbidity, or mortality, the more intricate the MDM.

In accurately reflecting the level of complexity in the documentation and coding of E/M services, healthcare providers ensure proper reimbursement and compliance with coding guidelines. By carefully evaluating the factors that contribute to MDM, providers can effectively demonstrate the complexity of the problems addressed and the resources required to manage them.

Here is a breakdown of the key considerations for MDM selection in E/M services:

- Number and complexity of problems addressed

- Comorbidities

- Amount and complexity of data reviewed and analyzed

- Risk of complications, morbidity, or mortality

- Final diagnosis and its impact on management

- Complexity of problems and their management

Accurately documenting and coding the appropriate level of MDM is essential for ensuring proper reimbursement and comprehensive representation of the complexity of the patient’s condition. It is crucial to pay attention to the specifics of each patient’s case and make informed decisions based on thorough evaluation and analysis.

Impact of Office Visit CPT Code Changes on Medical Billing

The changes in office visit CPT code guidelines have had a significant impact on medical billing and reimbursement. Healthcare providers must adapt to these changes and understand the documentation requirements and accurate coding necessary to ensure proper reimbursement and reduce the risk of audits.

Accurate coding is crucial in accurately reflecting the level of service provided during the office visit. It ensures that healthcare providers receive accurate reimbursement for their services and helps to reduce the burden of potential audits. Proper documentation and coding also contribute to compliance with coding and documentation requirements, mitigating the risk of financial loss and noncompliance.

It is essential for healthcare providers to familiarize themselves with the new guidelines and understand how to properly document the relevant information. This includes accurately capturing the level of service provided, the complexity of problems addressed, and the time spent on the date of the encounter. By adhering to these documentation requirements, healthcare providers can ensure accurate coding and reimbursement, reducing the risk of claims denials or audits.

Proper documentation not only helps in accurate coding and reimbursement but also simplifies auditing processes, ensuring compliance with coding and documentation requirements. Auditing plays a vital role in the healthcare system, and having the appropriate documentation in place can streamline the auditing process and provide evidence of accurate and compliant billing practices.

Compliance with coding and documentation requirements is essential to avoid potential financial loss and maintain a good standing within the healthcare industry. By accurately documenting and coding office visit services, healthcare providers can demonstrate their commitment to compliance and ensure that they are providing high-quality care to their patients.

In conclusion, the changes in office visit CPT code guidelines have had a significant impact on medical billing and reimbursement. It is crucial for healthcare providers to understand the documentation requirements, accurately code the services provided, and ensure compliance with coding and documentation guidelines. By doing so, healthcare providers can streamline the billing process, reduce the risk of audits, and ensure accurate reimbursement for their services.

Resources for Understanding Office Visit CPT Code Guidelines

When it comes to understanding the guidelines for office visit CPT codes and navigating the changes in E/M coding, healthcare providers can rely on valuable resources provided by reputable organizations such as the American Medical Association (AMA) and the Medicare Learning Network (MLN). These resources offer comprehensive guidance and tools that can help healthcare providers stay up to date and ensure accurate reimbursement.

The CPT Evaluation and Management Services Guidelines, developed by the AMA, provide detailed information on office visit CPT codes, E/M coding principles, and documentation requirements. This resource serves as a comprehensive guide to help healthcare providers understand the intricacies of office visit coding and ensure compliance with the latest guidelines.

The Medicare Learning Network, an educational resource developed by the Centers for Medicare & Medicaid Services (CMS), offers webinars, articles, and other educational materials specifically designed to assist healthcare providers in understanding and implementing the changes in E/M coding. These resources provide practical insights and clarification on the documentation requirements and coding changes specific to office visit CPT codes.

Furthermore, the Medicare Physician Fee Schedule Lookup Tool, available on the CMS website, enables healthcare providers to access reimbursement information for specific office visit CPT codes. This tool allows providers to accurately determine the appropriate reimbursement for their services and ensure proper billing practices.

By leveraging these resources, healthcare providers can enhance their understanding of office visit CPT code guidelines, navigate the complexities of E/M coding, and ensure accurate reimbursement for their services. Staying informed and utilizing these valuable resources is imperative for maintaining compliance and optimizing coding practices.

Understanding the guidelines for office visit CPT codes is essential for accurate medical billing and insurance reimbursement. The recent changes in E/M coding guidelines, particularly regarding time-based code selection and medical decision making, necessitate proper documentation and accurate coding. By comprehensively understanding these guidelines, healthcare providers can maximize their payment, reduce the stress associated with audits, and ensure compliance with coding and documentation requirements.

Accurate medical billing is crucial for healthcare practices to receive fair reimbursement from insurance companies. By following the comprehensive guide provided by the American Medical Association (AMA) and the Medicare Learning Network (MLN), healthcare providers can confidently navigate the complexities of office visit CPT codes. This comprehensive guide provides detailed information on selecting the appropriate codes based on medical decision making, time-based code selection, and documentation requirements.

Properly documenting the relevant information and coding accurately not only ensures accurate reimbursement but also reduces the risk of audits and increases compliance. By adhering to the guidelines and best practices outlined in the comprehensive guide, healthcare providers can maintain accurate and compliant medical billing practices, ultimately benefiting both their practice and their patients.

In conclusion, understanding the guidelines for office visit CPT codes is crucial for accurate medical billing and insurance reimbursement. By following the comprehensive guide provided by industry resources such as the AMA and MLN, healthcare providers can navigate the changes in E/M coding and ensure compliance with coding and documentation requirements. This comprehensive understanding of the guidelines allows healthcare providers to optimize payment, minimize audit-related stress, and maintain accurate and compliant medical billing practices.

What are office visit CPT codes?

Office visit CPT codes are evaluation and management (E/M) codes used for billing purposes in family medicine practices and other healthcare settings.

What are the changes to the office visit CPT code guidelines?

The office visit CPT code guidelines have been revised to eliminate the history and physical exam elements, introduce an add-on code for visit complexity, revise the medical decision-making table, and expand the definition of time for E/M services.

How can total time be used for office visit CPT code selection?

Total time, which includes both face-to-face and non-face-to-face interactions, can be used to select the level of service for office visit codes and other E/M services.

What should be included in the calculation of total time for office visit code selection?

Activities such as examining the patient, counseling and educating the patient, reviewing external notes/tests, and documenting in the medical record should be included in the calculation of total time. Ancillary staff time and time related to separately reportable activities should be excluded.

How should total time be documented for office visit code selection?

It is important to document the specific total time spent on activities on the date of the encounter in the patient’s medical record, rather than providing generic time ranges.

What are the documentation guidelines for split or shared visits?

In a split or shared visit scenario, the time personally spent by the physician and other qualified health professional (QHP) should be summed to define total time. Distinct time should be counted, and time spent on activities performed by ancillary staff should not be included.

Can total time be used for other E/M services besides office visits?

Yes, total time can be used to select the level of service for inpatient and observation care services, hospital inpatient or discharge services, consultation services, nursing facility services, and home or residence services.

What are the caveats and considerations for time-based E/M coding?

Time-based coding should only be used when counseling dominates the encounter, and it should not include time spent on separately reportable services. It is important to ensure that the services provided were necessary for the management of the patient.

What updates have been made to the CPT E/M guidelines?

The CPT E/M guidelines have been updated to emphasize the need for a medically appropriate history or exam and to revise the levels of medical decision making to align with office visit levels.

How is medical decision making (MDM) determined in E/M services?

MDM is determined by considering the number and complexity of problems addressed, comorbidities, the amount and complexity of data reviewed and analyzed, and the risk of complications, morbidity, or mortality.

What is the impact of the office visit CPT code changes on medical billing?

The changes in office visit CPT code guidelines have a significant impact on medical billing, requiring proper documentation and accurate coding to ensure accurate reimbursement and reduce the risk of audits.

Where can healthcare providers find resources to understand the office visit CPT code guidelines?

Healthcare providers can refer to resources such as the CPT Evaluation and Management Services Guidelines from the American Medical Association and the Medicare Learning Network for guidance on understanding and implementing the office visit CPT code guidelines.

What is the importance of understanding office visit CPT code guidelines?

Understanding office visit CPT code guidelines is crucial for accurate medical billing, insurance reimbursement, and compliance with coding and documentation requirements.

What is the overall purpose of the comprehensive guide on office visit CPT code guidelines?

The comprehensive guide on office visit CPT code guidelines provides healthcare providers with a thorough understanding of the guidelines, enabling them to maximize payment, reduce the stress associated with audits, and ensure compliance with coding and documentation requirements.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

AVAILABLE MON-FRI

From 8 am to 8 pm mst, houston office:.

525 N Sam Houston Pkwy E, Suite #246 Houston, Texas, 77060

Denver Office:

3000 Lawrence Street Suite #15 Denver, CO 80205

Tampa Office:

260 1st Ave S, #34 St Petersburg, Florida 33701

Phoenix Office:

7042 E Indian School Rd #100 Scottsdale, AZ 85251

Copyright © 2024 | All Rights Reserved | Medical Billing Company | XML Sitemap | Privacy Policy | Cookie Policy | HIPPA Compliance Policy

Digital Marketing by Denver Digital Marketing Agency

- Become a Member

- Everyday Coding Q&A

- Can I get paid

- Coding Guides

- Quick Reference Sheets

- E/M Services

- How Physician Services Are Paid

- Prevention & Screening

- Care Management & Remote Monitoring

- Surgery, Modifiers & Global

- Diagnosis Coding

- New & Newsworthy

- Practice Management

- E/M Rules Archive

September 13, 2024

Consultation Codes

First, CMS stopped recognizing consult codes in 2010. Outpatient consultations (99241—99245) and inpatient consultations (99251—99255) were still active CPT ® codes, and depending on where you are in the country, are recognized by a payer two, or many payers.

- In 2023, codes 99241 and 99251 are deleted. These two low level consult codes were rarely used. There are four levels of office/outpatient consults and hospital consults. These correspond to the four levels of medical decision making.

- CPT has removed the coding tip –and all language– regarding transfer of care.

- CMS is not planning on changing its policy on consultations.

The advantages to using the consult are codes are twofold: they are not defined as new or established, and may be used for patients the clinician has seen before, if the requirements for a consult are met.”

In this article about consultation codes update:

- Category of code for payers that don’t recognize consult codes

- Definition of a consultation–updated with 2023 CPT guidance

- 2023 documentation changes

Want unlimited access to CodingIntel's online library?

Including updates on CPT ® and CMS coding changes for 2025

Category of code for Medicare and other payers that don’t recognize consult codes

When CMS stopped paying for consults, it said it still recognized the concept of consults, but paid for them using different categories of codes. For an inpatient service, use the initial hospital services codes (99221—99223). If the documentation doesn’t support the lowest level initial hospital care code, use a subsequent hospital care code (99231—99233). Don’t make the mistake of always using subsequent care codes, even if the patient is known to the physician.

For office and outpatient services, use new and established patient visit codes (99202—99215), depending on whether the patient is new or established to the physician, following the CPT rule for new and established patient visits. Use these codes for consultations for patients in observation as well, because observation is an outpatient service.

For patients seen in the emergency department and sent home, use ED codes (99282—99285).

How will clinicians know if the payer recognizes consults? They won’t know. Most groups suggest that their clinicians continue to select and document consults (when the service is a consult) whether or not they know if the payer recognizes consults or not. They set up an edit in their system so that consult codes can be reviewed and cross walked to the appropriate code, depending on the payer.

Definition of a consultation

When reporting a consultation code follow CPT rules. The statement that I recommend is “I am seeing this patient at the request of Dr. Patel for my evaluation of new onset a-fib.” At the end of the note, indicate that a copy of the report is being returned to the requesting clinician. In a shared medical record, this can be done electronically.

The requirements for a consultation have not changed.

- There is a request from another healthcare professional or other appropriate source

- An opinion is provided, and

- A report is returned.

From 2023 CPT : “A consultation is a type of evaluation and management service provided at the request of another physician, other qualified health care professional, or appropriate source to recommend care for a specific condition or problem. A physician or other qualified health care professional consultant may initiate diagnostic and/or therapeutic services at the same or subsequent visit.”

CPT goes on to say that if the consultation is initiated by a patient or family member or other appropriate source, do not use consult codes. The list of professionals who are “other appropriate sources” according to CPT includes non-clinical social workers, educators, lawyers or insurance companies. However, if your payer still recognizes consults, they will likely require the NPI of a requesting clinician. You likely will not get paid for a consult requested by one of these professionals.

A report is required. “The consultant’s opinion and any other services that were ordered or performed must also be communicated by written report to the requesting physician, other qualified health care professional, or other appropriate source.”

- CPT does not say how the written report is returned: mail, fax, electronic communication.

When you look in your book, notice that CPT has entirely removed the concept of transfer of care . There is no longer a notation that says you cannot bill a consult for a transfer of care.

Consults in 2023 use medical decision making or time

- The AMA has extended the framework for office and outpatient services to consults in 2023. Use either medical decision making or the practitioner’s total time on the date of the visit to select the level of service.

Consulting physician services for hospitalized Medicare patients

What should a consulting physician bill when seeing a hospitalized Medicare patient? An initial hospital service or a subsequent hospital visit?

Medicare stopped recognizing and paying consult codes, but consults are still requested and provided to inpatients every day. The question is, how should they be billed?

If the documentation supports an initial hospital service, use codes 99221-99223, initial hospital care codes. According to CPT ® , these codes are used for new or established patients. While we think of them and even talk about them as “admission” codes, CPT ® doesn’t use that word.

If the documentation doesn’t have a detailed history and detailed exam, then bill a subsequent hospital visit, rather than the initial hospital care services. But, the correct category of code is initial hospital care. The citation from the Medicare Claims Processing Manual is at the end of this Q&A.

Many commercial insurance companies still recognize consults. Neglecting to bill consults when the carrier pays them results in lost revenue.

Citation from CMS | Inpatient Hospital Services

The CMS Claims Processing Manual, Chapter 12, §30.6.9 F

Physicians may bill initial hospital care service codes (99221-99223), for services that were reported with CPT ® consultation codes (99241 – 99255) prior to January 1, 2010, when the furnished service and documentation meet the minimum key component work and/or medical necessity requirements. Physicians may report a subsequent hospital care CPT ® code for services that were reported as CPT ® consultation codes (99241 – 99255) prior to January 1, 2010, where the medical record appropriately demonstrates that the work and medical necessity requirements are met for reporting a subsequent hospital care code (under the level selected), even though the reported code is for the provider’s first E/M service to the inpatient during the hospital stay. In the inpatient hospital setting and the nursing facility setting, physicians (and qualified nonphysician practitioners where permitted) may bill the most appropriate initial hospital care code (99221-99223), subsequent hospital care code (99231 and 99232), initial nursing facility care code (99304-99306), or subsequent nursing facility care code (99307-99310) that reflects the services the physician or practitioner furnished. Subsequent hospital care codes could potentially meet the component work and medical necessity requirements to be reported for an E/M service that could be described by CPT ® consultation code 99251 or 99252. A/B MACs (B) shall not find fault in cases where the medical record appropriately demonstrates that the work and medical necessity requirements are met for reporting a subsequent hospital care code (under the level selected), even though the reported code is for the provider’s first E/M service to the inpatient during the hospital stay.

Get more tips and coding insights from coding expert Betsy Nicoletti.

Subscribe to receive our FREE monthly newsletter and Everyday Coding Q&A.

Last revised July 15, 2024 - Betsy Nicoletti Tags: office and other E/M

CPT®️️ is a registered trademark of the American Medical Association. Copyright American Medical Association. All rights reserved.

All content on CodingIntel is copyright protected. Any resource shared within the permissions granted here may not be altered in any way, and should retain all copyright information and logos.

- What is CodingIntel

- Terms of Use

- Privacy Policy

Our mission is to provide up-to-date, simplified, citation driven resources that empower our members to gain confidence and authority in their coding role.

In 1988, CodingIntel.com founder Betsy Nicoletti started a Medical Services Organization for a rural hospital, supporting physician practice. She has been a self-employed consultant since 1998. She estimates that in the last 20 years her audience members number over 28,400 at in person events and webinars. She has had 2,500 meetings with clinical providers and reviewed over 43,000 medical notes. She knows what questions need answers and developed this resource to answer those questions.

Copyright © 2024, CodingIntel A division of Medical Practice Consulting, LLC Privacy Policy

- YoungOD Connect

- CollaborativeEye

- Cataract/Refractive Surgery

- Contact Lenses

- Cornea/Anterior Segment

- Health Policy

- Human Interest

- Imaging/Diagnostics

- Neuro-Optometry

- Nutrition/Pharmaceuticals

- Ocular Surface

- Patient Care

- Practice Enrichment

- Current Issue

- Issue Archive

- GA Case Compendium

- OptoMemoirs

- Collaborative Case Reports

- Optometric Scholar

- Significant Findings

- youngodconnect

September 2022

Billing and Coding for the Optometric Practice

Key takeaways from the optometric business management session at the MOD Live 2022 meeting held in Nashville, Tennessee.

Rachael Wruble, OD, FAAO

Thomas Cheezum, OD, CPC, COPC

Walter O. Whitley, OD, MBA, FAAO

Link has been copied to your clipboard.

Answers to Your Top Billing and Coding Questions

By Rachael Wruble, OD, FAAO

I get asked a fair share of questions pertaining to billing and coding, but there are a handful that come up regularly. Following are some of the more common billing and coding topics.

TO CREDENTIAL OR NOT

The biggest question I hear from new graduates is, “What do I do next? Do I start credentialing on an insurance panel?” If you’re joining a clinic, they may have someone who helps you credential. I help my doctors credential, but if one of them starts talking about partnership, then I want them to credential themselves, work with my staff, learn about the insurance companies, figure out the largest health care plan providers in the community, and compare the rates in the area. Having potential partners credential themselves helps them understand the process and the paperwork that is involved. You can negotiate rates for vision and medical plans with insurance companies. Every state and every carrier is different.

MEDICARE & MEDICAID

Many doctors want to know if they should accept Medicare. Well, Medicare represents about 60 million patients in our country right now, 1 so it’s probably not a bad idea. Medicaid is another one I get asked about a lot, and some states are switching from straight Medicaid to managed care contracts, which has been difficult because the contracted rate may not be at 100%; it may be significantly lower. If your state hasn’t yet made the switch from straight Medicaid to managed care Medicaid, I encourage you to work with your state association and state optometric society on those rates, because they can be negotiated with the managed care plans. Then you’ll want to look at all of the commercial plans to see what’s big in your area and find out what the local hospitals and employers have. Blue Cross, United Healthcare, Cigna, Humana, and Aetna may have routine eye exams that pay a little higher than the actual vision plan. It’s confusing, but important to know what’s what. Make a cheat sheet if necessary. Having a cheat sheet for the staff and doctors helps them understand the billing side of insurance.

SETTING EXAM FEES

The easiest way to figure out your exam fees is by consulting the Medicare allowables, which are set by the Centers for Medicare & Medicaid Services. 2 Note that these do change, so I create a task for myself on one of my administration days once a year to go through and look at these allowables and see where we are with all of our most common diagnoses. My EHR generates a report so I can check to see if I need to raise or lower my fees. You don’t want to set your fees lower than what Medicare pays because you’ll be leaving money on the table, so make sure you’re setting your fees at or above Medicare levels.

IMPROPER CODING

Using the wrong code or undercoding an exam is oftentimes the result of physician inexperience. If you code an eye exam as new and it results in a denial, that usually means the patient doesn’t meet the new candidate guidelines, and that you will have to refile, which takes many weeks. Thus, it’s important to try to bill and code properly the first time.

BILLING ERRORS

The three most common billing mistakes involve: 1) mixing up routine versus medical visits, 2) misused and unused modifiers, and 3) submitting a claim before you’re credentialed.

Routine Versus Medical

I had a new staff member who was part of my insurance team get their wires crossed, and all of a sudden we’re billing 99214 for presbyopia when 99214 is for a medical exam. Presbyopia is not a medical diagnosis, so this billing error resulted in a ton of denials.

Misused and Unused Modifiers

Using modifiers incorrectly or not using them at all is another common billing mistake. If you’re providing postoperative care, use modifier 55. However, use modifier 54 (the surgeon’s modifier) and your claim will be denied.

Submitting a Claim Before You’re Credentialed

A new doctor may receive a welcome letter congratulating them, but it doesn’t mean they’re fully credentialed. They may still have required training to complete with an insurance company, so if they submit a claim, they’re not going to get paid for any of them as in-network. Make sure you’re fully credentialed.

UNDERBILLING

You won’t get penalized for underbilling, but you won’t get paid what you should be paid for the services that you are providing.

the more you know ...

Credentialing can seem daunting with all the paperwork, but take it one step at a time. Medicare, Medicaid, and commercial payers may continuously change policies. Keep an active membership with your state association to be aware of updates. It is important for eye care providers and their staff to be aware of different aspects of testing, billing, and coding guidelines in order to both file correct claims with insurers the first time and also to understand their practice habits, which may result in receiving reduced fees for their services.

- 1. CMS releases latest enrollment figures for Medicare, Medicaid, and children’s health insurance program (CHIP). CMS.gov. December 21, 2021. www.cms.gov/newsroom/news-alert/cms-releases-latest-enrollment-figures-medicare-medicaid-and-childrens-health-insurance-program-chip#:~:text=As%20of%20October%202021%2C%20the%20total%20Medicare%20enrollment%20is%2063%2C964%2C675. Accessed August 21, 2022.

- 2. Physician fee schedule look-up tool. CMS.gov. www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PFSlookup. Accessed August 24, 2022.

Glaucoma Coding and Billing Considerations

By Thomas Cheezum, OD, CPC, and Walter O. Whitley, OD, MBA, FAAO

When it comes to billing and coding for glaucoma, there’s a lot we can talk about, but this article addresses some of the most common questions pertaining to this topic. If you have a question not addressed here, let us know.

WHAT’S THE FREQUENCY?

Some of the more common questions we get is how often OCT can be performed, how often visual fields can be performed, whether multiple tests can be done together, and how often we should be seeing our patients with glaucoma.

When it comes to frequency guidelines (eg, testing, visits, etc.), it’s all about what information is necessary to diagnose, treat, and manage your patient while following the standard of care for the level of disease severity. Great resources are available, including the American Optometric Association Optometric Clinical Practice Guidelines and the American Academy of Ophthalmology Preferred Practice Patterns. 1,2

For a patient with borderline or controlled mild to moderate glaucoma, once a year OCT (92133) is covered, but uncontrolled glaucoma may warrant OCT performed at least two times a year, based on medical necessity. For visual fields (92083), once a year is warranted for borderline or controlled glaucoma, twice a year for uncontrolled, and three times per year for rapidly progressing disease.

Remember that anytime you order a test, documentation is key. Include what test you need, why you need the test, what information it gives you (including comparative analysis to previous tests), and next steps in management.

Another consideration when ordering tests is that Medicare applies a multiple procedure payment reduction (MPPR) to the practice expense (PE) payment of select procedures and services. Full payment is made for the procedure with the highest PE payment, and for subsequent procedures to the same patient on the same day, full payment is made for work and malpractice and 50% payment is made for the PE for procedures submitted on either professional or institutional claims. You could perform visual fields, OCT, and a full dilating exam every single time, but you will get reimbursed 100% for the first test, and then only 50% for the second test. Unless it’s medically necessary, it’s not clinically efficient to do both tests on the same day. Additionally, we typically see patients two to three times per year, so you could space the special testing out throughout the year, which also raises your ticket price per visit.

WATCH IT NOW

Walt Whitley, OD, MBA, FAAO, and Will To, OD, ABOC, discuss the benefits of networking with fellow optometrists and sharing tips about billing and coding at the 2022 MOD Live meeting. Watch here .

STAGING PATIENTS

Glaucoma staging is important because it not only determines how we code and bill our patients’ conditions, but it also helps us determine how much pressure lowering we want to do. 1,2

For example, a patient with mild glaucoma has optic nerve abnormalities, but they’re not going to have visual field defects unless it’s detected on frequency doubling or short wavelength automated perimetry test. In this case, we would want about a 20% to 30% reduction in IOP. 4,5 A patient with moderate glaucoma will have visual field defects in either superior or inferior hemifield outside of the central 5˚. Those are patients in whom we want about a 35% decrease in IOP. If it’s affecting both hemifields or if it’s within the central 5˚, then that patient has advanced glaucoma and we’ll want a target pressure of below 18 mm Hg and/or target low teens to reduce visual field loss and progression. 5

You don’t want to do OCT on a patient with advanced glaucoma because of the limited information it provides due to the floor effect. (Also, most insurances won’t reimburse for it.) An adjustment to the stimulus size or a 10-2 threshold visual field test will provide more reliable information for detecting and monitoring progression.

OTHER CODING CONSIDERATIONS

- For ICD-10, if both eyes are at the same stage in the disease, then it’s important to use a bilateral code.

- Be as specific as possible when coding (ie, include stage, laterality, etc.).

- If each eye is at different levels of severity, then we want to code the more severe eye first.

- Use “indeterminate” when a patient hasn’t had a visual field or OCT done, but you suspect they have glaucoma and it’s unspecified. (Don’t use “unspecified”—billing people don’t like that.)

- Once again, make sure you have an order for each test.

FOLLOW THE RULES

Remember, proper documentation is key, along with orders for each test. Use available resources to guide your treatment and management protocols, which will help ensure proper coding and following the standard of care.

- 1. Optometric Clinical Practices Guideline. American Optometric Association. www.aoa.org/AOA/Documents/Practice%20Management/Clinical%20Guidelines/Consensus-based%20guidelines/Care%20of%20the%20Patient%20with%20Open%20Angle%20Glaucoma.pdf. Accessed August 29, 2022.

- 2. Primary open-angle glaucoma PPP 2020. American Academy of Ophthalmology. November 2020. www.aao.org/preferred-practice-pattern/primary-open-angle-glaucoma-ppp. Accessed August 29, 2022.

- 3. Heijl A, Leske MC, Bengtsson B, Hyman L, Bengtsson B, Hussein M; for the Early Manifest Glaucoma Trial Group. Reduction of intraocular pressure and glaucoma progression: results from the Early Manifest Glaucoma Trial. Arch Ophthalmol . 2002;120(10):1268-1279.

- 4. Musch DC, Gillespie BW, Niziol LM, et al; for the CIGTS Study Group. Intraocular pressure control and long-term visual field loss in the Collaborative Initial Glaucoma Treatment Study. Ophthalmology . 2011;118(9):1766-1773.

- 5. The Advanced Glaucoma Interventional Study (AGIS): 7. The relationship between control of intraocular pressure and visual field deterioration. TheAGIS investigators. Am J Ophthalmol . 2000;130(4):429-440.

Optometrist and Owner, Belmont Eye, Belmont North Carolina, and Northlake Eye, Charlotte, North Carolina Member, Modern Optometry Editorial Advisory Board [email protected] ; Instagram @dr.eyegotthis Financial disclosure: None

Tidewater Optometric Consulting Services [email protected] ; optometricconsulting.com Financial disclosure: None

Director of Referral Services and Residency Program Supervisor, Virginia Eye Consultants, Norfolk, Virginia Co-Chief Medical Editor, Modern Optometry [email protected] Financial disclosure: None

Advertisement

End of Advertisement

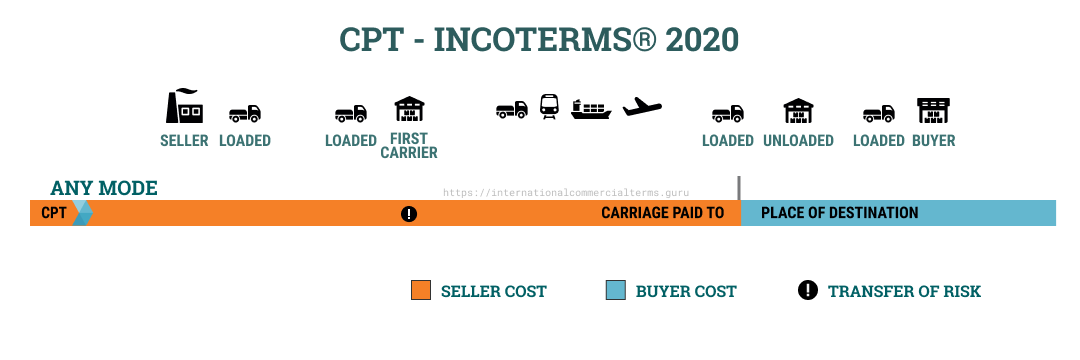

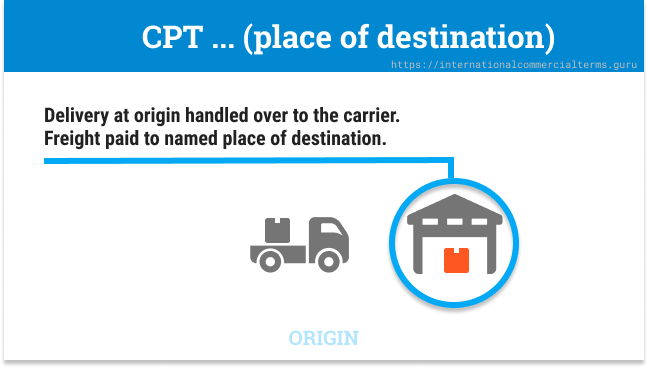

CPT – Carriage paid to (Place of Destination) - Incoterms 2020

In CPT the seller clears the goods for export and delivers to the carrier nominated by the seller at the agreed place of shipment at the origin. At this point, the risk is transferred to the buyer. The seller is responsible for contracting and paying the main carriage until the agreed named place of destination. The contract of carriage must specify origin and destination. This term can be used for any mode of transportation.

It is advised to mention the destination place as clearly as possible in the contract of sale. Unless otherwise agreed, unloading at the named place of destination will be under sellers account.

Doing Business

Similar to CIP, but without insurance paid by the seller. Seller pays transportation to the destination. The buyer obtains insurance for his own risk. Delivery happens at the origin with the first carrier, this means that delivery happens at origin and the seller pays for freight until the final destination. Seller arranges export clearance and can be used for any mode of transportation. In the case of claims, the buyer can claim directly with the insurance company.Freight doesn’t have the same cost when transported to the port of destination or inland destination warehouse, additional inland and terminal handling charges will apply. The buyer is responsible for customs clearance. In practice, delays caused at origin which incurs in additional expenses are usually a point of discussion between buyer and seller.

This term is popular in Ro-Ro and airfreight shipments. If there is more than one mode of transportation, the risk is transferred when goods have been delivered to the first carrier.

Computer monitors from China to Indonesia:

Seller, a reputable electronics company, sells Monitors to Jakarta via ocean. Seller pays for freight from origin to a warehouse located in Jakarta and unloads goods. The buyer is responsible for insuring goods from origin until Jakarta warehouse. In this scenario, even if it would be more convenient and easy for the buyer to arrange transportation from the port of destination to Jakarta warehouse, sellers are in charge of this segment of transportation and expenses via a destination forwarder or a contract of carriage which includes all expenses. Additionally, the buyer pays for customs clearance plus duties and taxes.

Seller and Buyer obligations

Getting clear on the new coding rules can help you eliminate bloated documentation and improve reimbursement to reflect the value of your visits.

THOMAS WEIDA, MD, FAAFP, AND JANE WEIDA, MD, FAAFP

Fam Pract Manag. 2022;29(1):26-31

Author disclosures: no relevant financial relationships.

In 2021, significant changes were adopted for the documentation guidelines for outpatient evaluation and management (E/M) visit codes. Most notably, medical decision making or time became primary drivers of visit level selection, rather than the number of history and physical exam bullets.

In this article, we review the context for these changes, describe them briefly, and offer a quick reference tool to help physicians apply the new rules in practice.

The revisions to the E/M outpatient visit codes reduced administrative burden by eliminating bullet points for the history and physical exam elements.

Code level selection is now simplified — based on either medical decision making or total time.

The authors' one-page coding reference tool can help simplify the new rules.

HOW WE GOT HERE

In the 2019 Medicare physician fee schedule final rule, released in November 2018, the Centers for Medicare & Medicaid Services (CMS) adopted revisions to the outpatient E/M codes in order to reduce administrative burden. (See https://www.cms.gov/newsroom/fact-sheets/final-policy-payment-and-quality-provisions-changes-medicare-physician-fee-schedule-calendar-year .) Originally scheduled for implementation in 2021, these changes would have combined visit levels 2–4 into a blended payment rate (e.g., one rate for 99202-99204 and one rate for 99212-99214), among other changes.

In response, the American Medical Association (AMA) convened a joint CPT Editorial Board and Relative Value Scale Update Committee (RUC) workgroup to build on the changes and propose some alternatives. The workgroup's goals were to decrease administrative burden, payer audits, and unnecessary medical record documentation while ensuring that payment of E/M services is resource-based.

The workgroup approved significant revisions to the outpatient office visit E/M codes. Code 99201 was deleted. The history and/or physical examination and the counting of bullets were eliminated as components for code selection (although history and/or physical examination documentation should still be performed as medically appropriate). Medical decision making (MDM) or time could be used for code level selection. Changes were made to the code descriptors for 99202-99205 and 99211-99215, the definition of medical decision making, and the calculation of time, and a shorter prolonged services add-on code was created. CMS adopted these new E/M coding guidelines. As a result of the changes to medical decision making and time-based coding, the RUC revised the 2021 relative value units (RVUs) for office visit E/M codes. Most of the values increased, yielding an overall increase of more than 10%.

CODING BASED ON MEDICAL DECISION MAKING

For outpatient E/M coding, medical decision making now has three components:

Number and complexity of problems addressed at the encounter,

Amount and/or complexity of data to be reviewed and analyzed,

Risk of complications and/or morbidity or mortality of patient management.

There are four levels of decision making for each of these components: straightforward, low complexity, moderate complexity, and high complexity.

To determine the level of code for a visit, two of the three components must meet or exceed that level of coding. ( See the table .) For example, if the patient has multiple problems addressed at the encounter, but the data is limited and the risk of complications is low, then the level of medical decision making would be low. New patient codes 99202-99205 and established patient codes 99212-99215 use the same components and levels of decision making for code selection.

Determining medical decision making usually starts with identifying the number and complexity of problems addressed and then determining the data or risk components that support that medical decision making. If a second component does not meet or exceed the problem component, then a lower level of decision making is appropriate. The set of tables below illustrate the essential concepts of these code levels. Each level has specific criteria for each component.

Straightforward medical decision making: Codes 99202 and 99212 include one self-limited or minor problem with minimal or no data and minimal risk.

An example of a 99202 or 99212 is an otherwise healthy patient with cough and congestion due to the common cold.

Low complexity medical decision making: Codes 99203 and 99213 include two or more self-limited or minor problems, one stable chronic illness, or one acute uncomplicated illness or injury.

The data component requires one of two categories to establish the level. Category 1 data requires at least two items in any combination of the following: each unique source's prior external notes reviewed, each unique test result reviewed, or each unique test ordered. Tests include imaging, laboratory, psychometric, or physiologic data. A clinical lab panel, such as a complete blood count, is a single test. Of note, if a test is ordered, the review of that test is included with the ordering, even if the review is done at a subsequent visit. Tests ordered outside of an encounter may be counted in the encounter in which they are analyzed. Category 2 data includes significant history given by an independent historian. Parents giving the history for their child is a typical example.

The risk component is low. There is low risk of morbidity from additional diagnostic testing or treatment.

An example of a 99203 or 99213 is a sinus infection treated with an antibiotic. Although the prescription makes the risk component moderate, the one acute uncomplicated illness is a low-complexity problem, and there are no data points.

Moderate complexity medical decision making: Codes 99204 and 99214 include two or more stable chronic illnesses, one or more chronic illnesses with exacerbation, progression, or side effects of treatment, one undiagnosed new problem with uncertain prognosis, one acute illness with systemic symptoms, or one acute complicated injury. A patient who is not at a treatment goal, such as a patient with poorly controlled diabetes, is not stable. Systemic general symptoms such as fever or fatigue in a minor illness (e.g., a cold with fever) do not raise the complexity to moderate. More appropriate would be fever with pyelonephritis, pneumonitis, or colitis.

The data component requires one of three categories to establish the level. Category 1 data requires at least three items in any combination of the following: each unique source's prior external notes reviewed, each unique test result reviewed, each unique test ordered, or independent historian involvement. Physicians cannot count tests that they or someone of the same specialty and same group practice are interpreting and reporting separately (e.g., electrocardiogram, X-ray, or spirometry). Category 2 data includes the independent interpretation of a test performed by another physician/other qualified health care professional (QHP) (not separately reported). For instance, if a chest X-ray was ordered and the ordering clinician included the interpretation in the visit documentation, this would qualify for data point Category 2. However, if the ordering clinician bills separately for the interpretation of the X-ray, then that cannot be used as an element in this category and would be an element for Category 1. Category 3 data includes discussion of management or test interpretation with an external physician/QHP (not separately reported).

The risk component may include prescription drug management, a decision for minor surgery with patient or procedure risk factors, a decision for elective major surgery without patient or procedure risk factors, or social determinants of health (SDOH) that significantly limit diagnostic or treatment options, such as food or housing insecurity. For prescription drug management, renewing pre-existing chronic medications would qualify. Documentation that the physician is managing the patient for the condition for which the medications are being prescribed would help establish validity in the use of this criterion for MDM.

An example of a 99204 or 99214 is a patient being seen for follow-up of hypertension and diabetes, which are well-controlled. An example using SDOH would be a patient with chronic knee pain and a positive anterior drawer test who needs imaging of the knee but cannot afford this care. Documenting that the patient cannot afford to obtain an MRI of the knee at this time, which significantly limits your ability to confirm the diagnosis and recommend treatment, adds to the risk component.

High complexity medical decision making: Codes 99205 and 99215 include one or more chronic illnesses with a severe exacerbation, progression, or side effects of treatment, or one acute or chronic illness or injury that poses a threat to life or bodily function.

The data component requires two of three categories to establish the level. These data categories are the same as those for 99204 and 99214, and they follow the same rules.

The risk component may include drug therapy requiring intensive monitoring for toxicity. Decisions regarding elective major surgery with patient or procedure risk, emergency major surgery, hospitalization, or “do not resuscitate” orders are also high risk. Intensive prescription drug monitoring is typically supported by a laboratory test, physiologic test, or imaging, and is done to evaluate for complications of the treatment. It may be short-term or long-term. Long-term monitoring is at least quarterly. An example would be monitoring for cytopenia during antineoplastic therapy. Monitoring the therapeutic effect of a treatment, such as glucose monitoring during insulin therapy, is not considered intensive prescription drug monitoring.

An example of a 99205 or 99215 is a patient with severe exacerbation of chronic heart failure who is admitted to the hospital.

CODING OUTPATIENT E/M VISITS

Time-based coding.

An alternative method to determine the appropriate visit level is time-based coding. A major change is that total time now includes both face-to-face and non-face-to-face services personally performed by the physician/QHP on the day of the visit. Additionally, time-based coding is no longer restricted to counseling services. Instead, it includes the following:

Preparing to see the patient (e.g., reviewing external test results),

Obtaining and/or reviewing separately obtained history,

Performing a medically appropriate examination and/or evaluation,

Counseling and educating the patient, family, or caregiver,

Ordering medications, tests, or procedures,

Referring and communicating with other health care professionals (when not separately reported),

Documenting clinical information in the electronic or other health record,

Independently interpreting results (not separately reported with a CPT code) and communicating results to the patient, family, or caregiver.

Care coordination (not separately reported with a CPT code).

Time spent by clinical staff cannot count toward total time. However, time spent by another physician/QHP (not a resident physician) in the same group can be included. If a nurse practitioner performs the initial intake and the physician provides the assessment and plan, both of those times can be counted, although only one person's time can be counted while they are discussing the case with each other. The visit should be billed under the clinician who provided the substantive portion (more than half) of the time, although both clinicians need to be identified in the medical record. Time spent must be documented in the note. It is advisable to specifically document the time spent and the activities performed both face-to-face and non-face-to-face.

The amount of total time required for each level of coding changed under the new time-based coding guidelines. (See the “Total time ” table.)

PROLONGED VISIT CODES

When time on the date of service extends beyond the times for codes 99205 or 99215, prolonged visit codes can be used. The AMA CPT committee developed code 99417 for prolonged visits, and Medicare developed code G2212. These are added in 15-minute increments in addition to codes 99205 or 99215. Code G2212 can be added once the maximum time for 99205 or 99215 has been surpassed by a full 15 minutes, whereas code 99417 can be added once the minimum time for 99205 or 99215 has been surpassed by a full 15 minutes. Less than 15 minutes is not reportable. Multiple units can be reported. Prolonged visit codes cannot be used with the shorter E/M levels, i.e., 99202-99204 and 99212-99214. (See “Prolonged services ” tables.) Clinicians should consult with individual payers to determine which code to use — G2212 or 99417.

SIMPLIFIED CODING AND DOCUMENTATION

The revisions to the outpatient E/M visit codes reduced administrative burden by eliminating bullet points for the history and physical exam elements. Only medically appropriate documentation is required. Code level selection is simplified — based on either medical decision making or total time. By applying these changes, primary care clinicians can eliminate bloated documentation and improve reimbursement reflecting the value of the visit.

Continue Reading

More in FPM

More in pubmed.

Copyright © 2022 by the American Academy of Family Physicians.

This content is owned by the AAFP. A person viewing it online may make one printout of the material and may use that printout only for his or her personal, non-commercial reference. This material may not otherwise be downloaded, copied, printed, stored, transmitted or reproduced in any medium, whether now known or later invented, except as authorized in writing by the AAFP. See permissions for copyright questions and/or permission requests.

Copyright © 2024 American Academy of Family Physicians. All Rights Reserved.

IMAGES

VIDEO

COMMENTS

Step 1: Total time. Think time first. If your total time spent on a visit appropriately credits you for level 3, 4, or 5 work, then document that time, code the visit, and be done with it. But if ...

CPT® code 99212: Established patient office or other outpatient visit, 10-19 minutes. As the authority on the CPT® code set, the AMA is providing the top-searched codes to help remove obstacles and burdens that interfere with patient care. These codes, among the rest of the CPT code set, are clinically valid and updated on a regular basis to ...

2021 E/M Office/Outpatient Visit CPT Codes. Office or other outpatient visit for the evaluation and management of a new patient, which requires these 3 key components: A problem focused history; A problem focused examination; Straightforward medical decision making. Counseling and/or coordination of care with other physicians, other qualified health care professionals, or agencies are provided ...

According to CPT, a typical level-II visit lasts 10 minutes, while a typical level-III visit lasts 15 minutes. If counseling or coordination of care account for more than 50 percent of the visit ...

Coding office visits the easy way - based on time. An E/M office visit may be coded based solely on face-to-face time when more than half is devoted to counseling or coordination of care. CPT ...

Management (E/M) Visits . Effective January 1, 2021, for PFS payment of office/outpatient E/M visits (CPT codes 99201 through 99215), Medicare generally adopts the new coding, prefatory language, and interpretive guidance framework that has been issued by the AMA's CPT Editorial Panel (available at the following website:

The Current Procedural Terminology (CPT) code range for Office or Other Outpatient Services 99202-99215 is a medical code set maintained by the American Medical Association. ... The CMS guidance was if the majority of the visit was able to be completed via video, code 99202-99215. If the video never connected, the...

CPT® code 99417 is used to report additional time beyond the time periods required for office/outpatient E/M visits. Additional time includes face-to-face and non-face-to-face activities. Code 99417 may only be used when total time has been used to select the appropriate E/M visit and the highest E/M level has been achieved (i.e., 99205 or 99215).

The CPT/RUC Workgroup on E/M is committed to changing the current coding and documentation requirements for office E/M visits to simplify the work of the health care provider and improve the health of the patient. Guiding Principles: 1. To decrease administrative burden of documentation and coding 2. To decrease the need for audits 3.

To report an office or other outpatient visit for a new patient, you'll choose from E/M codes 99201-99205. As this article mentioned previously, office/outpatient visits include history, clinical examination, and medical decision-making (MDM) as the three key components for code selection. To determine which E/M code from 99201-99205 is ...

The CPT Editorial Panel made significant revisions to the documentation and coding guidelines for office visit E/M services in 2021, with further changes introduced in 2023. These updates aim to simplify documentation requirements, reduce administrative burden, and ensure accurate coding for evaluation and management services.

Consultation Codes. First, CMS stopped recognizing consult codes in 2010. Outpatient consultations (99241—99245) and inpatient consultations (99251—99255) were still active CPT ® codes, and depending on where you are in the country, are recognized by a payer two, or many payers. In 2023, codes 99241 and 99251 are deleted.

types of factors, the E/M visit is more complex. In this example, you may bill G2211. G2211 and Modifier 25 . G2211 may not be reported without reporting an associated O/O E/M visit. G2211 isn't payable when the associated O/O E/M visit is reported with modifier 25. You can add modifier 25 to an E/M CPT code to show the E/M service is ...

The American Medical Association (AMA) has established new coding and documentation guidelines for office visit/outpatient evaluation and management (E/M) services, effective Jan. 1, 2021. The ...

The Current Procedural Terminology (CPT®) guidelines provide clarification. If an abnormality is encountered or a preexisting problem is addressed in the process of performing a preventive/wellness visit, and the problem or abnormal finding is significant enough to require additional work to perform the key components of a problem-focused evaluation and management service, then the ...

E/M Coding: Let These 3 Tips Lead You to New vs. Established Patient Clarity. Otolaryngology Coding Alert. ... you can't collect for a new patient visit with 99202-99205 ... If the doctor sees the patient in 2022 for skin cancer and again in 2024 for eczema, the patient is still established. 3. Multiple Locations Won't Get You Around the 3 ...

In the 2021 Medicare Physician Fee Schedule (PFS) final rule, the Centers for Medicare & Medicaid Services added Healthcare Common Procedure Coding System code G2211 to the PFS as a reimbursable service. The code is intended to indicate visit complexity and to increase the valuation of office and outpatient visits for evaluation and management services associated with medical care that acts as ...

The 2018 Medicare Physician Fee Schedule allowable for 92285 is $21.24. 2 For tear film imaging, CPT instructs providers to use the code 0330T, while 0507T is the appropriate code for near-infrared light meibography. 2. Although there are no limitations for repeat imaging, valid documentation is required with the reason for the additional images.

EXAMPLES. Let's look at some examples of when it would be appropriate to bill for a problem-oriented E/M code (CPT 99202-99215) along with a preventive or wellness visit. Patient 1: A 70-year-old ...

The Current Procedural Terminology (CPT) code range for Consultations 99242-99255 is a medical code set maintained by the American Medical Association. Subscribe to Codify by AAPC and get the code details in a flash. Novitas and FCSO will require documentation for certain pathology and laboratory claims.

It is important for eye care providers and their staff to be aware of different aspects of testing, billing, and coding guidelines in order to both file correct claims with insurers the first time and also to understand their practice habits, which may result in receiving reduced fees for their services. 1.

Easy-to-understand health information to help you be ready for your appointment. Learn what you need to know about symptoms, diagnosis, and treatment options to discuss with your doctor. From major surgery to routine procedures, find out what to expect and how to prepare for a successful outcome. Browse all health topics.

Before choosing 99213 for routine visits, consider whether your work qualifies for a 99214. PETER R. JENSEN, MD, CPC. Fam Pract Manag. 2005;12 (8):52-57. Data show that family physicians choose ...

Explained ¶. In CPT the seller clears the goods for export and delivers to the carrier nominated by the seller at the agreed place of shipment at the origin. At this point, the risk is transferred to the buyer. The seller is responsible for contracting and paying the main carriage until the agreed named place of destination.

When time on the date of service extends beyond the times for codes 99205 or 99215, prolonged visit codes can be used. The AMA CPT committee developed code 99417 for prolonged visits, and Medicare ...